Diversity target setting: solution or distraction?

Understanding the most effective way to embed a DEI culture within a firm can enhance performance. However, is narrow target setting, particularly centred on diversity, a help or hindrance?

Summary: With non-financial disclosure requirements increasingly focusing on DEI, we ask whether the target setting which typically centres around demographic diversity at the board level helps or hinders the development of a culture of DEI. We discuss some upcoming regulation, the confusion between measures and targets, manifestation and ambition and how sometimes what you are measuring isn't what you think you are measuring.

Why this is important: For sustainability professionals, understanding the most effective way to develop and embed a DEI culture within a firm can enhance strategy and performance for the long term.

The big theme: A key facet of sustainability is getting the most constructive impact for society as a whole with the most appropriate resources that we have. That is often people. Those people can have different backgrounds, different ways of thinking and different starting points. With an equitable view point we can create a culture that includes these diverse viewpoints and skills for the benefit of all.

If you want to read the rest and are not already a member...

The details

DEI and disclosure regulation

DEI is an umbrella term that brings together three linked but distinct concepts: Diversity, equity and inclusion.

Diversity is the presence of a wide range of people with differences, including gender, gender identity, age, race, nationality, religion, ethnicity, sexual orientation, socioeconomic status, physical ability, or even political perspective.

Whilst diversity highlights how people differ, equity is about understanding that different groups of people face different challenges. Note that this differs from equality, which makes no assumptions about people's starting points. Equity is more focused on outcomes than inputs.

Inclusion is about creating the right culture and environment so that everyone, regardless of their differences - their diversity - feels that they belong and are valued. They are not prevented from striving to reach their potential.

There is a strong social case for fostering an inclusive work environment. Providing jobs, particularly in leadership positions, to underrepresented people can create a virtuous circle where role models are created and the workforce becomes more diverse over time. There is a social responsibility.

There is also a financial one. Alex Edmans, Caroline Flammer and Simon Glossner recently looked at DEI in a ECGI working paper and found that high DEI was positively associated with all but one of the eight measures of future profitability that they studied.

There are a growing number of disclosure standards that require companies to publish information on diversity, social matters and treatment of employees.

For example, the EU's Corporate Sustainability Reporting Directive (CSRD) which came into force at the beginning of 2023 builds on rules introduced by the Non-Financial Reporting Directive (NFRD) and seeks to shine a light on diversity on company boards.

Nasdaq's board diversity rules have an important deadline coming up at year end (we shall discuss that shortly).

But diversity in itself is not enough.

"...financial performance depends not only on hiring high-ability and cognitively diverse employees, but also fostering a culture of equity and inclusion that allows them to contribute their abilities and perspectives."

Diversity, Equity and Inclusion", ECGI Working Paper N 913/2023. © Alex Edmans, Caroline Flammer and Simon Glossner 2023

In addition, many of the disclosure requirements are focused on the board or on senior management. In a recent article Alison Taylor (adjunct professor at NYU Stern School of Business) and Brian Harward (lead research scientist at Ethical Systems) commented that ...

Companies would not simply provide additional bonuses for meeting ‘human capital’ measures at the executive level and then hope these magically trickle down

Alison Taylor, Brian Harward, "Incentivising ESG: what does it really take?", SustainableViews

There are some encouraging signs though. The UK Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) have both issued consulting papers on proposals to introduce a new regulatory framework on Diversity and Inclusion in the financial sector. Their aim is to improve outcomes for consumers and markets by "reducing groupthink, support healthy work cultures, unlocking diverse talent and improving understanding of and provision for diverse consumer needs."

Their proposals include developing an evidence-based D&I strategy, owned by the board, setting targets for each of the board, senior leadership and the employee population as a whole and that those targets, alongside data collected on diversity performance are reported to the FCA/PRA and publicly disclosed.

The provocation of the title of this blog is focused on target setting. Solution or distraction? Let's explore that starting with a diversity rule that has a looming deadline.

