Sunday Brunch: Flooding and storms are the new (expensive) normal

Climate events such as floods are now more frequent. While globally a small % of the population lives close to the coast, for some countries (including New Zealand) this figure is much higher. Analysis of the NZ situation can help us frame our response. We need to take climate adaptation seriously.

As investors we can learn a lot from those organisations (or countries) that are already deep into the climate related changes we are only just starting to face. Flooding and sea level rise is a good example. While we may think that our situation is not yet too bad, now is the time to prepare. Before the problem gets very serious. Which is why it's really useful to look at what is happening in countries such as New Zealand and Australia.

As we wrote back in 2023 the data suggests that almost a third of the residential houses in New Zealand are located within 1km of the coastline. So, the risk of flooding and storm related damage is higher than in most other countries. And studies show that for many properties, these risks are increasing. Mean sea level in NZ Aotearoa will rise by at least 10cm by 2040 (from 2020 levels) - under all four IPCC pathways. And in 2015, the countries Parliamentary Commissioner for the Environment estimated that in some locations, a 10cm of sea level rise will turn what is currently a 1 in 100 year storm into an event that happens 1 in every 20 years.

So New Zealand is already well down this climate impact path.

To make this meaningful for investors we need to understand how many homes might be impacted, the extent to which they could be damaged, and what it might cost to rebuild. These questions were examined in a recent report by Climate Sigma for the New Zealand government.

Looking through the report and the data a couple of points leap out. First they estimate that as of 2023 c. 219,000 residential properties are located within inundation and flood zones. To give this some context, it is estimated that New Zealand has c. 2m homes. So over 1 in 10 are in at-risk locations.

Second, the scary bit. The Climate Sigma report estimates that between now and 2060 c. 1% of the homes could experience a flood type event so serious that c. 80% of the house was damaged. To you & I that sounds like pretty much total destruction.

And nearly 7% of homes will experience c. 20% or more damage. Enough to cause major disruption for the household.

And this could cost nearly NZ$13 billion to repair.

Remember New Zealand is a small country with a population of only 5.2m, with a GDP of c. NZ$430bn.

