China is going big in offshore wind

As Chinese turbine makers move out into international markets, what impact could this have on prices and profits? Focus: Renewables, offshore wind, China.

Summary: Battery storage has an increasingly important role to play as we build out an electricity grid dominated by renewables. The sector is at a tipping point. Current revenues from filling the generation gaps left by variable renewables are actually small, with the main income stream being from the smaller grid stability market. Is change coming and when?

Why this is important: From a financial perspective, as we shift to the electricity grid of the future, the risks and opportunities will change. The notion of an electricity utility being a safe investment needs to be rethought. Some of the new services will have "merchant " type characteristics, taking more market and price risk than before. This is not a bad thing, its just going to be different from before.

The big theme: 100% (or close to) renewable/low carbon electricity generation systems are looking more viable with each passing year, based on a combination of wind, solar and hydro/nuclear, supported by long distance interconnectors, demand management and storage. Offshore wind, while more expensive, has better operating characteristics. After being slow to start, China is accelerating into this theme, which could have material consequences for the profitability of global wind turbine makers and installers.

The details

An article in Electrek (22nd October 2022) says that the city of Chaozhou, in China’s Guangdong province, is planning to build an offshore wind farm so large that it is expected to provide more power than all of Norway’s power plants combined. The city intends to start work on the 43.3-gigawatt (GW) offshore wind farm before 2025, according to the city’s five-year plan, which is published online. The plan does not disclose how much the offshore wind farm is expected to cost.

The wind farm will be built between 47 and 115 miles (75 and 185 km) off the city’s coast, on the Taiwan Strait. “The area has unique topographical features that mean wind will be strong enough to run the turbines 3,800 to 4,300 hours a year, or 43% to 49% of the time, an unusually high utilization rate.”

Let's look at why this is important...

While offshore wind is small compared with onshore, it is still an important source of profit for some turbine manufacturers. Plus, many of the European wind majors, including Orsted, Iberdrola, RWE and Equinor, have big growth aspirations in this segment. While forecasts are for the offshore wind market to grow steadily, we suggest a key question for investors is "who will be able to generate profitable growth if Chinese manufacturers start to take market share".

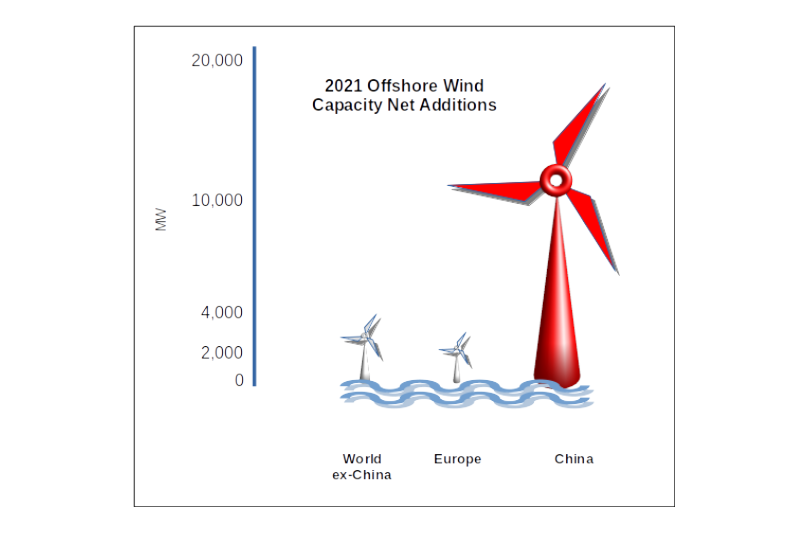

Let's start with just how big the offshore wind market is. According to the 2022 Global Wind Report, 2021 was a record year for offshore wind deployment, with just over 21GW of new projects commissioned globally. This was more than 3x 2020 levels, taking the offshore wind market share to 22.5% of new installations.

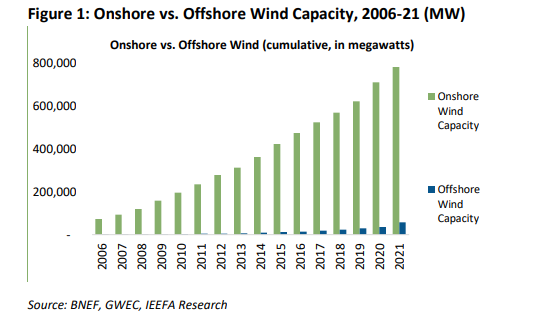

By comparison total onshore wind installations in 2021 were 72.5GW, down 18% on 2020, with the main drivers being the slow-down of onshore wind growth in the world’s two largest wind power markets, China and the US. But even though onshore wind growth has slowed, it's still a lot bigger than offshore when we look at the installed base (780GW onshore compared with 57GW offshore).

This difference is not at all surprising when you look at the cost of electricity generated (LCOE) - the latest IRENA data estimates that the global weighted onshore wind cost was $0.04/kWh, compared with offshore at $0.08kWh. So, despite the cost coming down, it's still nearly twice as expensive as onshore wind.

