KlimaSeniorinnen, the Great Indian Bustard and Insurance.

A number of judgments were handed down last week that could have important implications for insurance, investing and project viability.

The European Court of Human Rights ruled that Switzerland violated citizens' human rights by not doing enough to combat climate change. The court sided with over 2,000 Swiss senior women, the Klimaseniorinnen, who argued the government's inaction put them at heightened risk from heatwaves. While rejecting two other climate cases on procedural grounds - one brought by a group of six Portuguese children and young adults (Duarte Agostinho and Others v. Portugal and 32 Others) and one by a former mayor of a low-lying French coastal town (Carême v. France) - the ruling establishes a legal duty for the 46 European Convention signatories to reduce emissions.

Experts say it will embolden communities to sue governments over climate failures and could influence courts globally amid the rising wave of human rights-based climate litigation.

In the same week, an India Supreme Court landmark ruling from 21 March was made public regarding a case about protecting the habitats of critically endangered Great Indian Bustard and Lesser Florican bird species from power transmission lines.

Effectively the Supreme Court significantly expanded the "right to life" under the constitution (Article 21) to include protection against adverse climate change effects.

"Without a clean environment which is stable and unimpacted by the vagaries of

climate change, the right to life is not fully realised", Dr DY Chandrachud, Chief Justice said in his judgement.

All of the above cases increase the probability of further litigation at the sovereign level but potentially also against corporates.

And further litigation brings with it implications for the insurance industry and costs of insurance for organisations.

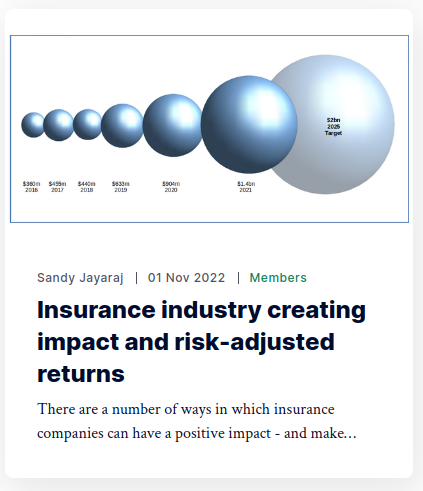

We have previously highlighted the critical position of the insurance industry in the sustainability transitions. Insurance companies can play a triple role through their choice of projects to underwrite (e.g. insurers walking away from the Adani Carmichael coal mine project), their choice of investments and their activities in the sustainability space that ultimately reduce the risk they are underwriting 👉🏾 https://www.thesustainableinvestor.org.uk/the-insurance-industry-creating-impact-and-risk-adjusted-returns/

In some cases there is a risk that insurers walk away from high risk areas (those areas become uninsurable) or the costs of insuring a project become too high rendering the project economically unviable 👉🏾 https://www.thesustainableinvestor.org.uk/is-climate-risk-becoming-uninsurable-2/

However, could we see more sustainable projects get the financial and resource backing they need as a result of investment / incentives from the insurance industry through appropriately priced policies and an effective splitting of underwriting savings ('I-support-a-project-that-ultimately-lowers-risk-I-therefore-have-a-lower-potential-payout-in-the-future')?

The Insurance Industry could be THE key player in the transitions.

This article featured in What Caught Our Eye, a weekly email featuring stories we found particularly interesting during the week and why. We also give our lateral thought on each one. What Caught our Eye is available to read in full by members.

If you are not a member yet, you can read What Caught Our Eye when it comes out direct in your email inbox plus all of our blogs in full...

Click this link to register 👉🏾 https://www.thesustainableinvestor.org.uk/register/

Please read: important legal stuff.