What caught our eye - three key stories (week 21-2024)

Greener agriculture just got more important, do we really understand how to measure responsible sourcing in EV and battery supply chains, and do we need to rethink surface flood protection in our cities,

Three stories that grabbed us last week, and why anyone interested in sustainable investing really needs to read them.

Is the need for greener agriculture even more urgent than we thought: what if the end to end food production process generated more GHG emissions than generating electricity and heat? The World Bank thinks it does.

Do we really understand how to measure responsible sourcing in EV and battery supply chains? Regulation, policies and audit's on their own, are unlikely to be enough. Maybe the answer is simple, investors and NGO's working together to build engagement?

Do we need to rethink surface flood protection in our cities, and if so who pays? Sponge cities could be part of the answer. Water utilities and local government don't have the money, so maybe we can get insurance companies to pay?

'What caught our eye' like all of our blogs are free to read. You just need to register.

Please forward to friends, family and colleagues if you think they might find our work of value.

Is the need for greener agriculture even more urgent than we first thought?

Does investment in green agriculture need greater attention? It seems pretty obvious to most people that we should be focusing our investments and actions on the biggest climate related challenges. If we are talking about GHG emissions, this would be electricity & heat, transport, and then manufacturing and construction. Or is it?

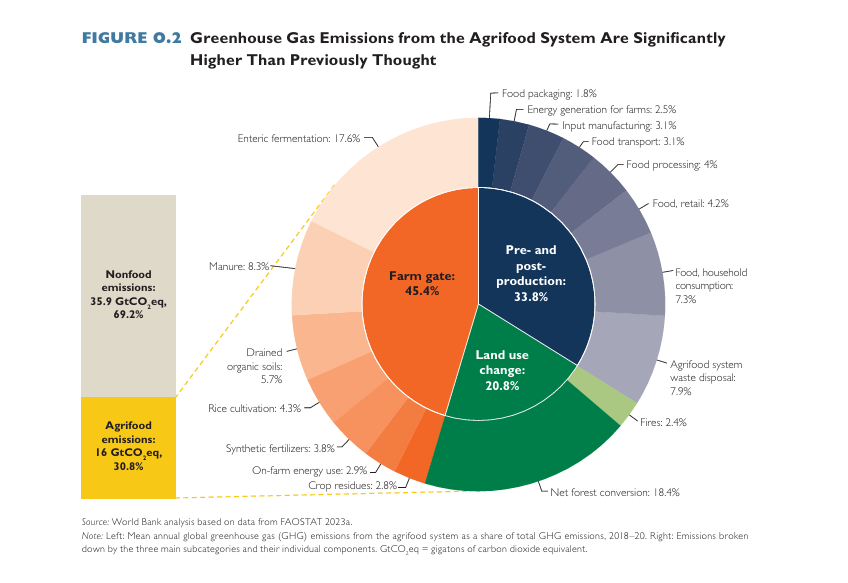

One of the most commonly quoted sources (and a good one in our opinion) is Our World in Data. And as of 2020 they had electricity & heat at 15.2 billion tonnes of CO2 equivalents, which is c. 32% of global GHG emissions. Transport was second and agriculture was 4th, at 5.9 billion tonnes. And here it's important to read the small print .... some things, in this case land-use change emissions, are not included.

But what if the agriculture emissions number was actually nearly 16 billion tonnes? More than Electricity and Heat. This was the conclusion of a recent World Bank conference paper - titled Recipe for a Livable Planet.

Would that change your view on the relative importance of investing in green agriculture as opposed to renewable electricity and EV's?

First the caveat. The first thing you will see when you open this document is "uncorrected proof: not for citation". As they go on to say, the text of this conference edition is a work in progress for a forthcoming book, Recipe for a Livable Planet: Achieving Net Zero Emissions in the Agrifood System.

But even if the 16 billion tonne number is slightly off, then it should alter how we think about where we need to focus investment.

How could there be such a big difference between what we thought, as illustrated by Our World in Data, and the conclusions of this report? The short answer is 'what is included'.

The World Bank report analysis is 'end to end', everything that is involved in producing the food that we eat. This goes from land use changes (that 'missing' bit in the Our World in Data chart), through the actual processes of farming (up to the farm gate), plus everything involved pre and post production (for instance food processing, transport and retailing).

I am still reading through the report but a few things leap out at me, which together at least partly explain why a lot more finance is invested in greening electricity generation and EV's than in agriculture. I will be coming back to some of the issues raised in future blogs.

So, what did I discover so far from the report?

First, we need to accelerate our efforts to get finance into greening our agriculture systems. A lot of work is being done in this area, and while our industry can do more, as Plant Tracker said in a recent guest blog on this topic "it will ultimately be political will that counts".

And we should never forget that political will follows social pressure. While our individual actions as consumers might have a small impact, our collective action as voters makes change happen.

The second point is the obvious one. There are a vast number of challenges to fix, and no one solution will solve all of them. And anyone who promises that 'their' solution will, is probably lying to you.

