Coal's (very) long goodbye

Bloomberg (republished in various newspapers) recently highlighted coal's recent period of resurgence, on the back of China's energy insecurity, rising Indian demand, the fallout of the Ukraine war, and "faltering international programs to wean developing economies off fossil fuels".

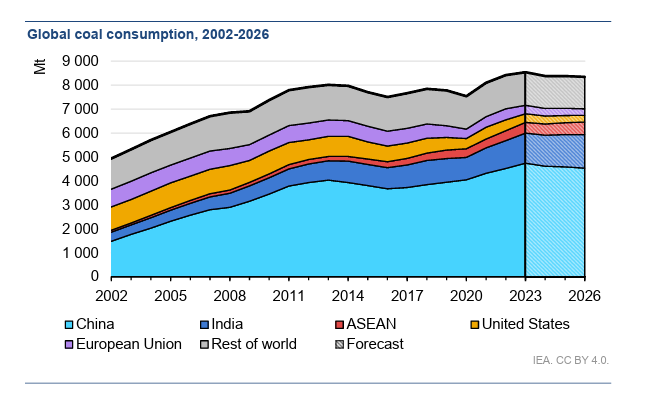

If we go back a few years, many analysts had predicted 'peak coal', with demand expected to plateau and then start to fall. And then, as the Bloomberg article says, the opposite happened.

Coal is the most carbon-intensive major fossil fuel in use today and it is deeply entrenched in the power system. Coal is responsible for over 40% of all energy sector CO2 emissions. Various IEA reports have highlighted that drastic reductions in its consumption are required to achieve net-zero emissions. Which is why it's seen as a litmus test for countries commitments to actually delivering net zero.

And in some parts of the world, less coal is already being used for electricity generation. For instance, the Ember European Electricity Review 2024 highlighted that Coal generated 12.3% of the regions electricity in 2023. This puts it back in No 4, behind Nuclear (22.9%), Wind (17.6%) and Gas (16.8%). And it reflects a long term drift downwards that dates back decades, only broken by the 2020 & 2021 upward blip.

But this is not a universal trend. As the IEA Coal 2023 report predicted "in absolute terms, coal demand in 2023 is estimated to have increased most strongly in China (up 220 Mt, or 4.9%), followed by India (up 98 Mt, or 8%) and Indonesia (up 23 Mt, or 11%)."

And according to Global Energy Monitor these three countries combined started operating new coal power plants amounting to 59 gigawatts last year, and either launched or revived proposals for another 131 gigawatts — about 93% of the world’s total.

It's all about energy security, something that is not going away any time soon.

So what is the future for coal? As the Bloomberg article says "coal’s days are numbered, of course. Advances in solar and wind have made those technologies far cheaper than coal power in most parts of the world, and similar gains for batteries and energy storage systems could finally make around-the-clock renewable power affordable enough to transform the energy mix."

But don't expect the end of coal to happen quickly, unless we are prepared to take dramatic and expensive actions. A recent IEA report, Accelerating Just Transitions for the Coal Sector, sets out some of the issues we face.

The biggest one is that favourable economics for renewables will not, on their own, be sufficient to achieve the rapid transition away from coal power. Coal as an energy source for electricity generator will only stop when the total cost of renewables is lower than the operating cost of an existing coal plant. This was something we highlighted recently in a What Caught Our Eye blog, prompted by the work of Jim Murchie at Energy income Partners 👉🏾 https://www.thesustainableinvestor.org.uk/economic-shutdown-in-the-energy-transition/

But that is not the only challenge. On top of the need to accelerate the role out alternative electricity generation sources (mostly renewables), we also need to shift the most efficient coal plants from baseload to more flexible operation, we need to fund the shut down of some existing coal plants, and we need to ensure the outcomes are fair for all (including electricity consumers and workers in the coal industry).

And one final thought. When we wrote about this topic back in November 2022 we highlighted that investing is a forward-looking activity. Yes, it's possible that we may see the use of coal for electricity generation remaining high for a while. But those analysts who see the surge in coal as a failure of renewables, and therefore a portent of the future, are likely to end up missing a trick. And misallocating their capital 👉🏾 https://www.thesustainableinvestor.org.uk/quick-insight-more-coal/

This article featured in What Caught Our Eye, a weekly email featuring stories we found particularly interesting during the week and why. We also give our lateral thought on each one. What Caught our Eye is available to read in full by members.

If you are not a member yet, you can read What Caught Our Eye when it comes out direct in your email inbox plus all of our blogs in full...

Click this link to register 👉🏾 https://www.thesustainableinvestor.org.uk/register/

Please read: important legal stuff.