While offshore wind is relatively small in revenue terms for companies such as Vestas (c. 18% of sales 2021), Nordex and GE, it's more important for Siemens Gamesa (global ex China No 1 by market share) at c. 30% of revenues.

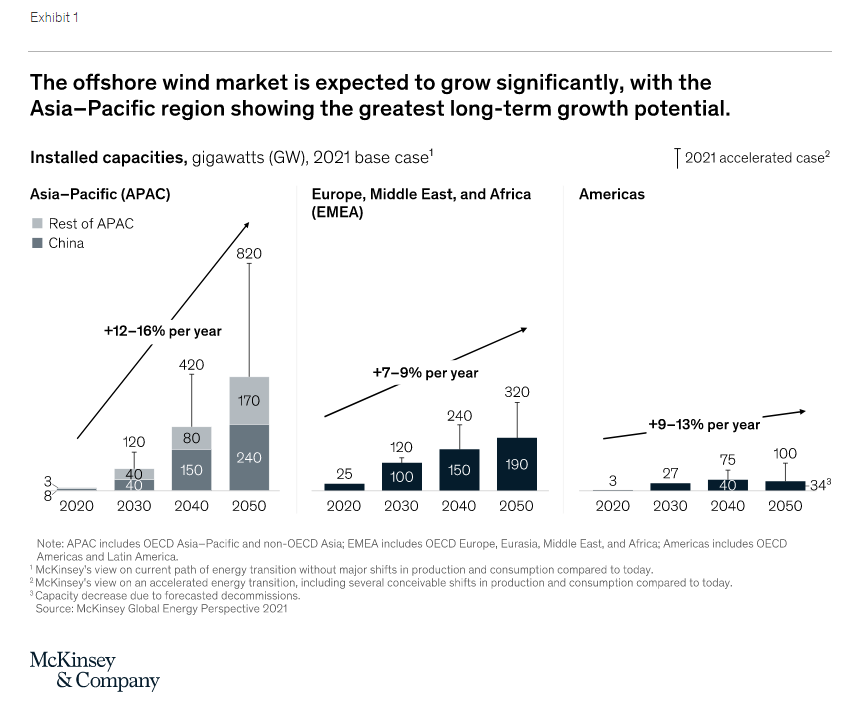

Looking forward, demand for offshore wind is expected to grow significantly, with McKinsey expecting Asia Pacific to become the largest market for new installations by the 2030's. So offshore wind, both in Asia Pacific and Europe/US, is something that investors in the renewables industry need to watch.

China is rapidly becoming an offshore wind powerhouse. China become the world’s largest offshore wind market last year, overtaking the UK. In 2021, the country erected 16.9GW new turbines offshore (out of the global total of c. 21GW) taking the cumulative installed capacity to just under 26.4 GW. Taken together, local plans point to a collective incremental capacity of 58.5GW to be installed between 2021 and 2025, while the local authority’s long-term plans for offshore wind amount to over 150GW.

Perhaps more importantly for investors, Chinese wind turbine maker Goldwind, recently supplied a giant 13.6 MW offshore wind turbine. The diameter of the impeller is 252 meters, and the swept area is about 50,000 square meters. At full wind speed, a single unit can generate 29 kWh of electricity per revolution and can output 63.5 million kWh of electricity pa. Given the progress that China has made in solar panels, batteries, and EV’s, it's worth watching Chinese manufacturers, who could end up making the global turbine market even more competitive.

It looks increasingly likely that Chinese turbine manufacturers will start to take share outside of their domestic markets.

BNEF has identified that strong domestic competition is pushing Chinese market players to push into international markets. "Competitive pricing and improving technology are helping Chinese turbine makers unlock more international opportunities. Exports of Chinese turbines to global markets has increased over the years, exceeding 1GW for the first time in 2020." The average onshore wind turbine price in China is half of the price of a similar unit produced outside of China, according to BNEF’s latest Wind Turbine Price Index.

It's been a tough time for the western turbine manufacturers. As WoodMac so succinctly put it in a recent blog - it's been "a perfect storm for profit margins. Energy price inflation, skyrocketing costs for specialised logistics, rising skilled labour rates and lingering Covid-related delays now combine with downstream cost pressure from aggressive power pricing tenders". Given this, its unsurprising that the year to date (YTD) share price trend has been weak, with Vestas down 26% ytd, Nordex down nearly 32% ytd, and Siemens Gamesa down just under 15% ytd. This compares with the Stoxx 600 index, which is down 16% ytd (all as of 31st October 2022).

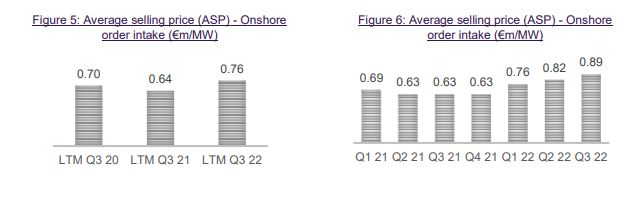

Yes, based on the company's most recent quarterly results, the average selling prices are looking better (at least in onshore), but if the Chinese turbine manufacturers can make market share gains in offshore, this could be a headwind yet to come.

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.