Sunday Brunch: where should we focus - electricity utilities ?

Dr Ellen Quigley argues investors can make the 'most' difference in our efforts to reduce GHG emissions by focusing on the utility sector. This was one of the many really interesting points to emerge from a recent interview she gave with with Tom Gosling - it's well worth watching.

The traditional wisdom is that we best reduce GHG emissions by working on the Oil & Gas companies. Getting them to agree to produce less, or at least stop exploration for new supply. But is this right ?

Maybe it's more effective to work on the main users of fossil fuels, getting them to switch to greener alternatives?

Regular readers will know that this is something we have written about before. Getting O&G companies to change is hard. Reducing demand for their products is more achievable. And we would argue that in terms of end demand for fossil fuels, the two big sectors where we have easily rolled out alternatives are electricity/heat generation and transport.

Many of you will know Dr Quigley, or at least know her work. She is one of the best thinkers on Universal Ownership, and I am a big fan of her work.

She recently did an interview with Professor Tom Gosling, to discuss the recent analysis that Tom did with Harald Walkate on 'does sustainable investing work'?

I will come back with some thoughts on Tom and Harald's three stage rocket analogy in a future blog but for now I want to explore the argument that Dr Quigley made on making sustainability more effective, in part by focusing on electricity utilities.

Attacking fossil fuel demand rather than supply

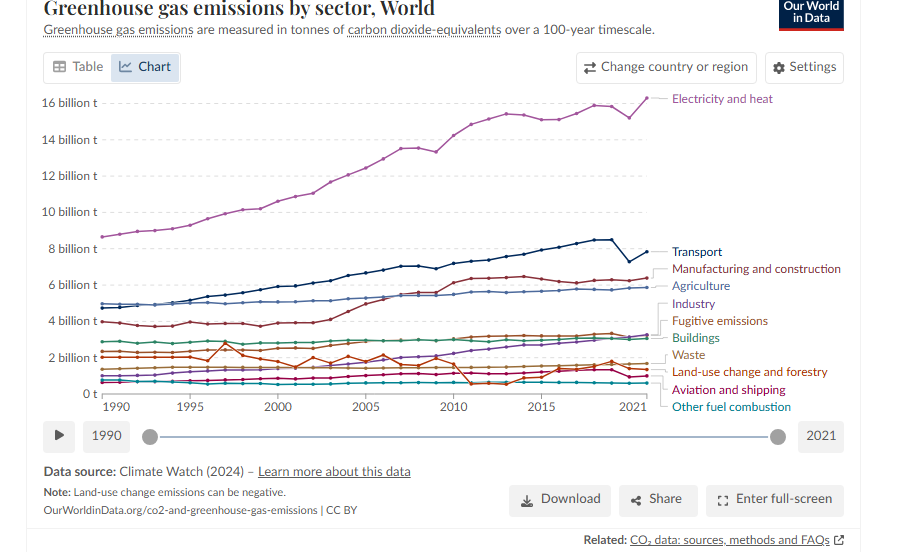

Let's disaggregate this question a bit. This chart (from Our World in Data) is now a bit out of date, but the message is pretty clear. Electricity and Heat generation produce materially more GHG emissions than any other sector.

And if we just consider electricity generation, a recent IEA report (on electricity emissions) stated that ...

"Global CO₂ emissions from power generation rose by a modest 1% in 2024, following a 1.4% rise in 2023, due to a 1.3% y-o-y increase in fossil fuel-based generation amid global electricity demand growth of 4.3%. At about 13 800 million tonnes of CO2 in 2024, emissions from electricity generation remain the highest of any sector."

This suggests that the vast majority of the c. 16 billion tonnes of CO2 e from electricity and heat in the Our World in Data chart above come from electricity generation.

So - electricity generation matters.

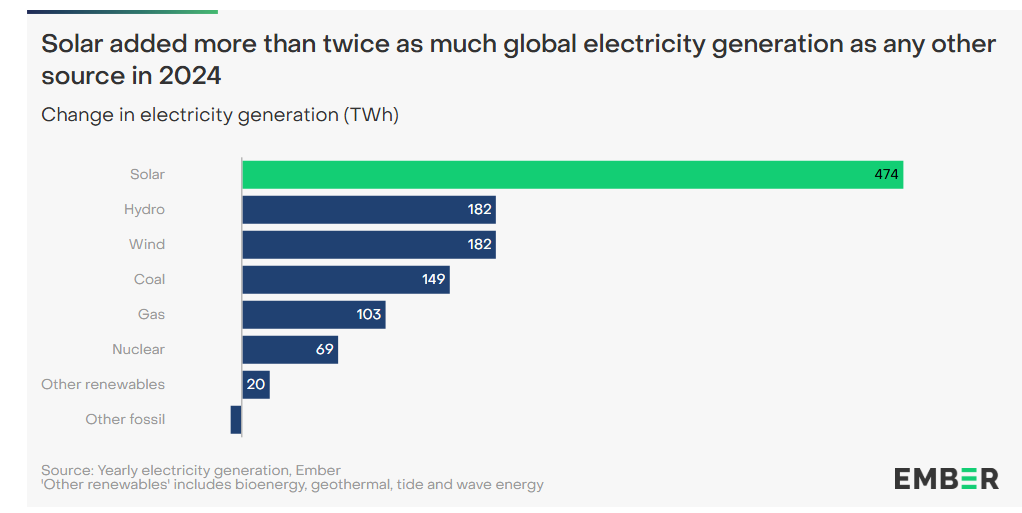

And we have low carbon alternatives that in many cases are cost effective. And these are being rolled out at an increasing rate. According to Ember, "solar added more than twice as much global electricity generation as any other source in 2024."