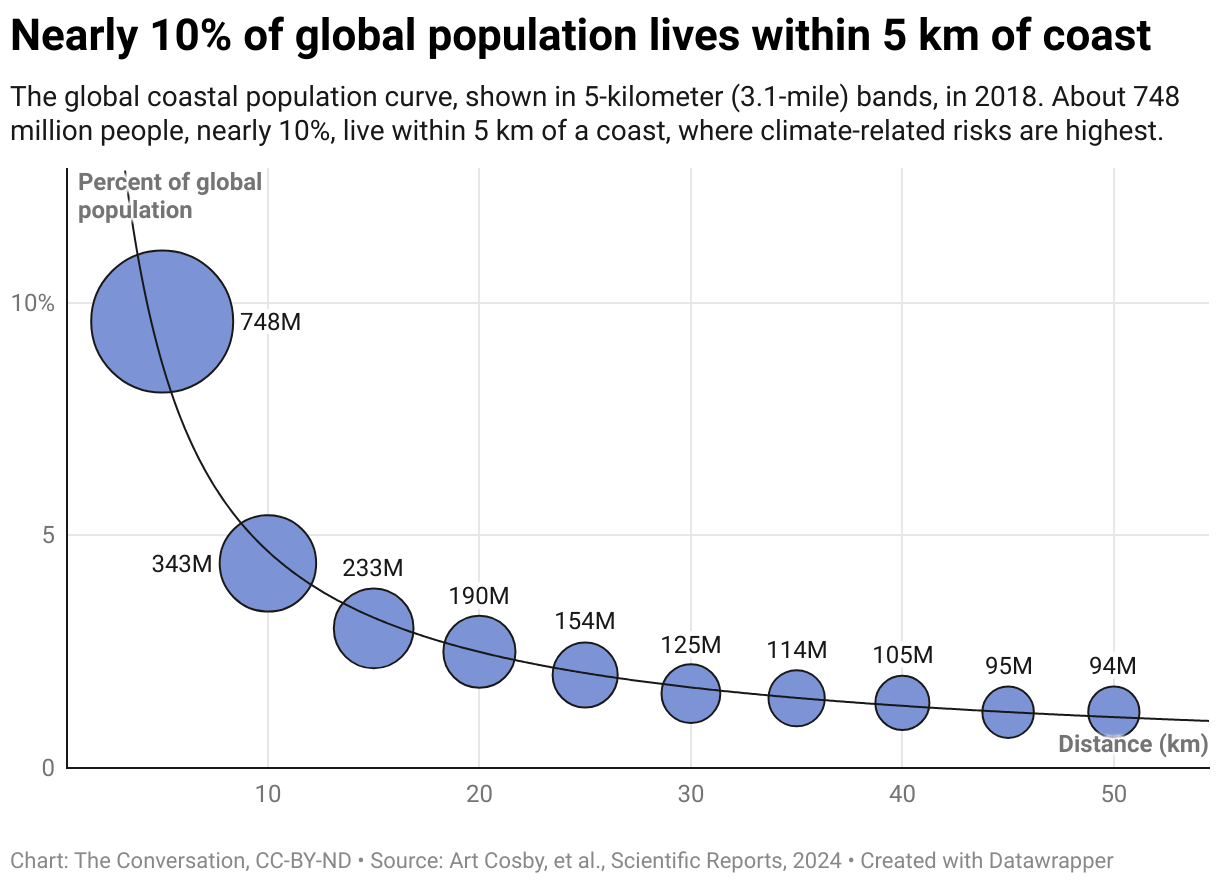

This is a problem that we will all face, sooner rather than later. Globally it is estimated that c. 10% of the world's population, or close to 750m people, lives within a few miles of the coast. Hardly any countries are immune.

A recent editorial for the Journal of Flood Risk Management estimated that the global annual costs of flooding were already c. US$100 billion.

And flooding is just part of the risk we face as a result of climate change. A November 2024 report by the consultancy Oxera, for the International Chamber of Commerce, estimated that the c. 4,000 climate related events that occurred from 2014 to 2023 cost the global economy c. US$2 trillion. And according to the insurance industry, this could be an underestimate.

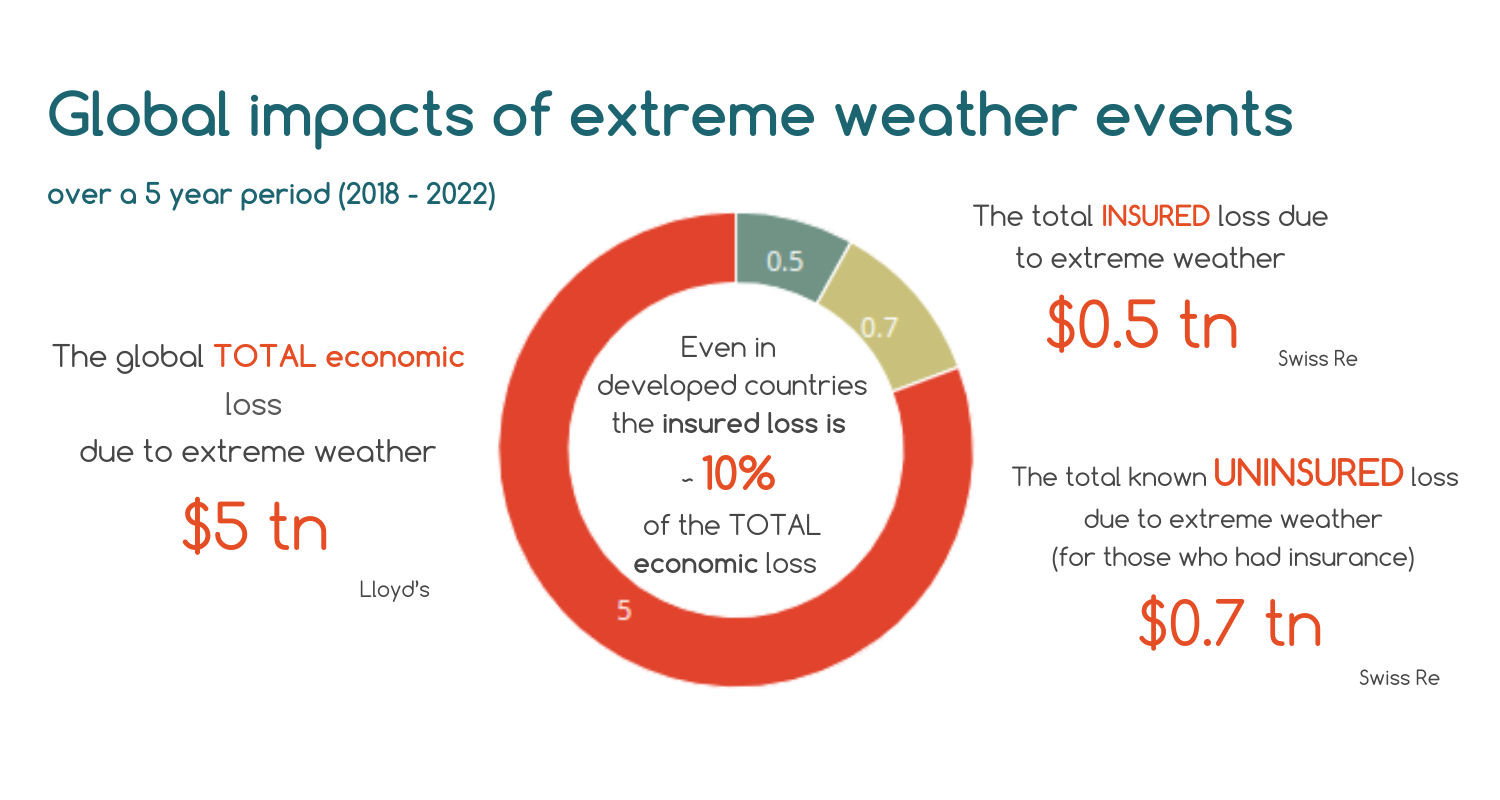

Some of this is covered by insurance, but most is not. A widely quoted Lloyds Insurance estimate suggests total global economic losses from extreme weather and physical climate risks in the 5 years to 2023 were c. US$5 trillion. Remember, this is heavily biased toward developed markets, which is where the insurance industry has the best data.

