Green steel - a template for other hard to abate sectors?

Not only is green steel an important sector from a GHG emissions perspective, it could be the trail blazer for a number of other important transitions. Why not read on ...

Green steel - do you care? You might think - I don't work in the industry, and I don't invest in or lend to it (and probably never will), and its very technical, so no, not really. Its a "nice to know about" sector, but it's not that important. If you are deeply into the challenges involved in decarbonising our society, you might care, but you may think, its a tough challenge to get involved with.

We think you are wrong. Not only is it an important sector from a GHG emissions perspective, it could be the trail blazer for a number of other important transitions. Why not read on ...

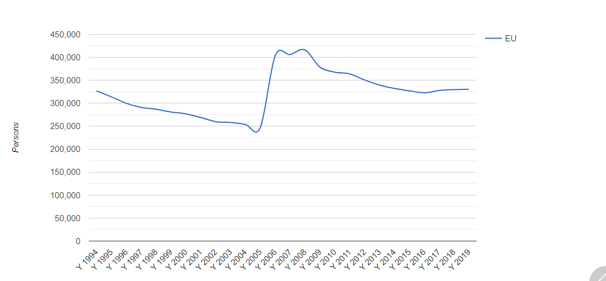

The last few years have seen a dramatic change in the outlook for green steel, especially in Europe (see chart below). Less than five years ago the consensus on green steel was that “investments in zero-carbon alternatives still come at prohibitive commercial risk”. Now, nearly all European steelmakers have announced plans to replace their old, high carbon emitting blast furnaces with direct reduction iron and electric arc furnaces. And we have realistic plans for production at scale by the end of this decade. You can track the current state of play of proposals for green steel mills through the green steel tracker from Leadit.

We have now got to the stage where we can say that there is a high probability that green steel is actually going to happen. It will be slow, with some production this decade, gradually scaling up as existing steel mills reach their end of life, or need a major refurbishment and upgrade. And we need to be realistic. China, the world's largest steel maker by a large margin, might move more slowly than other regions.

Perhaps more importantly, progress on green steel also suggests ways that similar progress might be possible in other hard to abate sectors such as cement and chemicals. This is particularly true for those activities where fossil fuels are not used as an energy source (ie creating heat) but instead are feed-stocks or a part of the chemical process.

That is the good news.

However, as with nearly all sustainability transitions, this shift will bring challenges. After all, these are not called hard to abate sectors for nothing. An obvious one is cost, quickly followed by a likely requirement to massively scale up the production of green hydrogen, which in turn will need vast quantities of green electricity.

Plus, the steel making process, like many heavy industries, is incredibly complex. Its not just a case of throwing some iron ore, coking coal, and limestone into a furnace. Companies have invested a lot in accumulated knowledge and infrastructure. Changing processes from what they know to something new is a material "step into the dark". Learning how to create green steel in a cost effective way will involve hundreds if not thousands of small improvements - fine tuning production processes, inputs and operating practices. This is an important factor to bear in mind - its going to take time.

The challenges are however solvable. Some of the solutions require financial and other assistance from governments, as they seek to create benefits for the wider society that they represent. Some need action by customers, specifying green steel for products such as buildings, cars, consumer products and of course renewable infrastructure. The other important action that is needed is ... to start early.

This is a capital intensive industry with relatively low margins and returns on capital employed. Developing new processes to create green steel, even if they might look broadly similar to processes used now, is a material risk for the companies involved. The sensible way to manage this risk is to start early, to trial the processes in pilots, to work with raw material suppliers, and to lobby governments and customers. Ignoring the challenge, and then having to play rapid catch up will likely be a recipe for future financial losses.

On the flip side, we think its important that transition advocates do not over promise. We need to be clear about the risks, challenges, trade-offs and of course the time scales, plus we need to be honest about the financial implications. There seems to be little point in heading down a decarbonisation route that leaves the relevant industries in financial distress. Steel is an industry with a massive installed base of generally not very old steel making plants, which somewhat limits our wriggle room.

