The implications for sustainability of falling gas prices

Energy Source (from the FT - so behind the paywall) recently highlighted just how much gas prices have fallen in many regions around the world. As they say, the Russian invasion of the Ukraine triggered disarray in the energy markets. And one consequence was a massive spike in gas prices.

But since the peak in c. late 2022 gas prices have fallen sharply. The European benchmark (Dutch TTF) is now close to levels last seen pre the latest energy crisis. And East Asian spot LNG has shown a similar trend. Why is this? It's supply and demand. As Ademiju Allen, senior analyst at Rystad Energy says “We have too much gas. There’s not enough storage, and so prices have to go to a point where they curtail supply.”

The analysis of what happens next to gas prices is beyond my scope of expertise. But I do note that many analysts are suggesting that a surge of LNG production scheduled to come on stream later this decade might keep some downward pressure on gas prices. If this is correct, then what might it mean for the sustainability transitions?

The obvious linkages are around electricity prices, where gas (often via CCGTs) is the marginal price setter in many countries, and the shift from coal to gas as an energy source.

First, electricity prices. All other things being equal, lower gas prices will make electricity cheaper for the consumer. But they will also act to close the price gap between gas and renewables. So, we need to watch for a (short term) slowing of new renewable build outs.

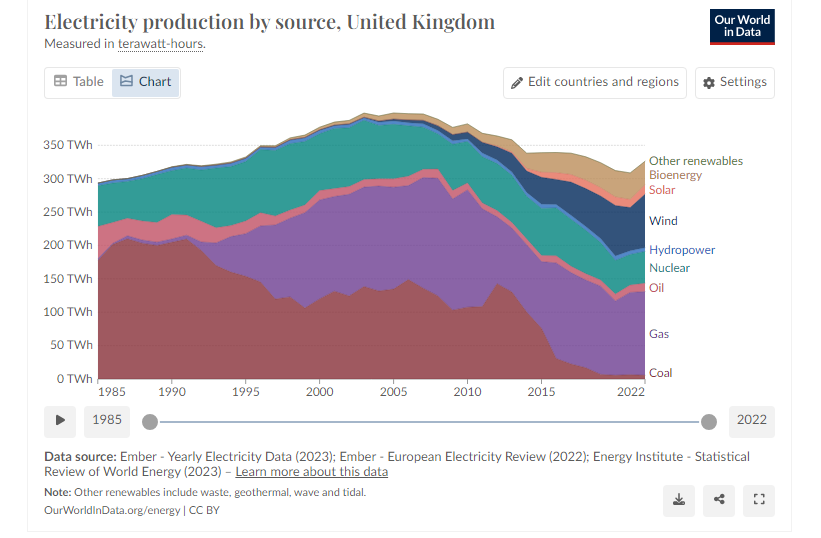

Second cheaper gas as a substitute for coal. This is better news. If gas prices remain low, then we should see a continuing shift away from coal. But then this was already happening in many countries (but not China). The example below is from the UK.

So net net both of these impacts could be thought of as possible short term blips and surges in what is an already well established trend (more renewables and less coal).

But, the gas price also has a material impact on fertiliser prices, as highlighted in a June 2022 article in The Conversation. This could have two implications for the sustainability transitions in agriculture. The first is that cheaper gas could lead to a recovery in fertiliser use - not something we really want as we already use too much fertiliser.

And second, cheaper nitrogen based fertilisers could discourage farmers from trying more environmentally friendly alternatives. In the absence of subsidies this could make the transition harder. We have noted before that farmers are understandably cautious about change. And cheaper gas might add to this.

This article featured in What Caught Our Eye, a weekly email featuring stories we found particularly interesting during the week and why. We also give our lateral thought on each one. What Caught our Eye is available to read in full by members.

If you are not a member yet, you can read What Caught Our Eye when it comes out direct in your email inbox plus all of our blogs in full...

Click this link to register 👉🏾 https://www.thesustainableinvestor.org.uk/register/

Please read: important legal stuff.