The energy world is changing, and yet staying the same

The latest IEA World Energy Outlook has been published, and as always it's a useful source of both data and commentary. The headlines were encouraging.

Full report here 👇🏾

An energy system in 2030 in which clean technologies play a significantly greater role than today. This includes almost 10 times as many electric cars on the road worldwide; solar PV generating more electricity than the entire US power system does currently; renewables’ share of the global electricity mix nearing 50%, up from around 30% today; heat pumps and other electric heating systems outselling fossil fuel boilers globally; and three times as much investment going into new offshore wind projects than into new coal- and gas-fired power plants.

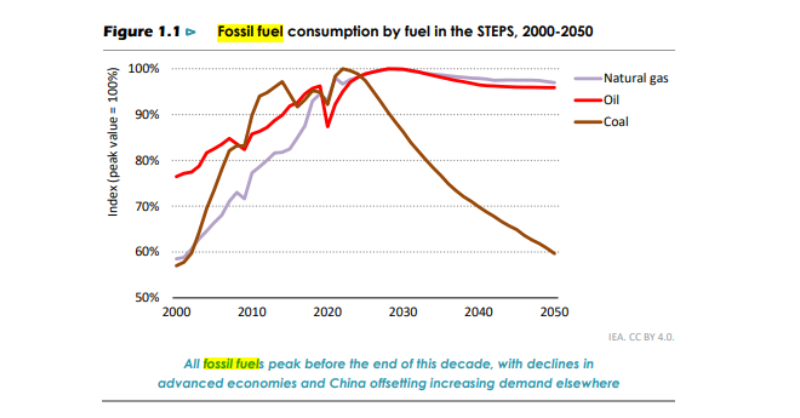

Not wanting to spoil the good news story - but we also want to highlight something from page 26 of the report (ie well past when the casual or busy reader gives up). It's about fossil fuel usage.

The good news is that they forecast that coal usage will continue to decline. The not so good news is that even under their STEPS scenario, oil and gas demand only falls slowly. What is STEPS? It's the outlook that is based on countries various latest policy settings, including energy, climate and related industrial policies. So, if these policies get tightened, fossil fuel use could decline faster (and of course the reverse also holds).

Keeping some balance, yes, Oil and Gas (O&G) are losing market share to clean energy technologies. And yes, in some countries peak O&G has already been reached. But as a planet, we are still forecast to consume a lot of O&G, out to 2050 and beyond. And even as demand falls, "energy security challenges will remain".

Why is this worth highlighting? Because of narrative. If you read our recent Sunday Brunch you will know that narrative sits at the foundation of your investment case. And for many O&G companies, their narrative is that the world is going to need a lot of O&G over the coming decades. And that it's going to be important to maintaining energy security. And from their perspective, the O&G supply might as well come from them. It does look like the IEA data supports this.

This is not to argue that they are right. But it's important to understand the other sides' narrative. The narrative that the financial market as a whole believes (market expectations) plays a big part in where capital gets allocated and hence how share and debt prices move.

We wrote a recent blog on engaging with O&G companies. It's well worth a read, but the bottom line was - don't expect them to change, and don't expect them to be the main driver of green energy. The best weapon Sustainability Professionals have to drive change is not engagement, it's supporting fossil fuel alternatives. If the world needs less O&G because we are using something greener instead, O&G production will fall.

Link to blog 👇🏾

This article featured in What Caught Our Eye, a weekly email featuring stories we found particularly interesting during the week and why. We also give our lateral thought on each one. What Caught our Eye is available to read in full by members.

If you are not a member yet, you can read What Caught Our Eye when it comes out direct in your email inbox plus all of our blogs in full...

Please read: important legal stuff.