In this blog, the first in a series on the hard to abate transitions, we discuss the progress that has been made on green steel, where the industry is likely to be in c. 5 to 10 years time, and expand on some of the expected obstacles. The focus is largely on Europe, as this is where the fastest progress is being made.

In the next blog in this series we will begin to examine what the progress being made on green steel can potentially tell us about other transitions. We think there is a lot we can learn from the shift to green steel that we can take into a whole range of other hard to abate sectors.

Unlike many other blogs on the topic, we will avoid, as much as possible, detailed technical discussions about the different steel making processes and options. For this reason the technical discussions are at the end, rather than the beginning of the blog (which is why this is a longer blog than normal). We think you need to have some background knowledge, but you don't need to become an industrial process expert to understand why this is an important issue for everyone involved in the steel value chain - from suppliers, through steel producers themselves, their investors & lenders, end customers, and of course employees and local communities.

“ We choose to go to the moon not because it’s easy, but because it’s hard; because that goal will serve to organize and measure the best of our energies and skills, because that challenge is one that we are willing to accept, one we are unwilling to postpone, and one which we intend to win. ” JF Kennedy 1961

What is the big theme?

Steel is a fundamental building block of our modern economy. It is currently produced via two main routes: blast furnace-basic oxygen furnaces (BF-BOF) & electric arc furnaces (EAF). Put simply, the EAF technology, which uses mainly recycled scrap steel, is seen as better for the environment as it produces materially fewer GHG emissions. But, there is not enough recycled steel to meet growing demand using the EAF steel making method alone. As a result some 70 -75% of current global steel production comes from the BF-BOF method, and its looking unlikely that this percentage will fall materially any time soon.

This is problematic, as the steel industry is responsible for about 7% of all man made global carbon emissions, most of it from the BF-BOF processes.

Let's take a look at why this is important...

The details

Let's start at the end.

This might seem odd, but we want to start where most reports and articles on green steel normally end - what does it all mean? For now, we are going to skip all of the technical explanation and charts about how steel is made, and why its a material GHG generator, and what the alternatives are (don't worry they are here, just later on).

Remember, our focus is on where sustainability meets finance.

So, some key questions for us are why should governments care enough to pump money and political capital into green steel, what might its emergence mean for the business cases of companies in the steel value chain, and how should they respond. Plus, what might the green steel journey tell us about how we could address other hard to abate sectors.

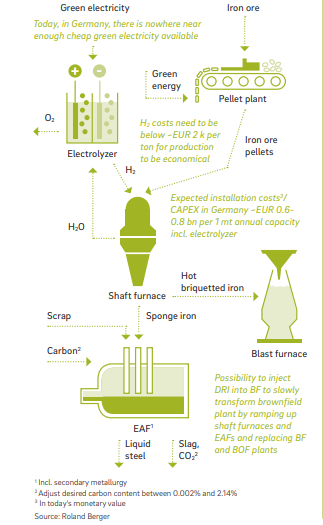

For now we want you to take on trust that technical solutions to the green steel challenges exist - probably involving variations on what is known as Direct Reduced Iron (DRI) plus Electric Arc Furnaces (EAF). Both of these exist at scale now, they just don't operate in a manner that is consistent with truly green steel. Plus we want you to also take on trust that green steel could become financially viable in the future (yes, we know that is a tougher ask).

We start our "what might this mean" journey with perhaps the most important element - governments.

Why might governments care?

The first obvious answer to this question is ...the steel industry is responsible for about 6-7% of man made GHG emissions. This is as large as all passenger cars in the world.

Lets pause for a moment - its as big as the passenger car market. Its worth thinking about how much attention switching to electric vehicles (EV's) gets. We all know about Tesla, and many of us will know about the moves being undertaken by the European automotive OEM's, such as VW, to shift production away from fossil fuel cars to EV's. In addition, the topics of EV charging and range anxiety get regular coverage in the newspapers.

Now think for a moment - do you know the companies that are doing the same things, but it green steel ? And yet steel is as important an element as passenger cars in the transition to net zero. This is part of the reason why governments care.

But, of course there are other reasons.