Nasdaq's board diversity rule

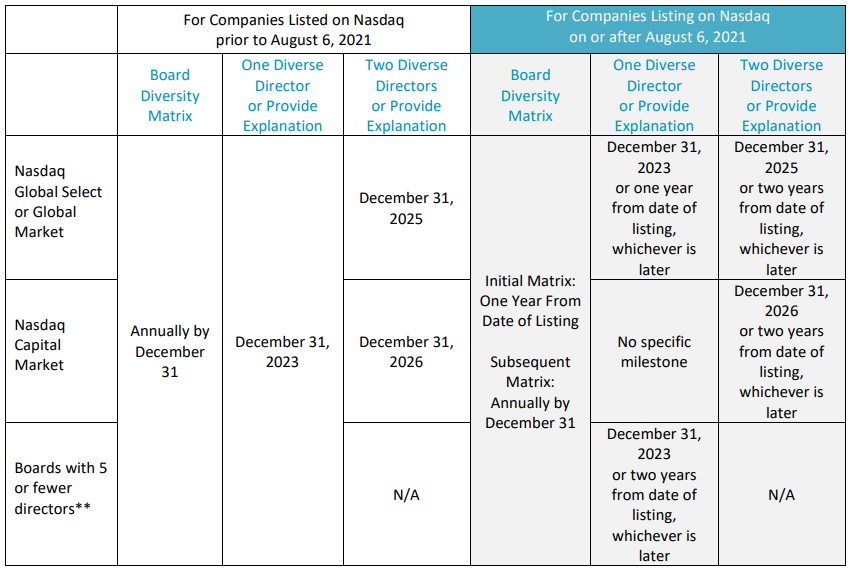

The SEC approved Nasdaq's board diversity listing standards back in August 2021. The standards are designed to encourage (but not compel) greater board diversity and require board diversity disclosures for Nasdaq-listed companies.

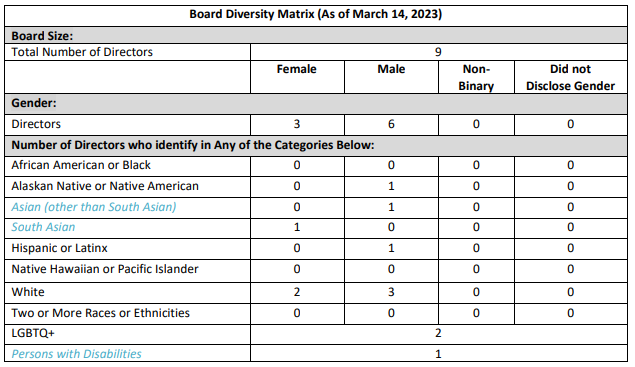

The main disclosure requirement is a matrix showing the composition of the board by gender, certain racial categories, sexuality and disability.

Here is an example:

In addition companies need to have at least one 'diverse director' if the board has more than five directors or provide an explanation as to why they don't, but the introduction of that requirement has been staggered. You can see the various deadlines below with the next one being for 31st December 2023.

So with these disclosure requirements and others in different jurisdictions companies should start to improve their DEI right? A couple of problems. Most are still focused on the board alone and are only focused on one aspect of DEI.

"Companies can 'hit the target, but miss the point' - improve diversity statistics without improving DEI."

"Diversity, Equity and Inclusion", ECGI Working Paper N 913/2023.

© Alex Edmans, Caroline Flammer and Simon Glossner 2023

This highlights a key issue with diversity target setting. The confusion between measures and targets.

Measures versus targets

"Any observed statistical regularity will tend to collapse once pressure is placed upon it for control purposes."

Charles Goodhart, "Problems of Monetary Management: The UK Experience" 1975

Goodhart's law, which is often stated as "when a measure becomes a target, it ceases to be a good measure" is particularly apt when it comes to DEI.