But, there are some potential big wins. For instance, land use change, specifically net forest conversions (deforestation to you & I) is massive at over 18% of total agriculture emissions. We have written on this before, including recently on the excellent World Resources Institute report that highlighted how little data we have on this challenge, and how 'meaningless' many of the deforestation pledges really are.

And thirdly, agriculture is not just about GHG emissions. Working on our soils, including making them more resilient, and biodiversity, are important topics. We need to make sure that in investing in solutions, we do not become over focused on GHG emissions.

And one last, but very important point. Agriculture is about people. Many farmers around the world are on low incomes, with limited ability to manage risk or to invest capital. Investors can help, but it means working together with food manufacturers, food retailers, NGO's, impact investors and farmers.

Link to blog 👇🏾

Citation for the World Bank report : Sutton, William R., Alexander Lotsch, and Ashesh Prasann. 2024. Recipe for a Livable Planet: Achieving Net Zero Emissions in the Agrifood System. Agriculture and Food Series. Conference Edition. World Bank, Washington, DC. License: Creative Commons Attribution CC BY 3.0 IGO

Understanding responsible battery supply chains

Do we really understand how to measure responsible sourcing in EV and battery supply chains? As the demand for EV's and stationary energy storage grows, we are going to need more batteries. This is understandably leading to attention being paid to where the required raw materials will come from (do we have enough supply, at the right price, and from where).

And it's also leading to questions about how these raw materials are mined and processed. What you could broadly call responsible sourcing.

Part of how this will happen is related to regulation from government, and policy action (including audits) by companies. But this is unlikely to be enough. To quote Julie Schindall from Levin Sources "of all the practices we’ve seen work, especially deep into the supply chain, engagement is the “make or break” factor".

Let's dig into this a bit more.

Starting at the beginning. A recent report from Rainforest Foundation Norway (RFN) and AidEnvironment found (to quote):

"a disturbing lack of commitments on deforestation in mineral supply chains across EV battery producers and automakers alike and identified ‘broken links’ between automakers' and battery manufacturers' policies."

What they mean by 'broken links' is that even where the automaker has a deforestation commitment, in some cases they source raw materials from battery manufacturers who have no similar commitment. Which raises the question of how real the deforestation commitment is in practice.

In the interests of balance, they highlight that some EV automakers are doing better in this regard than others - specifically calling out Tesla, BMW and Mercedes Benz as being among the best performers.

As an aside, this is broadly consistent with a recent PIRC report (Leading the Charge 2024). This found that there had been steady progress across the industry, in particular on fossil-free steel and human rights due diligence. US automakers are making the fastest progress, led by Tesla who shot up in the rankings from #9 to #3 in one year. However, progress by the industry as a whole is lackluster when compared to the scale of the challenge ahead.

This got me thinking. I don't know about you, but responsible sourcing is one of those topics that I feel I don't know enough about. I understand what it means. And as an investor I understand why its important.

What I am less sure about is the key question ...'how do we know that it's actually happening on the ground'.

As we highlighted at the beginning of the blog, one part of the answer is regulation. For instance in Europe we now have the EU Batteries Regulation.

To quote, this 'mandates companies to establish a batteries due diligence policy, for the purpose of addressing and mitigating human rights, environmental and climate change impacts along the battery materials value chain.'

If you want to know more about how this regulation will work, I recommend a recent Insight blog from Levin Sources (The new EU Batteries regulation: driving companies to higher due diligence standards).

Another element will be sustainable sourcing policies and practices from companies. For instance, as the PIRC report highlights, Ford has a standalone responsible minerals sourcing policy, which goes beyond conflict minerals to cover cobalt, mica, lithium and nickel.

But, regulation, policies and audit's, on their own, are unlikely to be enough.

This brings us back to engagement. Many companies will respond to this by saying, we cannot have a conversation with thousands of suppliers. And this is true. On their own they cannot.

Which is where the power of collaboration comes in. To again quote Julie Schindall "collaborations, partnerships, industry initiatives, multistakeholder initiatives, dialogue platforms: over and over we have seen their power in engaging, supporting and pushing supply chain partners to rise to the standard that we expect of all companies to do business with respect for people and planet."

So as well as regulation and policy, let's also focus on collaboration. This is a topic I want to come back to - after I have done a bit more research. So watch this space for real world examples.

I want to finish this part of the blog with 'why is responsible sourcing important'?

One obvious answer is that it's the 'right thing to do'. Increasingly employees are 'voting with their feet', choosing not to work for companies that have poor social and environmental track records. This is recognised as a material issue for the mining industry - what a recent McKinsey article called the deterioration of the industries employee value proposition (I think that means less people what to work for them!).

And pressure is coming from customers to show that the product is being manufactured responsibly, from raw materials mining all the way through to the production process.

But there are also very direct financial implications for companies and investors. As Julie Schindall (from Levin Sources) said in a presentation back in May 2022 "companies ignore the perspectives of local communities at their peril - we see direct ties between harms to communities and material risks to mining companies".