The first is jobs. Looking specifically at Europe -while the steel industry is nowhere near as important as it used to be, its still a decent sized employer. According to Eurofer data, the sector directly employs c. 325,000 people across Europe, with the biggest country being Germany (just over 83,000).

If you add in indirect employment, the total number of jobs is claimed to be as much as 2.6m, with c. 500,000 of these being in Germany. The region produces over 177m tonnes of steel per year, c. 11% of global output. In terms of consumption, the biggest European end markets are the construction industry, automotive, and metal goods.

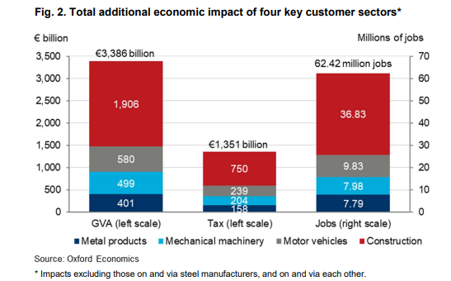

The next concern is supply chain security. A 2019 report from Oxford Economics estimated that the four main steel customer groups (fabricated metal products, mechanical machinery, automotive, and construction) together contributed €3,386bn in Gross Value Added (GVA) and supported over 62m jobs. To quote the report, "across all four sectors combined, almost one-third of their additional economic impacts could be thought of as being ‘enabled’ by EU steel". The biggest impacts were in automotive and machinery manufacturing (60%) and the smallest in construction (12.5%).

In 2022 Europe was estimated to have imported some 35m tonnes of finished steel products, of which the majority came from Turkey, South Korea and India. In the context of total European production (as above c.177m tonnes) this is not overly material. But you can see that, especially in times of supply chain stress, many manufacturers would be concerned if the level of imports rose substantially.

How is this government concern reflected?

I don't propose to give a detailed list of all of the measures being taken by the European Union and the various governments. I will just pick out a few highlights. Hopefully this should make clear the level of financial support that the various governments, especially those with material steel producing and/or consuming industries, are prepared to put on the table.

Direct financial aid

European Research Fund for Coal and Steel: This European wide fund totals some E142m, and grants under this programme are increasingly being linked to the long term objectives of the European Green Deal for a climate neutral Europe by 2050.

France: In early 2022, the French government announced support for ArcelorMittal’s low carbon programme, which involves a €1.7 billion investment in its Fos-sur-Mer and Dunkirk sites in France. Integral to this transformation is the financial support provided by the French state, which comes out of a ring fenced investment of €5.5 billion to assist steel, aluminium, chemical and cement industries in their efforts to reduce emissions as part of its “France 2030” investment programme.

Sweden: The availability of non carbon emitting electricity is a key component of the country’s drive to reach net zero greenhouse gas emissions within the next 13 years, with a series of large-scale hydrogen-use industrial initiatives already underway. For instance, the HYBRIT project (which we discuss later) was granted SEK 528 million in financial backing by the state-owned Swedish Energy Agency, and it was also awarded additional support from the EU Innovation Fund. Plus, through the state owned project partners, LKAB and Vatenfall, the Swedish government has effectively provided further financial support.

Germany: Steel is important to the German economy. It produces 26% of all steel output in the European Union, and it has the highest levels of direct employment in the sector. Steel is currently the country’s biggest industrial emitter of greenhouse gases, and the financial support required for a transition to green steel in Germany is estimated to sit in the region of €13 to €35 billion. In 2021 Germany announced it would spend €5 billion for hydrogen steel production projects and research programmes, as well as supporting green steel infrastructure construction, with the government striving for the maximum green steel subsidies allowed under EU state-aid rules.

Plus in 2021, the German Government announced plans around contracts for difference (CfDs), offering ten-year CfDs should heavy industry, including steel, commit to slashing CO2 emissions by over 50% using innovative technologies.