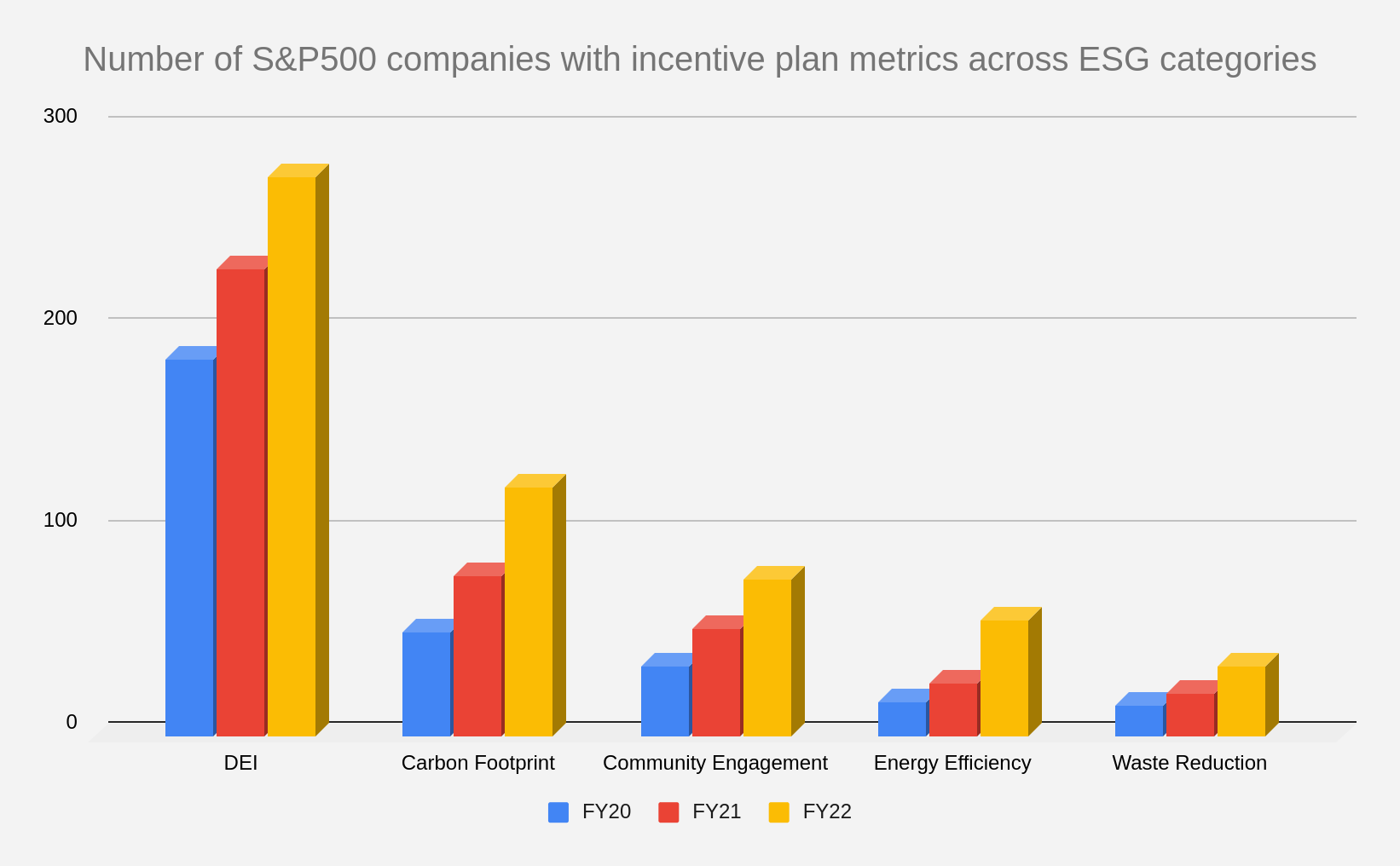

Executive compensation can often play to the disclosure. What is disclosure? It is the provision of information with which to make investment decisions - in sustainability it is a holistic perspective of a company's performance. That sounds encouraging, bringing together financial and non-financial performance.

Regulations such as the Nasdaq Board Diversity Rule that we mentioned earlier has led to the imperative for Boards to consider, measure and do something about the diversity on their boards. In theory this should ultimately lead to increased representation for minority groups at senior leadership levels.

So that's great isn't it? Boards appear to be taking on board the importance of diversity and catalysed by new disclosure requirement are incentivised to drive that change.

However, this is an example where a focus on the target can miss the point and result in gaming of the system.

A report by Deloitte and the Alliance for Board Diversity in 2021 found that some Fortune 500 company boards were “recycling” board members to fulfil diversity quotas. Over one-third of board members of colour and two out of every five Black members held seats on more than one Fortune 500 board in 2020, according to the research.

This year's updated report showed that recycle rates (which measures how many unique individuals serve on more than one board) increased from 2020 to 2022 with 1.29 seats per underrepresented race and ethnic group (UR & EG) director, up from 1.19 in 2020.

Clearly that particular stat cannot be taken in isolation as there will be UR & EG directors who are highly competent and valued and can benefit multiple boards.

However, hiring from a limited pool not only reduces opportunities for others to enter board level roles, but it narrows the expertise and diversity of thought that these boards offer.

Finally, it is worth considering that when it comes to groups in the workplace, the type of diversity depends on what the group is designed to do. For example, for an operational team work-style diversity and particularly the balance of those styles is perhaps more important than in a Board room. Cognitive diversity with contrasting viewpoints and challenge may be needed more.

There is some interesting research on executive compensation and ties to ESG or sustainability metrics. That is for another blog.

When a measure isn't measuring what you think it is measuring

Classifications tautologically are measurable but in some cases they only appear to be easy to measure.

