Sunday Brunch: Forecasting is tough but necessary

Like most of you I am rubbish at forecasting. Which is a problem if you believe (as I do) that the future will not look like the past. Extrapolating history can result in us investing in industries in decline. The good news is that we only need to get the direction of travel right, not the detail.

Trying to value companies without some sort of forecast is a bit like picking investments by throwing darts at a board.

At the end of last year I recapped my thoughts on how sustainability issues impact investing. I argued that one potentially useful approach is to use the logic of long term value creation. Which involves us thinking about how the companies competitive advantages will change over time?

This obviously requires us to have a meaningful picture of how the future might (probably) look. But we know that many (if not most) financial forecasts are often no better than tossing a coin.

This isn't the problem that it first seems to be - we don't need to be exactly right for our 'forecasts' to be useful.

For this blog I am not going to dig down into how we can create useful forecasts (narratives) that help to power our investment decisions. If this is something you are interested in I suggest a good starting place is 'Numbers & Narrative' by Aswath Damodaran.

What I instead want to explore is how we need to protect against the misuse of short term data and newsflow to 'decide' if our longer term predictions are correct. This seems a particularly relevant discussion in the current geopolitical environment.

My key point is simple - if our narrative is medium or longer term, don't over use short term data fluctuations. Yes, when we get new data we have to ask if it changes the story. But if we are 'forecasting' structural changes that will play out over 5 or 10 years, then some volatility must be expected. The move to the future scenario will never be a straight line. And as investors, a shift in short term narrative can create interesting buying opportunities.

Let's look at EV sales as an example.

EV's will take over the world - or will they ?

The consensus view up until recently was that Electric Vehicles (EV's) would continue to take market share, until at some point in the future they would dominate the transport market. This would obviously not be good news for companies that were focused on producing vehicles powered by internal combustion engines (ICE's). And if this fade was not reflected in the share share, these companies could make poor investments.

More recently, some analysts have started to question this narrative. Why ? While I would argue that some of the questioning is political, it's also true that the data momentum has changed. As the FT highlighted in a recent Moral Money article (paywalled sorry) the auto sector has reported some pretty serious financial charges as they reversed or at least massively slowed, their EV conversion strategies.

And forecasts for 2026 suggest a slowing in EV demand growth. The much quoted Bloomberg NEF is forecasting that the growth in EV sales will slow, as China winds down some subsidies, Europe wavers on its phase-out of combustion engines, and U.S. producers and policymakers make a U-turn from the segment. They are now forecasting growth in 2026 of c. 12%, a material slowdown from the c. 23% seen last year.

While this low teens sales growth is still pretty healthy, the headlines have turned negative. My favourite example is from the Detroit News, which suggests that automakers will face an EV winter.

And while the FT headline of 3rd Jan is less emotional, they are still reporting it as 'electric vehicle sales are set for slowest growth since the pandemic'.

Given all of this, it's perhaps not surprising that for some investors the narrative is changing.

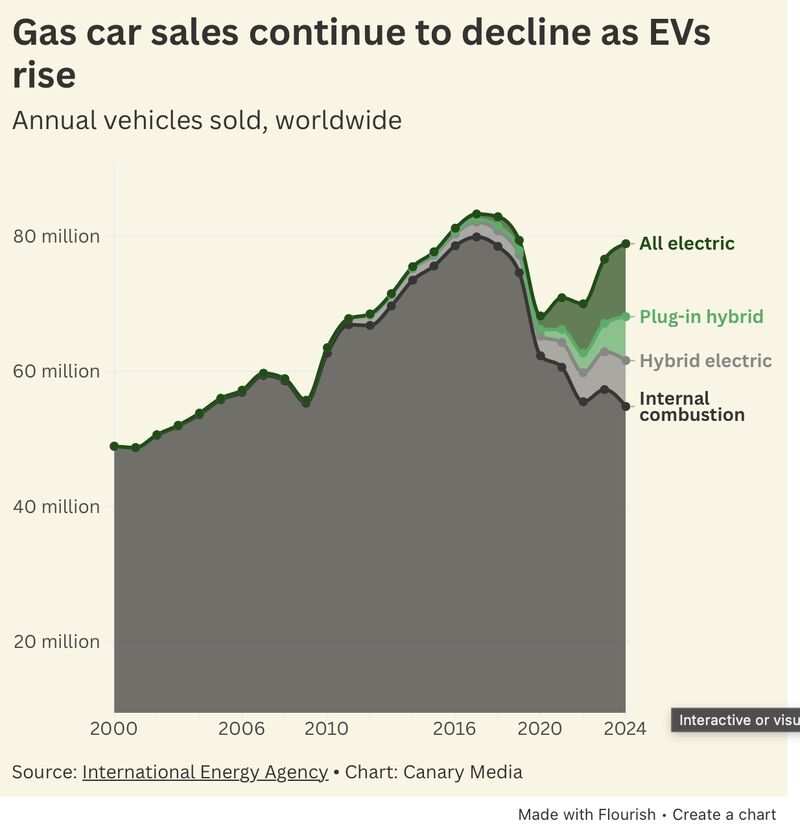

But, if we stand back a bit the longer term picture doesn't seem to have changed that much. Using data from the IEA, Canary Media has produced the chart below which illustrated that while at their all-time high in 2017, global sales of pure ICE vehicles hit 79.9 million units, by 2024 sales dropped to 54.8 million.

Let's remind ourselves of the underlying narrative. As investors the key piece is not that EV sales will continue to growth at 20% plus rates. It's that sales of ICE vehicles will continue to fall.

I don't know about how you are reading the data, but to me that narrative still feels like it's still intact.

I understand why apparent changes in news flow make the headlines. And that this can lead to a review of the underlying investment narrative. But I would caution against reading too much into short term data.

A companies share price reflects market expectations of the future stream of cashflows. This means (mathematically) that while this year's data is important, it's not as important as the long term trend.

It's critical that we are clear about our narrative, and how this feeds into the investment numbers . This helps us keep perspective when the short term noise starts to dominate.

One last thought

Life is not easy for European automotive companies. Sales will likely remain below pre covid levels for some time, and margin pressure looks unlikely to abate. And EV investment needs are rising. Can we expect them to be able to fund the EV transition - or does the future lie elsewhere?

Grant me the strength to accept the things I cannot change, the courage to change the things I can, and the wisdom to know the difference. Reinhold Niebuhr - a Lutheran theologian in the early 1930's

Please read: important legal stuff. Note - this is not investment advice.