EU wide carbon pricing & the border adjustment mechanism

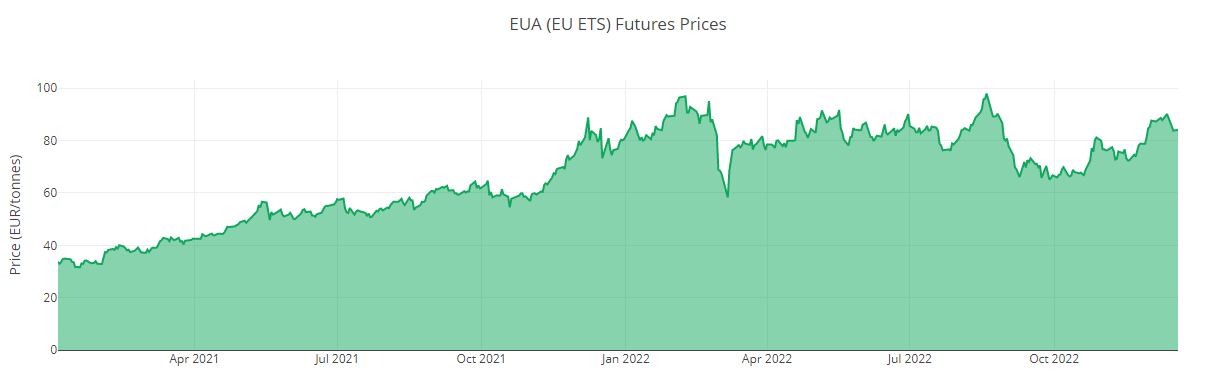

The EU Emissions Trading System (EU ETS) is a carbon market, based on a system of cap-and-trade of emission allowances for energy-intensive industries and the power generation sector. The ETS includes oil refineries, coal and steel, power plants and cement, glass, paper and parts of the chemical industries. These sectors make up 40% of total emissions in the EU. For a long time after its introduction, the scheme was seen as a failure, and then more recently, it roared back into life.

After a surge from a carbon price of sub €40/tonne back in late 2020 right up to just under €100/tonne through much of 2022, the carbon price has fallen slightly, sitting at c. €84/tonne at the end of 2022. At these levels it starts to make a real difference to corporate decision making.

Despite its apparent success, the ETS is still seen as a bit of an inconsistent patchwork. At the end of last year, the European Parliament finally agreed a much needed reform of the scheme. Some key elements of the new scheme include a move away from so-called "free allowances", and the related introduction of the much debated Carbon Border Adjustment Mechanism (CABM). This second regulation will effectively apply the EU’s own domestic carbon price to products imported from outside of the region, thereby shielding European industry from cheaper, more-polluting products imported from abroad.

It will initially apply to iron and steel, cement, aluminium, fertilisers and electricity, as well as hydrogen. Any companies importing these into the EU will have to buy certificates to cover the carbon emissions embedded in them unless they can prove they have already been accounted for by climate legislation in the producer country. We wrote about this in a blog published back in December last year, which you can read here.

How should companies respond?

The short answer is to keep on doing what they are already working on. As we highlighted earlier, most European steelmakers have announced plans to replace their old, high carbon emitting blast furnaces with direct reduction iron and electric arc furnaces. When will this happen? We get some clues from the announcements we highlighted above, with for instance the HYBRIT project in Sweden planning to produce green steel in commercial quantities toward the end of this decade.

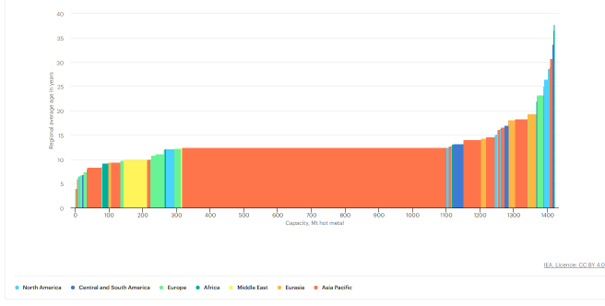

We suggest that another key driver of the pace of the transition is around when existing plants either reach the end of life, or when they need a major refurbishment and upgrading. After all, companies have got a lot of capital tied up in their steel mills, and a new mill is expensive.

The chart above, from the IEA, shows the regional average age of the world's steel production (this includes DRI furnaces, but these are a low percentage of global capacity). European capacity is shown in green, and you can clearly see that a material proportion is between 10 and 15 years old, with another block between 20 and 25 years old.

