Green buildings offer good financial value as well?

We know we need greener buildings, but the 'how' is often less clear. And we need to better understand the financial implications. A recent report from the engineering consultancy ARUP, for the World Building Council for Sustainable Development, highlighted the important role that making buildings greener will play in achieving our net zero targets. As they highlighted "representing around 40% of global carbon emissions, the built environment is a critical sector to tackle on the road to net-zero".

But how do we do this? Buried deep within the report (page 43 of 59) was a short section on the NABERS Energy rating system, first launched in Australia, but now slowly spreading. For those less familiar with it, NABERS Energy originated from the Australian Government’s drive to better understand and measure the energy efficiency and greenhouse gas intensity of office buildings. Over the last 25 years, NABERS has evolved to provide greater visibility of environmental impacts including water, waste and indoor air quality and ratings for different building types.

It is reported that, over the last 14 years, Australian offices rated using NABERS Energy have benefited from average energy savings of 42%, and have reduced greenhouse gas emissions intensity by 53%.

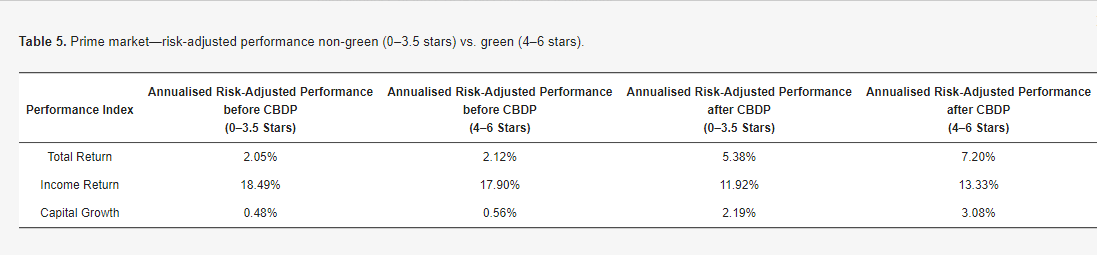

But that is not all, there also seems to be a financial benefit for the building owner. A recent study published by MDPI assessed the premium of green buildings by considering the role of mandatory energy efficiency of commercial building disclosure program (CBDP) using the MCSI/IPD NABERS data over 2005–2020. The results of the study showed that, in Australia, buildings with NABERS rating of 4 stars and above, delivered a higher total return compared with buildings with lower NABERS ratings.

This will come as little surprise to regular readers of our blogs. Back in September, we highlighted a study by Julian Zehner of University College London, which looked at 2,537 property sales and 2,907 rental transactions, between 2010 and 2021. The headline result - anything between a 8.3% and 26% premium for green buildings (as measured by the BREEAM certification).

Link to blog 👇🏾

This article featured in What Caught Our Eye, a weekly email featuring stories we found particularly interesting during the week and why. We also give our lateral thought on each one. What Caught our Eye is available to read in full by members.

If you are not a member yet, you can read What Caught Our Eye when it comes out direct in your email inbox plus all of our blogs in full...

Please read: important legal stuff.