Bridging the gap 27.23

In case you missed it ...

Not a subscriber yet? Click here ('Bridging the gap' is free)

Here is a selection of recently published Deep Dives, Perspectives and Quick Insights that our subscribers get to read in full.

- Is this what transition risk looks like? (Built Environment, Transitions / Human Rights)

- Will consumers consume differently in an electrified world? (Electricity Systems, Greener Energy Applications)

Plus a few from the archives:

- The global response to Antimicrobial Resistance (Health and Wellness)

- Will half the world starve without fossil fuels? (Agriculture / Natural Capital)

- The good stuff in wastewater (Built Environment)

What subscribers are reading this week

Is this what transition risk looks like?

(Built Environment, Transitions / Human Rights, Professional)

We often read about transition risk and stranded assets, but what does this really mean, and how does it get reflected in the financial statements and value of companies? The short answer is - often much more slowly than you may think. Thames Water (and other cases) illustrates this rather neatly.

Transition risk and the threat of stranded assets are often talked about as reasons why investors should 'avoid' certain assets or companies. But, if the impact on profits and share prices is slow, their effectiveness as a sustainability finance tool is much reduced. So why might investors continue to own the equity and debt of companies when it's clear, at some point, they will 'hit the buffers'.

One lesson Steven learnt in his years as an investor (sometimes the hard way) is that even knowledge that seems to be known does not get 'priced in'. He hasn't found any research that properly explains this, but his working explanation is that investors get fooled by a form of recency bias. Put simply, they over emphasise what they are seeing now and ignore what might happen in the future.

Many investors see sustainability transition risk, and the challenge of potentially stranded assets, in this way. They know that it will probably happen, but they comfort themselves with the notion that 'nothing has happened yet, and it may not happen for a long time, and so in the meantime, the companies make a good investment (at least financially)'. Until of course, something happens that makes this belief untenable. But by then it's too late.

There are some rational reasons why investors think the transition risk is mispriced, but they should never ignore it.

Link to blog 👇🏾

Will consumers consume differently in an electrified world?

(Electricity Systems, Greener Energy Applications, Premium and Professional)

"Insanity is doing the same thing over and over and expecting different results" is often attributed to Albert Einstein. Actually there is no real evidence that he ever said that. It is applicable in the world of sustainability.

In transitioning to a more sustainable world, there is sometimes the temptation to look at an individual component of a system and replace it with something 'more sustainable' and carry on. Look at cars and other ground vehicles. The focus has been on replacing the high-carbon emitting internal combustion engine (ICE) with the low-carbon / no carbon emitting electric motor to produce an electric vehicle (EV). However, that brings some challenges. In 2021 the IEA estimated that the production of an EV uses approximately six times more minerals than a conventional car. So if we replaced all of the ICE vehicles with EVs, whilst we may reduce emissions from the engine in operation, the resource requirements (including energy requirements for mining the additional minerals) would impact other areas of sustainability. So can things stay the same?

The transition to a more electrified world will likely result in changes in behaviour by consumers. The extent and pace of any changes is likely to vary across regions, depending on factors like infrastructure development, government policies, and consumer preferences. We look at three broad areas as a starting point: transportation, the home and how we pay for things.

Link to blog 👇🏾

From the archives

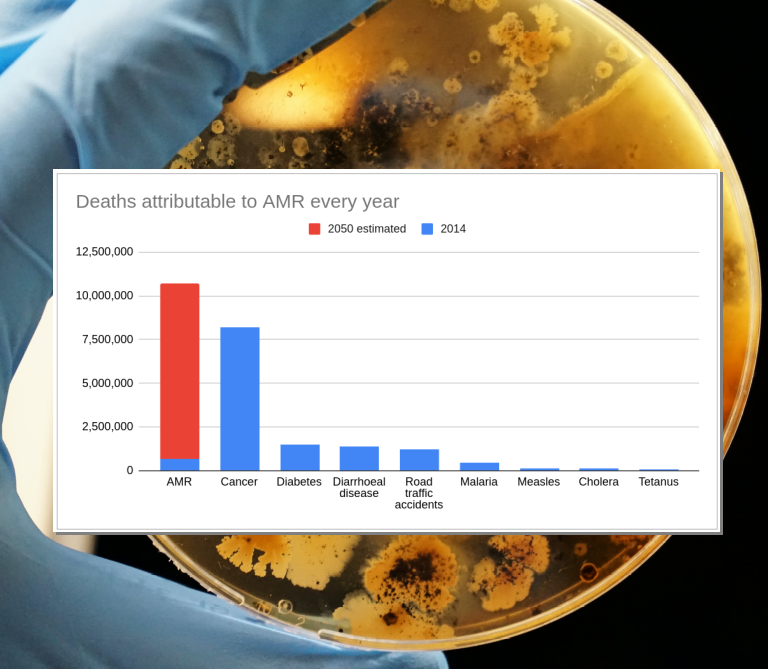

The global response to Antimicrobial Resistance

(Health and Wellness, Professional)

Researchers have found substantial variability in the strategic responses to antimicrobial resistance (AMR) from governments across the globe. The conclusion is that the international response is currently not enough given the severity and scale of AMR. National Action Plans (NAPs) were particularly lacking in education, accountability and feedback mechanisms which can improve policy direction and implementation over time.

Low Income, Middle Income Countries (LIMIC) are disproportionately impacted by AMR and may not have enough funding without support from foreign donors, philanthropies and other blended finance. Health equity is mentioned more frequently in NAPs from LIMIC and less in higher-income regions even though they have the capability to increase access to medicines in those LIMIC regions.