What can we conclude from this - we see two outcomes.

The first is that companies will move cautiously. By the end of the decade, many of the steel mills will be c. 20-25 years old, with some heading for 30 years plus. So a good time to plan refurbishment work. The good news is that it looks like this time scale will coincide with expected timings on higher outputs of green hydrogen (a key element in the green steel transition), most likely at a materially lower cost than we are seeing now. And it gives them time to plan, and to carry out the necessary R&D and process testing.

The second is that while the role of customers, such as the automotive sector, in specifying green steel (and being willing to pay a price premium) will be important, government assistance, of the type and scale we outlined above, will be critical for the transitions financial case. Ex any carbon tax impacts, green steel will likely be more expensive than traditionally made steel for a long time, possibly well into the 2030's.

Remember the statistic from the start of this blog - the steel industry is responsible for about 6-7% of man made GHG emissions. This is as large as all passenger cars in the world.

Returning to the technical challenges - how do we make steel now, and why is this a problem?

I am sure you have all seen pictures or movies of steel mills, vast halls full of molten metal. What is not so clear from this image is that there are actually two quite different methods of producing steel, which have very different implications for GHG emissions. At this point I want to apologise to iron & steel specialists for grossly simplifying what is a complex process.

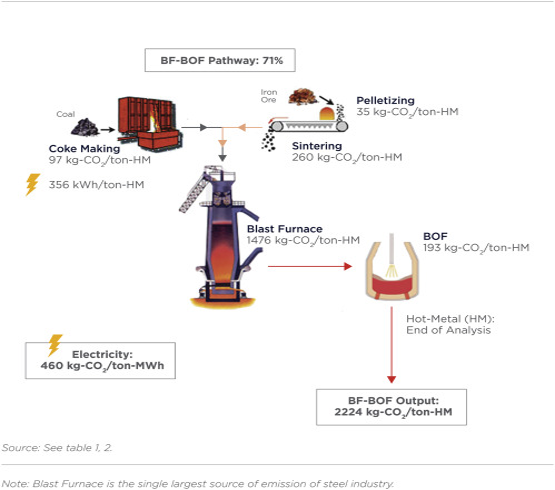

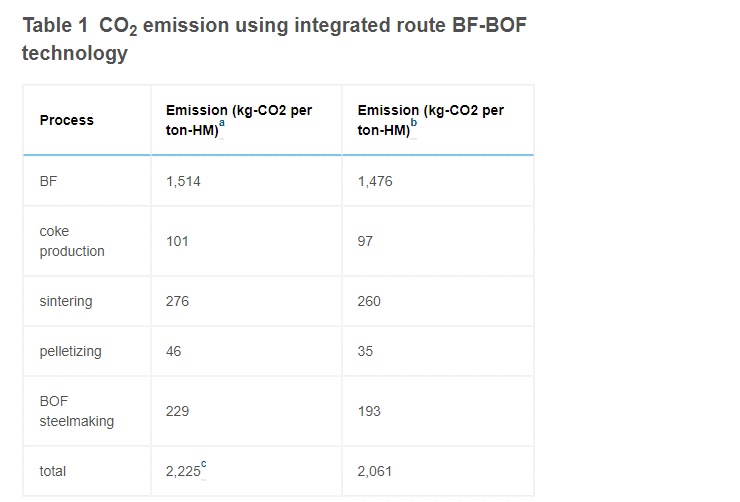

The most common method used is known as blast furnace-basic oxygen furnaces (BF-BOF). This takes iron ore, which is mainly Iron (Fe) plus some Oxygen (O), and various impurities, and chemically reduces it using coal. This is done in a blast furnace (BF), so at temperatures ranging from 900 to 1300 degrees C. Its important to note here - the interaction between the coal and the iron ore is a chemical process, its not just a case of using the coal to heat the iron ore. Limestone is also added to the blast furnace to create the "slag" which removes the non volatile impurities.

Sadly, pig iron on its own is not much use, so there is a second step, involving a basic oxygen furnace (BOF), which is a reactor in which oxygen is blown through molten pig iron that is heated to approximately 1,600℃ to convert it into steel.