So, briefly recapping. Electricity generation is (probably) the single biggest sector source of GHG emissions. And the good news is that not only do we have low carbon ways of producing electricity but these are taking market share.

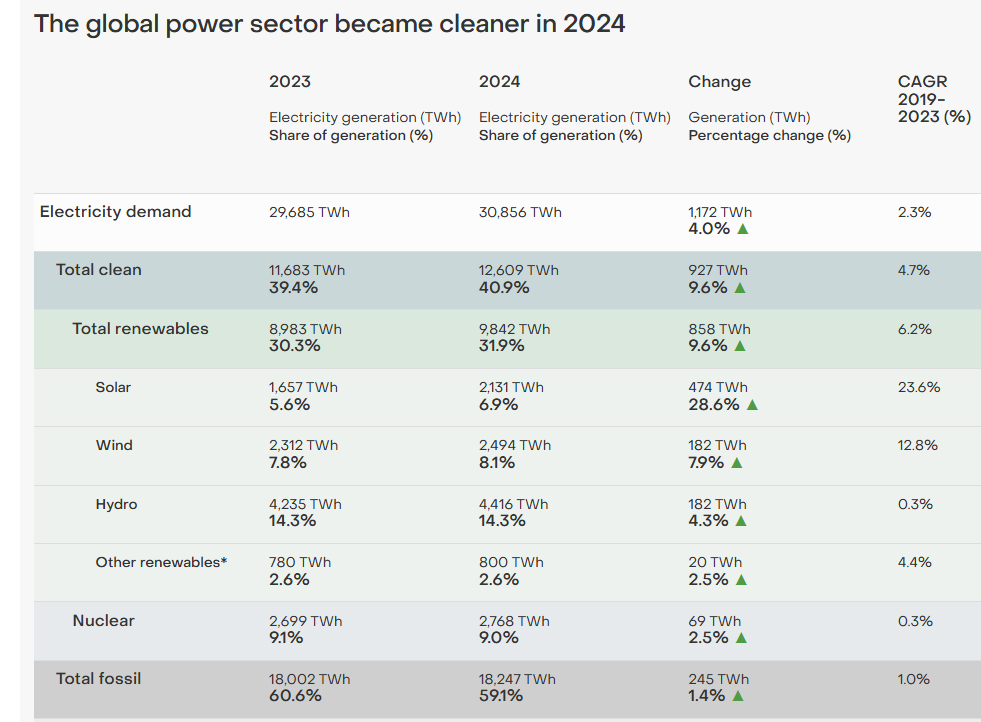

According to Ember (same reference), total clean generation is now nearly 41% of 2024 generation, growing over twice as fast as total electricity demand and way faster than generation from fossil fuels.

But despite this - gas is seeing a resurgence

But (you probably guessed that there was a 'but' coming) ... fossil fuel generation is still over half of total generation, and over 34% of this is from coal.

And gas turbine orders (used to power gas fired CCGT power station) are surging. According to Wood Mackenzie, orders were up 32% y/y in 2024. And various countries are planning to build dozens of new plants.

Power Magazine reported in December 2024 that the EIA forecasted nearly 8GW of new gas fired production will be added in the US this year and a similar amount in the eyar after. Sticking with the US, the FT reported the energy consultancy Enverus as estimating that as many as 80 new gas fired power stations could be build by 2030. And it's not just the US, new production capacity is planned across the world, partly fueled by growing demand from data centres and AI.

And these power stations will probably keep generating well into the 2050's.

So, you can see Dr Quigley's point. While our electricity generation is getting cleaner, and globally clean energy investment is rising fast (now at US$2.2 trillion compared with 'only' US$1 trillion on fossil fuels), there is much more that can be done. And the companies that are able to make these decisions are largely the electricity utilities. Yes, we know that we also need action by politicians and regulators, but companies can make a real difference. As Dr Quiley argues, investors need to push them to go greener faster.

So maybe she is right, focusing on electricity utilities is our most effective GHG reduction action.

One last thought

Another important point to come out of the conversation between Dr Quigley and Professor Gosling was on the need to focus more on debt. For what are probably understandable reasons much of the attention of sustainability professionals and NGO's is given to listed equity markets. But, despite the obvious attraction (shareholders 'own' the company), using these markets as a mechanism for change has a big drawback - they are mostly what are known as secondary markets (investors selling shares to each other ). While some companies use the listed equity markets to raise new capital, this is a small component. And so our ability to limit a companies access to new capital is not as easy as we might first think.

By contrast the listed and traded debt markets are the main source of new capital for companies (or in many cases refinancing of existing debt, which for this purpose is very similar). And so, to a degree, this could be a better place to get leverage over a companies activities.

If you want to understand the sustainability linked debt markets, the recent handbook from the Anthropocene Fixed Income Institute is well worth a read.

Please read: important legal stuff.