Take my mate Iain. Iain is 'white English' according to the UK census. I am 'Asian British/Indian'. We are demographically diverse. However, we have known each other since we were three years old, we have had multiple shared experiences, got into trouble in similar ways and have a similar outlook on life. We are also both follically-challenged up top, but that may not be relevant to this discussion. Iain is very fit, an almost elite runner, triathlete and long-distance swimmer. Currently that is a big area of diversity between us.

My children have multiple ethnic backgrounds and studied in the south of England. What is the dominant influence on how they think and behave?

So there could be a problem in identifying diversity to begin with using traditional methods. From that starting point, it could be that corporates and organisations are then approaching DEI in the wrong way.

In Edmans's, Flammer's and Glossner's work, they developed a proprietary measure of DEI which utilised employee surveys and found it had a weak correlation with the more traditional measures of demographic diversity - gender, race, age, etc.

You can read more about that here 👇🏾

Manifestation versus ambition

Unless we understand what constitutes DEI in practice, we cannot really know whether our actions are increasing it or whether it is having a positive impact, both financially and from a social perspective. What constitutes 'good performance' is not as straightforward as people think.

In medicine there is often confusion between symptom and underlying cause and resulting treatment direction. Stopping your cough rather than stopping the infection that is causing the cough as one of a number of symptoms. For the runners out there, think about plantar fasciitis which manifests as pain in the heel of the foot but is actually due to stiffness and swelling in the calf.

Let's look at the example of the 15 minute city - an urban planning concept in which most daily necessities and services, such as work, shopping, education, healthcare, and leisure can be easily reached by a 15-minute walk, bike ride, or public transit ride from any point in the city.

"To make cars a choice, not a necessity." That is the implicit difference between the car-centric and people-centric urban design paradigms.

Making 15 minute cities requires a holistic approach with a number of things coming together. A neighbourhood with low traffic is in many ways a symptom or manifestation of an effective 15 minute city implementation but where there can be resistance (beyond the misinformation) is when it is the starting point or even the only measure by restricting motorised vehicles without any of the other facilities. This is where the confusion can sometimes arise with Low Traffic Neighbourhoods where the local authority has prohibited through-traffic. In short, implementation is key.

Inclusion is about creating the right culture and environment so that everyone, regardless of their differences - their diversity - feels that they belong and are valued. They are not prevented from striving to reach their potential.

Diversity should be a manifestation of an inclusive culture. As Alex Edmans puts it, DEI is...

"..not add diversity and stir"

Diversity is often focused on because it is perceived to be easy to measure, easy to set targets and therefore easy to set incentive plans on. We have already discussed the difficulties with that!

The left out piece of cheese

A former employer of mine, Morgan Stanley, had a programme called Step in, Step Up aimed at female students in the sixth form / years 12 and 13 of school in the UK to introduce them to the world of investment banking, highlight the variety of roles that exist that might be attractive to them and that they might have the aptitude for - and crucially, that they might not have considered up until this point. There is a potential financial benefit here as Morgan Stanley is increasing the pool of suitable candidates, potentially increasing the quality to select from.

Note the timing though. The results are not immediate. It takes up to six years before those participants in the Step in, Step up programme could start as graduate employees at the firm. But building it in that way can be a major contributor to building a solid foundation - supported by measures throughout the different levels within the firm (mentorship, transparency, etc).

A firm's culture is the weighted-average of the values that its people actually follow. It develops over time. How much does increasing DEI cost? There is no new deep technological or scientific hurdle to overcome. All you need to do is change behaviours, right?

Behavioural change is difficult! It requires many individual measures and structures and takes time.

The only culture that grows quickly is the one on the piece of cheese that I left out on the side.

Conclusion

So are diversity targets a solution or a distraction?

Target setting is important to provide a goal to the individuals concerned, an incentive for them to perform and meet that target and to provide disclosure on progress for other stakeholders. With DEI, there are a number of problems with how DEI is measured, assessed and regarded. This in turn can lead to counterproductive actions being taken both by corporates and regulators, for example, with regards disclosure. That can manifest in 'tick-boxing' without any real impact (other than directors getting paid!)

Diversity targets can be a distraction from achieving DEI goals if used in isolation. The other aspects of DEI should also be considered and at all levels within a firm.

A focus on traditional measures of DEI (often demographic diversity) may not capture the true inclusiveness of a culture, capturing different ways of thinking and approaching challenges. Ultimately that could mean that we don't reap the full benefits.

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.