For those who prefer a chart of the process ....

And for those who might wonder where most of the GHG emissions come from, and what happens if we use zero carbon electricity in the BF-BOF process, this table shows its nearly all emissions are from the BF process and, no, using zero carbon electricity makes almost no difference to emissions.

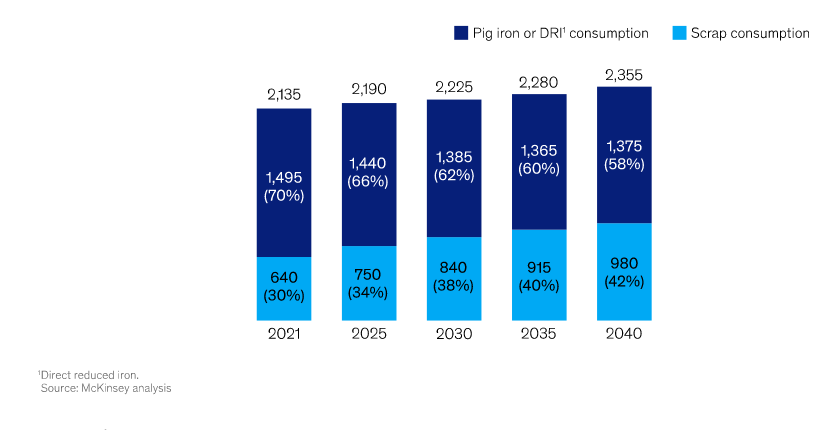

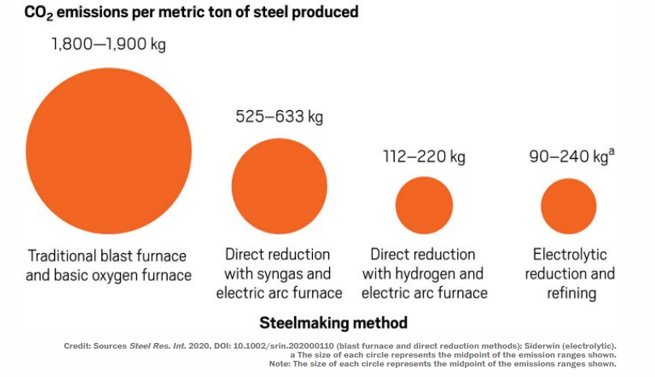

Circa 71% of world steel production comes from the BF-BOF process. The good news is that the alternate process for producing steel, Electric Arc Furnaces (EAF) produces a lower level of GHG emissions. Studies show that the carbon footprint per ton of EAF steel can be as low as 0.23~0.46 ton CO2 depending on iron type (pig iron or scrap), electricity sources and efficiencies. This is only 10%~20% of conventional BF-BOF operations.

Sadly, there are some practical limitations that prevent EAF from playing a larger role in decarbonising the steel making industry. First and foremost, EAF takes recycled steel scrap as its main feed-stock and is therefore subject to supply limitations. While we can do more to recycle steel, analysis from McKinsey suggests that no more than c. 40% of global steel demand can be met using scrap steel.

Now we understand the problem - what are the possible solutions?

There are a number of potential solutions. Some, such as Massachusetts Institute of Technology spin-out Boston Metal, propose making steel in an entirely new way (in their case molten oxide electrolysis). But they are at an early stage and in the case of Boston Metal, they only plan to have their first demonstration plant running by 2025.

Most industry experts see the likely solution as being a variation on the already proven Direct Reduced Iron or DRI process. This technique has been around since the late 1960's. This currently uses syngas (a mixture of H2 and CO) to directly reduce iron ore in its solid-state, using a lower reaction temperature of around 1,000 °C. The syngas is produced from natural gas (gas-based DRI) or coal (coal-based DRI) . Additional processing (typically using an EAF) is used to turn the output DRI sponge iron into useful steel.

Around 5% of steel globally is already produced this way, and so unlike alternatives such as that proposed by Boston Metal, the route to production at scale is less risky. We can think of DRI steel, produced using syngas, as being the intermediate stage in the transition to green steel.

