Could property linked finance unlock £bn of investment?

The Green Finance Institute (GFI) has recently released a report suggesting that introducing Property Linked Finance (PLF) to the UK market could enable £ billions of capital to be raised, to improve the energy efficiency of the UK’s homes and commercial buildings.

While the response to the report has been encouragingly positive, we caution that a lot of work is still needed. We need to think about this as a potential medium term solution, not something that can be rolled out now. But, if it can be made to work, its contribution on both environmental and social measures, could be material.

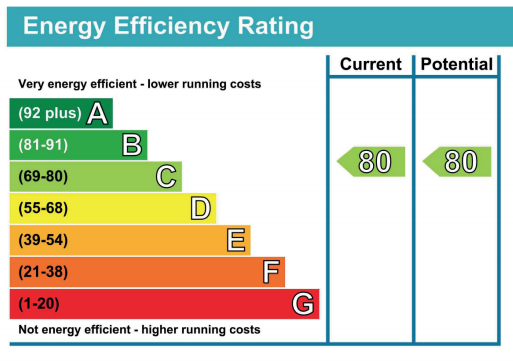

The UK has some of the oldest and least energy efficient homes in Europe. It is estimated that buildings are responsible for c.23% of the UK’s annual greenhouse gas emissions. According to the Climate Change Committee, an estimated £360 billion of investment will be required to upgrade the UK’s inefficient buildings by 2050.

A key question around upgrading building stock is who pays?

Or more strictly, who can afford to pay? And if you have to borrow to fund the work, what security can be offered to the lenders? This last point is probably the biggest barrier to getting property linked finance up & running at scale in the UK.

Access to capital to fund the work is a massive barrier. In September 2022, the GFI published Property Linked Finance: rising consumer demand for energy efficiency and the need for financial innovation. In that they highlighted that only 20% of individuals were likely or very likely to use existing types of finance to do upgrade works and around 50% were unlikely or very unlikely.

Clearly, we can learn from the experience of similar projects in other countries. As part of their study programme, the GFI examined similar (successful) rollouts including in the US, Canada, and Australia. One material difference that leapt out at us was ....

This is potentially a solvable issue, but we should not underestimate it's importance.

Finance is only part of the equation.

Finding a financial structure that works, while important, is not the full answer. As the GFI report highlights, it's also important that any solution is customer-centric.

We need systems thinking. Any solution must be:

- simple for the customer to understand (mis-selling has been an historic issue in the UK);

- have advice as part of the service (the options are often hard to evaluate);

- fully involve local delivery organisations, this cannot be a highly centralised process, it must be adaptable to local conditions and circumstances;

- offer a full end to end solution including construction management; and

- be deliverable within existing legislation.

While there is clearly a lot more work to be done, this report, and the analysis that underpinned it, is a really useful contribution to getting us closer to a workable solution.

We wrote on the importance of improving building energy efficiency, and how government actions can hinder progress, back in January of this year.

Link to blog 👇🏾

And more recently, with one of our guest authors - Rufus Grantham, co-founder of Living Places, we discussed how a place-based approach is needed to ensure buy-in, engagement and appropriate delivery of social value, economic and environmental benefits in a sustainable way for individual residents, communities and the various funders 👇🏾

This article featured in What Caught Our Eye, a weekly email featuring stories we found particularly interesting during the week and why. We also give our lateral thought on each one. What Caught our Eye is available to read in full by members.

If you are not a member yet, you can read What Caught Our Eye when it comes out direct in your email inbox plus all of our blogs in full...

Please read: important legal stuff.