The big theme: Antimicrobial Resistance (AMR) is a macro threat to the sustainability of the human race and other species. It is of a similar level to that of the worst impacts of climate change or biodiversity loss and is inextricably linked. Bringing together biological, behavioural, and physical solutions with appropriately incentivising funding we should be able to continue to enjoy the benefits of our microbe partners whilst avoiding their darker side. This is potentially a massive, if complex, theme for those who care about sustainability; the potential goes well beyond the pharmaceutical industry.

Link to blog 👇🏾

Will half the world starve without fossil fuels?

(Agriculture / Natural Capital, Professional)

Our World in Data is a fabulous source of data, charts and insights. One such chart - 'World population supported without synthetic fertiliser' and 'World population fed by synthetic fertiliser' - with an excellent accompanying article from the brilliant Hannah Ritchie, has been used by a number of commentators to make the assertion that 'stopping oil and gas production means half the world will starve.'

This intrigued us, so we thought we would explore. There are actually a number of separate questions within that assertion:

- Do we need oil and gas (hydrocarbons) to make synthetic fertilisers? The answer to this is currently (mostly) yes, but low carbon alternatives are emerging fast.

- Do we need to use so much synthetic fertilisers? The answer to this is no - we’re incredibly inefficient in our use of fertilisers in some areas, and we’re using far more than we need.

- How do we feed the World population? (how much food do we need?) To answer this we need to think about the entire food system, not just farm production. We can do much more with less inputs.

Link to blog 👇🏾

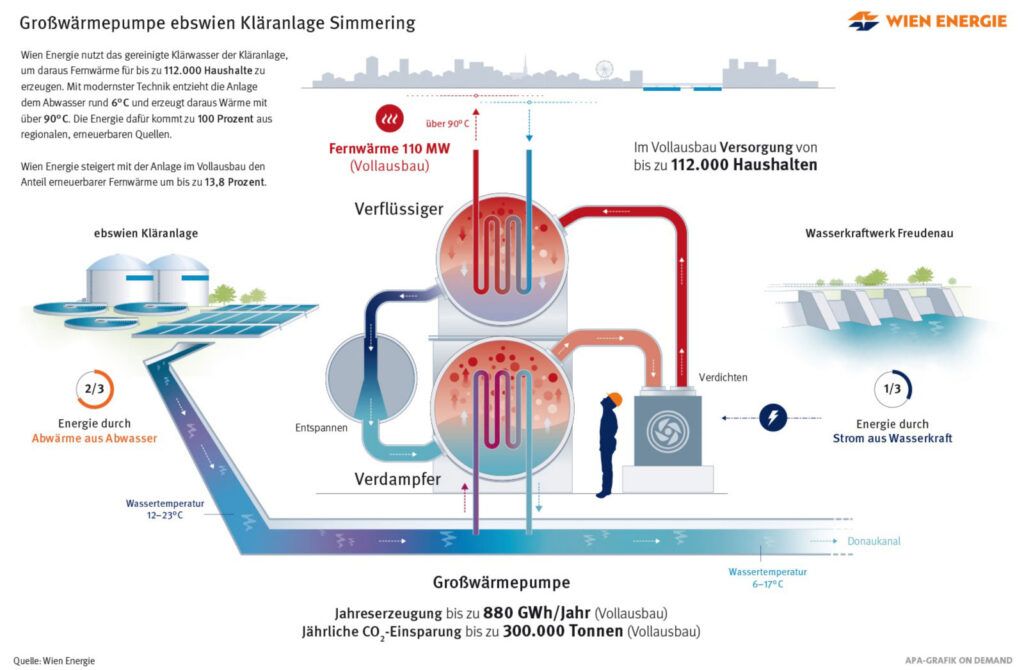

The good stuff in wastewater

(Built Environment, Premium and Professional)

In a world of increasingly scarce resources, wastewater can provide us with heat (for our buildings) plus raw materials for fertiliser and for energy. It now makes sense to better use the good stuff in our waste water - resources that we are currently just wasting.

We tend to think about wastewater treatment as being an environmental and health issue. That is why we treat our sewage rather than just pump it into rivers and the sea. But in our growing circular economy, recycling the resources in our wastewater increasingly makes financial sense.

The big theme: In their 2021 update, UN Water estimated that globally nearly half of household water flows were NOT safely treated. The data shows massive variations, with the lowest levels of treatment in Central and Southern Asia and Sub-Saharan Africa. Funding this is a massive challenge, so finding alternative revenue streams can really help.

Link to blog 👇🏾

Become a subscriber

Click here to joinPremium subscribers get to read in full...

- 'Quick Insights'

Designed to be short, easily digestible summaries to educate and stimulate thought and further exploration. 3-5 minute reads.

Professional subscribers get to read in full everything that Premium subscribers get plus...

- 'Perspectives'

Our unique perspective, based on our decades of financial and sustainability experience, on a key news story, development or report that is impacting sustainability investing, decision-making and transitions. We encourage you to think laterally. 5-6 minute reads.

- 'Deep Dives'

Setting the scene in more detail to aid understanding of how the transitions will develop and thinking laterally. 10-12 minute reads.

Please forward

to a friend, colleague or client

If this was forwarded to you, click the button below and sign up for free to get this email, 'What caught our eye' and the 'Sunday Brunch' in your inbox every week.

Please read: important legal stuff.