You have probably identified the variation on DRI that most steel companies are exploring - its using green hydrogen instead of syngas. However, technically the substitution is not totally straightforward.

Switching to a hydrogen-only system significantly changes the thermodynamic balance, so the hydrogen must be preheated before it enters the furnace. Plus, if we want a truly low carbon steel, the process uses iron ore pellets to feed the DRI plant, and their production is another (if smaller) source of emissions that needs to be reduced. But as the chart above shows, shifting to DRI with hydrogen and then creating steel in an EAF produces a lot less emissions.

So far so good - what is the catch (because you know there has to be one).

Challenges still to be solved

There are three - cost, the availability of enough green hydrogen & DRI feed stock, and technological readiness.

Lets start in reverse order with technological readiness. To really start to replace BF-BOF steel production, we need a process that is able to produce steel at scale, using green hydrogen. The good news is that, as we identified above, there are already proven techniques that use syngas, that with some modifications, could use green hydrogen instead. The bad news is that sadly, no such plant exists, at least not one operating at commercial scale.

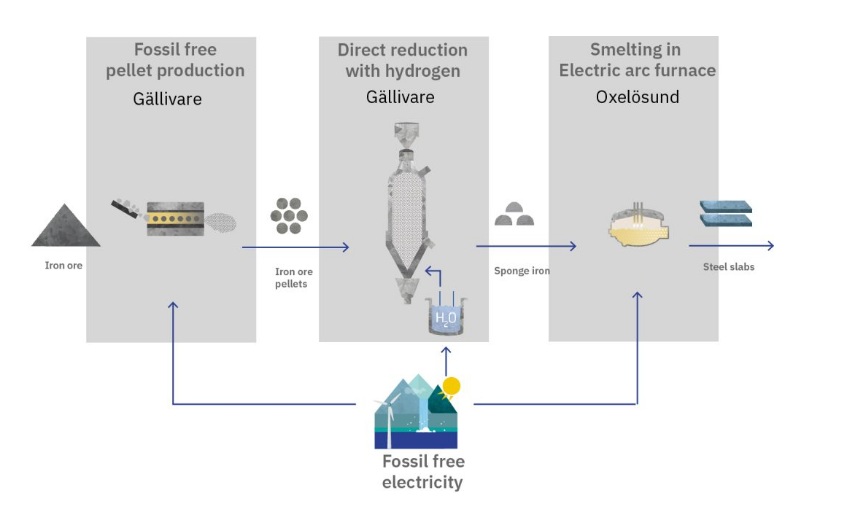

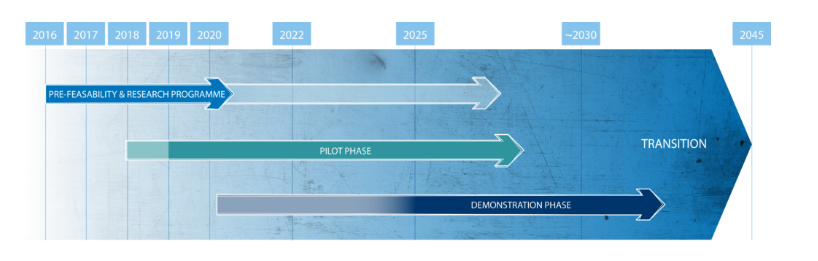

The closest we probably have is HYBRIT (Hydrogen Breakthrough Ironmaking Technology), which is a venture that combines the resources of SSAB (a Swedish steel maker, focused on high strength steel), LKAB (a global supplier of iron ore) and Vattenfall (one of Europe’s largest producers of electricity). They are tragetting an almost totally zero carbon green steel, by linking fossil free pellet production, direct reduction with green hydrogen,and final smelting in an electric arc furnace.

They have already produced their first batch of fossil fuel free steel (the customer was Volvo) and they aim to demonstrate the technology on an industrial scale as early as 2026. The project aims to produce approximately 1.2 Mt of crude steel annually, representing 25% of Sweden’s overall production.

