Can better governance improve stock valuations?

For listed companies, there are a number of choices that a board and executive management can make to increase the valuation of the shares in the company.

One example is choosing where to list. In my career I have seen many non-US companies running for US stock market listings in the hope that the greater liquidity of the US market would boost longer-term valuation.

In his excellent daily blog, Klement on Investing, Joachim Klement recently highlighted a meta analysis by Nguyen and Dao from Hanoi University, "Liquidity, corporate governance and firm performance: A meta-analysis" (2022) which compared the impact of improving share liquidity on company valuations with the impact of improved corporate governance.

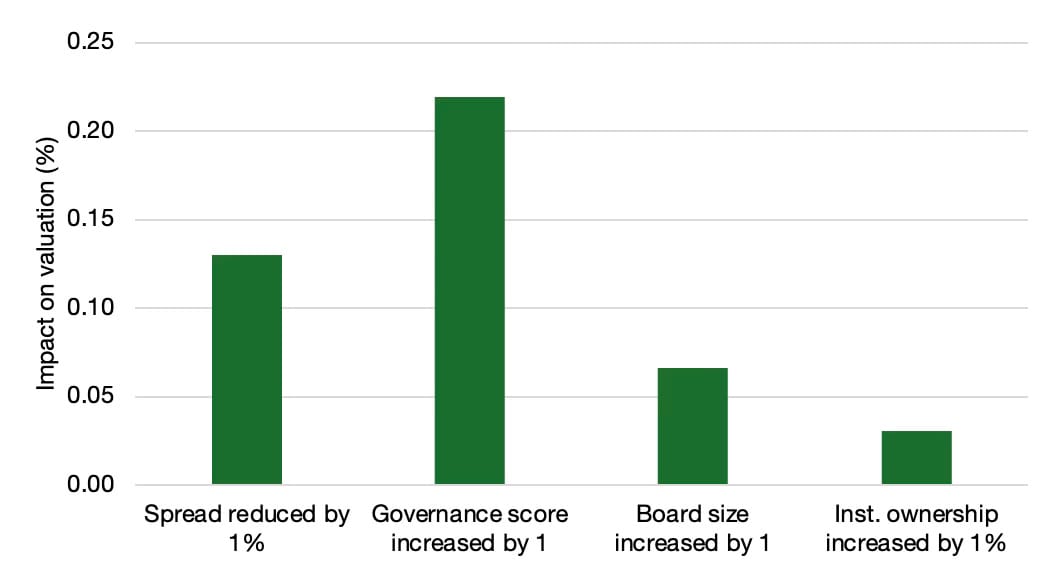

This chart by Joachim summarises Nguyen and Dao's results well

You can see clearly from the chart that improving overall governance has a much bigger impact on valuation than improving liquidity ('spread reduced by 1%')1

You can read Klement's article here 👉🏾 https://klementoninvesting.substack.com/p/improving-valuations-through-better?

... and here is a link to Nguyen and Dao's research 👉🏾 https://www.tandfonline.com/doi/full/10.1080/23311975.2022.2137960

There were a number of things we found interesting.

- Simple governance measures alone, such as simply splitting the roles of CEO and chair of the board or just increasing the number of board members are not really going to help. The study authors used broad measures of overall governance - corporate governance indices such as ISS Board Quality scores. Bottom line, a culture of strong governance does the trick.

- As Klement pointed out "...unlike trying to increase liquidity, it [governance] is a measure that is entirely under the control of executives and their boards."

- It asks a broader question: how do we measure 'governance'? This will be the topic of an upcoming Sunday Brunch...

[note 1: The 'spread' is the difference between what you can buy a stock in the market and what you could sell it for. The narrower the spread, the more liquid a market is]

This article featured in What Caught Our Eye, a weekly email featuring stories we found particularly interesting during the week and why. We also give our lateral thought on each one. What Caught our Eye is available to read in full by members.

If you are not a member yet, you can read What Caught Our Eye when it comes out direct in your email inbox plus all of our blogs in full...

Click this link to register 👉🏾 https://www.thesustainableinvestor.org.uk/register/

Please read: important legal stuff.