And Swiss Re estimated that only US$0.5 trillion was insured.

That's a lot of uninsured losses !

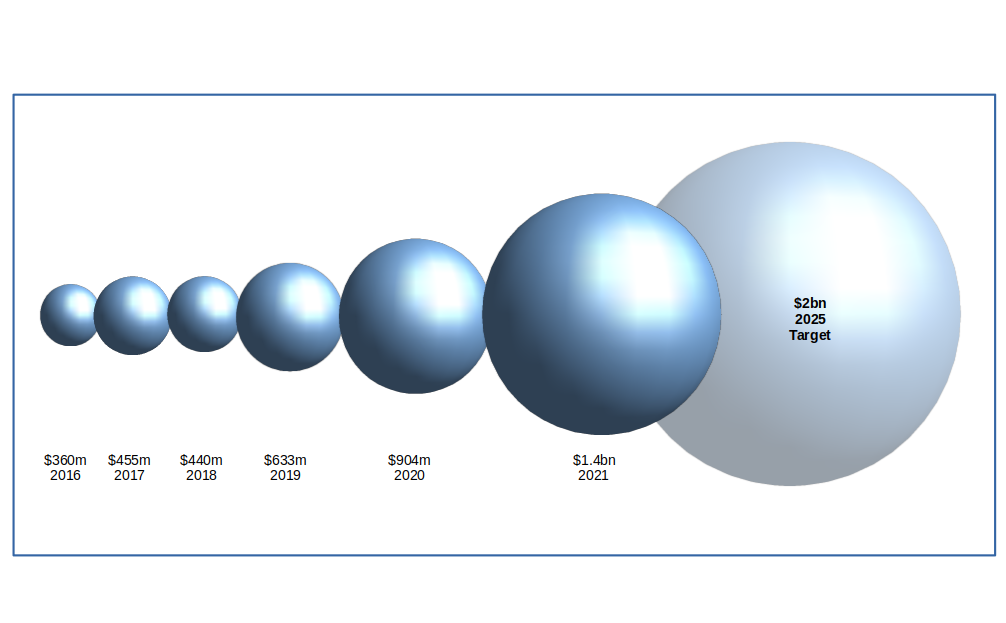

Which brings us back to spending on climate adaption. The simple point is that we are not spending enough.

First the scale of the challenge. A 2025 explainer from the World Resources Institute set out the spending need:

"the UNEP Adaptation Finance GAP Report estimates that developing countries need between $215 and $387 billion per year by 2030. The International Monetary Fund (IMF) estimates that adaptation costs exceed 1% of GDP per year in about 50 low-income and developing economies. This rises up to 20% of GDP for small island nations exposed to acute climate hazards such as tropical cyclones and rising seas."

And what are we spending? Again quoting the WRI report ....the Climate Policy Initiative (CPI) estimates that $68 billion was spent around the world on adaptation on average between 2021 and 2022.

So nowhere near enough.

Let's be clear. Not all of this gap is down to the private sector (investors and companies). Much of it will need to be spent by governments and multilateral agencies. But a decent proportion impacts commercial operations. The Oxera report referenced above quoted a US flood risk study that estimated ...

"that roughly 25% of all critical infrastructure, which equates to approximately

36,000 facilities, is currently at risk of becoming inoperable due to flooding."

So, let's look closely at the experience of countries such as New Zealand, and say 'this could be us in five or ten years'. Lets start preparing now. And as part of this, lets think about how we can encourage and incentivise the private sector to play their part. Insurance on it's own will not be the answer. In fact, it will certainly not be available at the scale we need, and for the people most at risk.

On a personal note some of you might have noticed that I have published a lot less over recent weeks. I don't get paid to write these blogs, it's a personal mission of mine to use my investment experience to assist in delivering the sustainability transitions. And sometimes family becomes the priority. To misquote Allen Saunders and more recently John Lennon "life is what happens to you while you're busy making other plans”. And sometimes life serves you some hard knocks. Hopefully we have turned the corner.

One last thought

Insurance companies can create impact by choosing not to underwrite projects that could adversely impact the transition, invest in impactful projects that generate a return or by reducing their own underwriting risk by directing capital to projects mitigating the harmful effects of climate change.

Grant me the strength to accept the things I cannot change, the courage to change the things I can, and the wisdom to know the difference. Reinhold Niebuhr - a Lutheran theologian in the early 1930's

Please read: important legal stuff. Note - this is not investment advice.