But they are not the only major steel producer aiming for green steel. Swedish start-up H2 Green Steel is planning to build a hydrogen-based DRI plant in Boden, just 30 km from Luleå, and they aim to begin production in 2024.

The company announced in October 2022 that they had executed conditional commitment letters for €3.3 billion in senior debt with AB Svensk Exportkredit (SEK) and BNP Paribas, ING, UniCredit, Societe Generale and KfW IPEX-Bank. Plus the European Investment Bank received board approval for €750 million of senior debt funding, and export credit agencies, including Euler Hermes, issued letters of intent to provide export credit-linked guarantees of €1.5 billion of the intended senior debt. Additionally, the Swedish National Debt Office issued a letter of intent to provide a green credit guarantee of €1 billion.

As we know from working in debt markets, there can be a way to go between conditional letters of intent and the final deal, but its a good start.

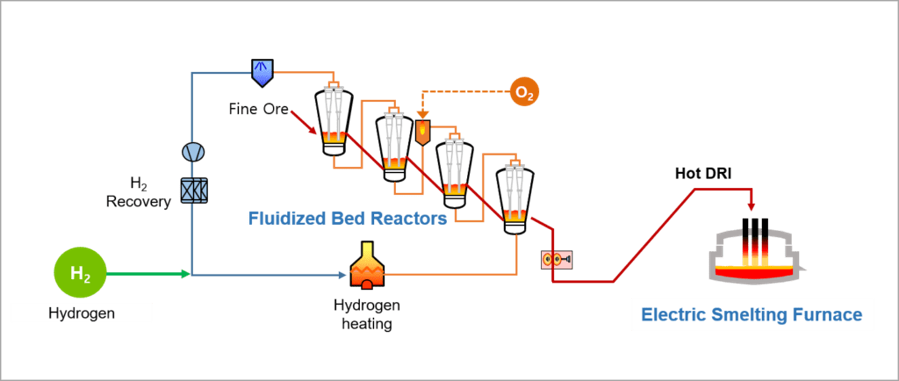

And in Korea, POSCO plans to enter the demonstration stage from 2025 (without a pilot stage), using HyREX technology, based on its expertise and experience from FINEX process development. HyREX is slightly different from the other green steel technologies, in that it uses a fluidized bed reactor rather than a shaft furnace. The technology uses sinter feed grade iron ore fines rather than pellets, which allows the use of mined ore directly, so without having to go through the pelletizing process.

On cost, back in 2017, HYBRIT estimated that its steel would be 20–30% more expensive than that produced by the traditional coke-based route. But the economic equation has changed since then, thanks in part to the European Union ETS we discussed above. When the economics were first calculated, an allowance to emit a metric ton of CO2 was priced at less than €10 (about $12), but as we highlight ed above, prices were over €100/tonne for long periods last year.

According to BloombergNEF, if the cost of green hydrogen fell from today’s $3–$6 per kilogram to $1 per kilogram, today’s carbon price would be enough to make hydrogen-based steel making cost competitive with traditional methods.

In terms of input resources, we need to bear in mind that a global industry-wide shift to these technologies would require "eye-watering quantities of solar and wind power". Research published in 2020 suggests that "the direct and indirect electrification (green hydrogen) of the steel industry would raise European electricity consumption by about 510 TWh". That additional demand is equal to about 18% of total current EU electricity consumption and is estimated to require an additional 50,000 wind turbines, remembering of course that this will likely happen over a multi decade time scale.

There is also an issue around the supply of DRI suitable iron ore. But this blog has got long enough already, so that's a topic for another day.

The last few years have seen a dramatic change in the outlook for green steel, especially in Europe. Less than five years ago the consensus on green steel was that “investments in zero-carbon alternatives still come at prohibitive commercial risk”. Now, nearly all European steelmakers have announced plans to replace their old, high carbon emitting blast furnaces with direct reduction iron and electric arc furnaces. And we have realistic plans for production at scale by the end of this decade. Plus, the economics are looking more promising, especially if the EU ETS carbon price stays up near €100/tonne. The transition is not going to be rapid, but the process is sufficiently complex and the investment needs so great, that all companies involved in the green steel supply chain need to start now.

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.