What caught our eye - three key stories (week 2, 2024)

Green investment opportunity in emerging markets; Critical mineral choke points; Soil carbon credits

Here are three stories that we found particularly interesting this week and why. We also give our lateral thought on each one.

Read in full by clicking on the link below.

'What caught our eye' like all of our blogs are free to read. You just need to register.

Please forward to friends, family and colleagues if you think they might find our work of value.

The $330bn/year green investment opportunity in emerging markets

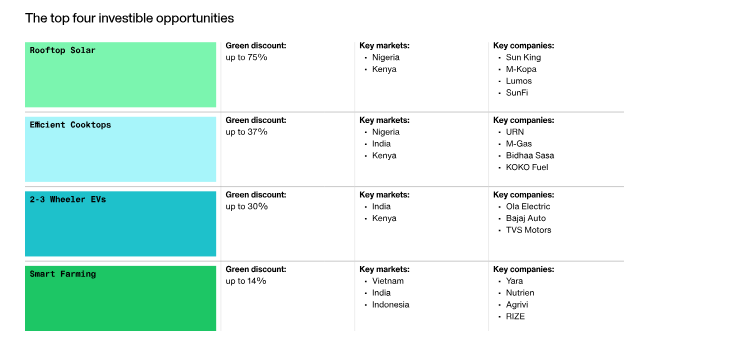

But, it might not be what you think. According to a report prepared by Leapfrog Investments for the CGAP and Temasek, dozens of green technologies are actually lower cost than incumbent technologies across the emerging world. Technologies that are already cheaper range from electric scooters in India, through rooftop solar in Kenya, efficient cook tops in Nigeria, and smart farming in Vietnam. Discounts to the traditional alternatives range from 14% in smart farming through to a massive 75% in rooftop solar.

This cost gap is expected to spark a wave of new green investments that could potentially reach $330Bn per year over the next decade. Furthermore, it is estimated that the new green technologies offer the potential for low income consumers to save as much as $500 pa - a material amount for many communities.

There is a lot for investors to like in the markets highlighted. The end market is growing (so tick), the new entrants have material cost advantages over incumbents (another tick), and the new(ish) technologies are now 'well proven' (so a reduced commercialisation risk - another tick). Plus, it is estimated that current investments in these markets total around 5% of what is needed, so investors can worry less about being late to the party (another tick).

One thing that struck us as we read the report was how advancing these markets was less about developing new products, and more about finding new ways of recruiting and retaining customers. This is what the report describes as overcoming 'non cost barriers' - making the point that, on its own, offering whole life cost savings is not enough to create a tipping point.

Taking the 'efficient cooktop' example, using gas for cooking is whole life cheaper, and better for health outcomes. But the upfront cost compared with the traditional alternative (firewood and charcoal) is a massive barrier. In some South East Asian countries government policies have helped. But finding a practical private sector led equipment rental model could really help unlock potentially massive markets.

Emerging markets don't really get the attention they deserve when it comes to sustainability investing. We understand why. Often the current market size is small, with different offerings needed depending on location. Access to local currency finance can also be a barrier. But all of this is changing. And in some technologies, the emerging markets are leading the way. Two and three wheelers are a good example.

Link to blog 👇🏾

Critical Minerals - will we have enough?

Kathryn Porter, who writes the Watt Logic blogs, recently did a two part detailed dive into the potential demand from the sustainability transitions for critical minerals. Part 1 sets the scene in some detail. In Part 2, the blog we are highlighting, she looks at the supply situation for two pinch point resources - copper and aluminium. Copper you probably know about - it's widely used in power grids, solar farms, and EVs.

She highlights that annual copper demand just for electricity grids is forecast by the IEA to grow from 5 million MT in 2020 to 7.5 million MT by 2040 in its Stated Policies Scenario and to nearly 10 million MT in its Sustainable Development Scenario. In other words even based only on the policies in place (assuming they survive) copper demand for grids would grow by c. 50% out to 2040. And to deliver global carbon objectives, it would double. And grids are only part of the picture.

The problem is that expanding copper production is tough, at least at any sort of speed. At the current pace of progress BNEF estimates that demand could outstrip supply as soon as 2027. And yet, many ESG funds have avoided mining companies, and even traditional investors have concerns about the capex requirements.

And then there is aluminium. Many of you might be less aware of how important this is for the sustainability transitions. It's used in wind turbines, batteries, electrolysers, transmission lines, and hydroelectric plants. Plus, it's essential for solar PV. Demand is set to increase at a similar annual pace, from 9 million MT in 2020 to 12.8 million MT in the IEA Stated Policies Scenario and 16 million MT in its Sustainable Development Scenario by 2040.