We talked about this back in March last year in a blog titled 'Critical mineral mining meets social license'. In it we made the point that recent research from a Finnish team suggested that “social aspects are now considered the biggest risk facing the mining industry”. They particularly highlighted political risk, where mining plans come into conflict with environmental objectives and legislation.

Social license in mining is becoming increasingly important. And the answer is not to limit peoples opportunities to object.

Link to blog 👇🏾

Should London become a sponge city, and who pays?

Do we need to rethink surface flood protection in our cities, and if so who pays? Over the last few years London has been hit by a series of disruptive and expensive floods, mostly caused by intense heavy rain falling on impervious sources such as concrete. The rain water has nowhere to go, as the storm water system rapidly backs up. And surface flooding is the result.

And Professor Lizzie Kendon from the Met Office told the BBC that storms capable of causing flash flooding "are expected to be four times more frequent in the future under a high-emission scenario". This is going to happen more & more often.

One solution is to give the water somewhere to go. We could make our storm water systems much bigger, but that would be very expensive, and if you follow the debacle that is the UK water industry, it's hard to see the funding being found for this.

The other set of solutions are grouped under the general heading of sponge cities. The idea behind them is simple, and not dissimilar to the old concept of water meadows. You mitigate surface flooding by using green spaces like parks and wetlands, and blue spaces like ponds and rivers, to lower the amount of excess rainwater entering the stormwater system.

And this doesn't have to be on a grand scale. Yes, parks and lakes are important. But smaller scale projects such as 'swales' can also make a difference.

What is a swale ? It's a shallow ditch, often alongside a road, that is designed to hold the water draining off houses, driveways and gardens. The water drains into the swales and is held there to gradually infiltrate into the land. Cheaper and easier to build.

This doesn't just apply to London. A recent report from the engineering consultancy Arup, looked at the 'sponginess' of 8 cities across the world, from the densely packed Mumbai, to the dispersed city of Auckland in New Zealand. London scored badly, at an index score of 22%. This compares with Auckland at 35%. But nowhere scored highly, this is a global challenge.

Fixing this is a good idea, and we seem to have a half decent solution in sponge cities. But who pays for this? As we pointed out above, our water companies would struggle to fund this quickly. And local government is already badly stretched.

Maybe the answer is an insurance levy. We all pay in our household and property insurance and the industry gets the work done. And they benefit from lower claims.

If you think this is just a dream, it's worth checking out this blog, that talks about insurance company QBE's Premiums4Good programme. Under this a proportion of their premiums are invested in projects that create social and environmental impact whilst making a financial return.

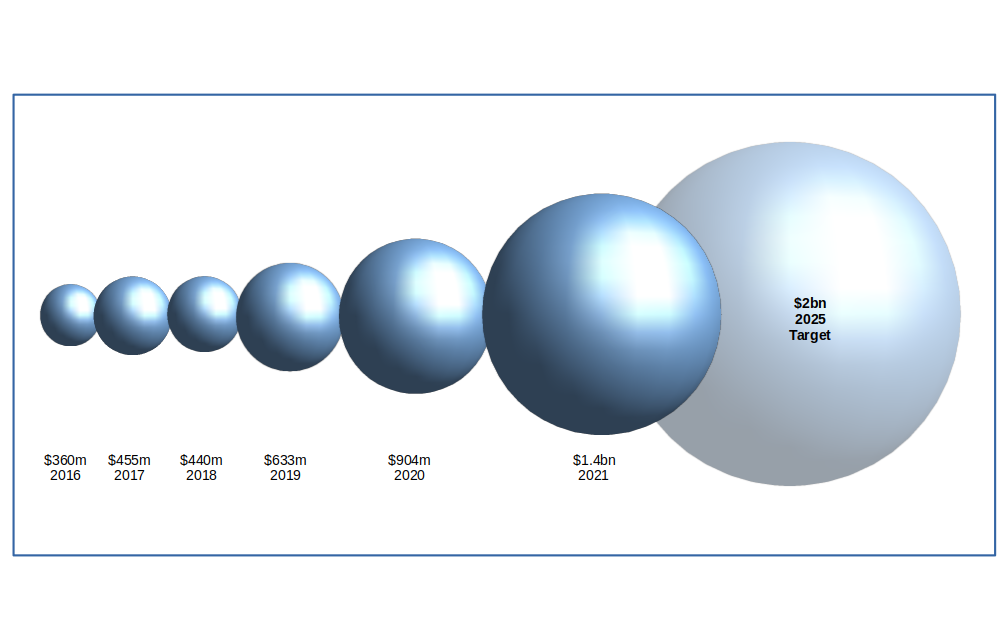

As of 31 December 2021, QBE had invested US$1.4 billion, with a target of investing US$2 billion by 2025.

And just in case you think we are just repeating the BBC story, we wrote about these topics and the Arup report back in May 2023, where we discussed swales, sustainable urban drainage, and pointed out, this is not a perfect solution. It cannot stop all floods.

Link to blog 👇🏾

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.