Investment opportunities hiding in plain sight ?

A $330bn/year green investment opportunity. What is not to like. So what is the catch ? Yes, it's in emerging markets. But the real challenge is that we need to develop new business models.

A $330bn/year green investment opportunity. What is not to like. So what is the catch ? Yes, it's in emerging markets. But that is where the long term future opportunity really lies. So that should be a long term positive, not a negative.

More importantly, the opportunities are not where you might at first think. We know about decarbonising electricity generation using renewables. And we know about EV cars and vans.

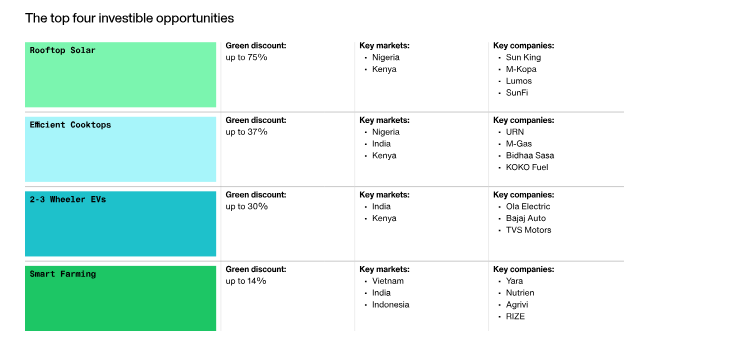

To find the 'new' opportunities we need to look in different places. Places where the cost of the new technology is already lower than the traditional incumbent. This covers a range of technologies from electric scooters in India, through rooftop solar in Kenya, efficient cook tops in Nigeria, and smart farming in Vietnam. Discounts to the traditional alternatives range from 14% in smart farming through to a massive 75% in rooftop solar.

And the catch - we need new business models. The traditional approach based around selling hardware, and routes to market, needs rethinking. We need to find ways of overcoming the non cost barriers.

The details

The $330bn/year green investment opportunity in emerging markets

According to a report prepared by Leapfrog Investments for the CGAP and Temasek, dozens of green technologies are actually already lower cost than incumbent technologies across the emerging world. Technologies that are already cheaper range from electric scooters in India, through rooftop solar in Kenya, efficient cook tops in Nigeria, and smart farming in Vietnam. Discounts to the traditional alternatives range from 14% in smart farming through to a massive 75% in rooftop solar.

This cost gap is expected to spark a wave of new green investments that could potentially reach $330Bn per year over the next decade. Furthermore, it is estimated that the new green technologies offer the potential for low income consumers to save as much as $500 pa each - a material amount for many communities.

There is a lot for investors to like in the markets highlighted. The end market is growing (so tick), the new entrants have material cost advantages over incumbents (another tick), and the new(ish) technologies are now 'well proven', with a reduced commercialisation risk (another tick). Plus, it is estimated that current investments in these markets total around 5% of what is needed, so investors can worry less about being late to the party (another tick).

The challenges are real but solvable

One thing that struck us as we read the report was how advancing these markets was less about developing new products, and more about finding new ways of recruiting and retaining customers. We see this point over and over again. Innovation and technology, on their own, are not enough. There are all sorts of challenges that also need to be overcome, before we see profitable mass scale commercialisation.

This is what the LeapFrog report describes as overcoming 'non-cost barriers' - making the point that, on its own, offering whole life cost savings is not enough to create a tipping point.

What is a non-cost barrier. It varies. Sometimes it's lagging infrastructure availability where, for instance, there are immature electricity grids to support broad adoption of renewable energy, or a lack of charging stations for EVs. Plus, as we know from examples all around the world, regulatory and policy support can change rapidly depending on the government of the day.

And, rather ironically, a big non-cost issue it can be the upfront cost. Regardless of the average total cost of ownership, high up-front costs can price out many low-income consumers in the absence of finance and insurance to help lower these initial payments.

The bottom line is that these non-cost barriers can be the main factor stopping these technologies reaching a tipping point. Even when the whole life cost economics are compelling.

Taking the 'efficient cooktop' example. According to research published in Environmental Research Letters ....

"nearly 3 billion people, 40% of the world's population, lack access to clean cooking fuels and technologies. Instead, they rely on polluting fuels like wood, charcoal, other solid biomass, kerosene, and coal. Commonly-used household stoves cannot burn these fuels efficiently and cleanly, resulting in exposure to products of incomplete combustion or 'household air pollution' (HAP) that contributes to nearly 4 million premature deaths each year"

Using gas for cooking is whole life cheaper, and better for health outcomes. Plus, it reduces deforestation. And it should be a growing market. According to the International Energy Agency, quoted in a 2018 report from the World LPG Association, somewhere between 800 million and two billion people will switch from traditional cooking with wood to other fuels (such as LPG and electricity) over the 2015-30 period.

But the upfront cost compared with the traditional alternative is a massive barrier. In some South East Asian countries government policies have helped. But there are also potential private sector solutions as well - using the concept of X as a service, in this case cooking energy as a service. This follows the approach used by many IT companies of offering Software as a Service (SAAS). You don't pay upfront for the software, you pay a subscription.

In the case of more efficient cooktops, customers could 'rent' the cooking unit, and pay for it via their electricity or LPG usage fees. And taking it a stage further, local micro businesses could be set up to distribute the cook tops, service them, and deliver the gas.

Finding a practical private sector led equipment rental model could really help unlock potentially massive markets.

One last thought - emerging markets as business model leaders

Emerging markets don't really get the attention they deserve when it comes to sustainability investing. We understand why. Often the current market size is small, with different offerings needed depending on location. Access to local currency finance can also be a barrier.

But all of this is changing. And in some technologies, the emerging markets are leading the way. Two and three wheelers are a good example.

Link to blog 👇🏾

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.