The challenges for aluminium are slightly different. Its production uses a lot of electricity and refining can cause serious environmental damage. But the end result is similar, there are real questions about how supply can keep up with demand.

People have very understandable concerns about the mining industry. These range across environmental and social impacts, and as a result in many western countries obtaining new mining permits can be challenging. But, if we want the sustainability transitions, we will need more mining of certain minerals. Maybe it's time that investors explained this better, and engaged more intensely with the industry to improve standards. Work is already underway, but much more is needed.

Link to blog 👇🏾

Do soil carbon-sucking projects deserve the credit they get?

A story over the holiday period that caught our eye in New Zealand publication Stuff was one discussing carbon dioxide (carbon) storage in soil. The article highlighted Australian agricultural start up Loam Bio that produces a fungal and bacterial seed coating which boosts plants' ability to absorb carbon into the soil. The company has raised more than A$100m (US$75m) from investors and last week launched a product offering the USA.

Boosting soil carbon is good for crop productivity. It is also good for reducing greenhouse gas emissions (GHG). A 1% gain in soil organic carbon represents 133 tons of CO2e emissions per hectare. It also aids drought resilience. Humus, the dark, organic material that forms in soil when plant and animal matter decays, holds 7 times its weight in water. For every 1% gain in soil organic carbon, soils can hold an extra 144,000 litres of water. Higher soil organic matter improves the physical structure of the soil reducing erosion, improving the habitat for microbiota (bacteria, fungus etc) and as a source of carbon, improves the nutrients in the soil which can also enhance soil biodiversity too.

Indeed producing healthy soil is a focus of regenerative agriculture.

Focusing on one of the benefits above, 'reducing GHG emissions', the article highlights that farmers in Australia could be eligible for carbon credits if their soil is absorbing and storing enough carbon. Australian Carbon Credit Units currently trade at A$33.75 per tonne of CO2e and in 2021 even Rupert Murdoch got in on the act with his Cavan Station wool property signing a A$500,000 deal to sell carbon credits to Microsoft (albeit that later analysis should the claimed increases in soil carbon to be far too optimistic)

But the potential for getting paid for looking after the soil, which a farmer would be doing anyway, suggests this is a win-win right? Of course it is a bit more complicated than that.

There are different forms of soil carbon and there is a trade off between the impacts on fertility (remember the crop productivity benefits we mentioned earlier?) and permanence.

Particulate organic carbon (POC) from fresh residues and living organisms stores carbon for 1-5 years (often referred to as 'labile'), whilst humus organic carbon (HOC) is stored for 20 to 40 years. Recalcitrant organic carbon (biochar, charcoal etc) is typically stored for 500-1,000 years.

Soil carbon markets focus on 'permanence' (25 to 100 years) but short term carbon (POC and HOC) offers the greatest fertility benefits.

Work from the University of Tasmania and the University of Melbourne found that the productivity benefits of improved soil organic carbon could be worth more than carbon income by a factor of up to 10x.

You can dive in further with this video from Matthew Harrison, Director of the Carbon Storage Partnership and Associate Professor from the University of Tasmania👇🏾

Carbon credits and offsetting is something we have written about in various forms previously. Organisations can reduce their net GHGs to zero ('net zero') by either making changes to their businesses that mean they produce no net emissions themselves or they can offset any net emissions they have to some degree by purchasing carbon offsets. Carbon offsets are programmes where GHGs are removed to compensate for emissions made elsewhere.

They can be very effective in providing funding for projects that are removing GHGs but an important aspect is how 'additional' those projects are and how permanent the removal is.

Additionality requires us to look beyond the business in isolation. Really the question that needs to be asked is whether "what I am doing is making the world as a whole a better place or not?" - We touch on that in this blog about the risk of inadvertent greenwashing 👇🏾

Stakeholders are increasingly considering the business as part of the broader ecosystem and are less inclined to absolve a business for 'sins of the connected.' Disclosure requirements are tending to hold businesses accountable not just for directly created emissions from their own activities including purchased energy (Scopes 1 and 2 emissions) but also those of their supply chain or Scope 3.

Scope 3 emissions, vary by sector but frequently account for over 70% of a company’s total carbon footprint. That's where 'insetting' comes in. In this case, a business works with its suppliers to enable them to implement projects that reduce emissions directly within their supply chain. There can also be positive impacts for communities and ecosystems in locations through the chain. You can read more in this blog were we discuss a joint report from Leading carbon intelligence and procurement platform, Abatable along with the International Platform for Insetting (IPI) 👇🏾

We shall be looking at soil in more detail in a future Deep Dive.

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.