Impact investing can align with fiduciary duty

A frequent debate is the one around impact investing and fiduciary duty. More specifically, does impact focused investing deliver financial returns that are similar to those of a meaningful benchmark?

A recent Pensions for Purpose report helps with this question. At the risk of ruining the surprise - listed global equity, private equity and real estate funds beat their benchmarks, while infrastructure and bond funds were broadly inline.

So, what did they study? They gathered investment performance data from 17

asset managers with UK pension fund clients, based in either Europe or the US. This collectively came to £18.6bn in impact assets under management (AUM). The assets were mainly invested globally (only 16% of AUM was in the UK).

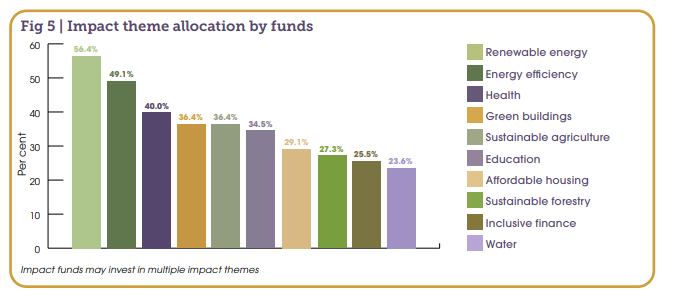

The largest impact themes were renewable energy, energy efficiency, health, green buildings, and sustainable agriculture. The smallest, somewhat disappointedly, was water.

There were a couple of interesting outcomes, beyond the headline issue of cumulative performance. First, for listed equities, while the average quarterly net returns of the impact funds was higher, so was volatility (103 bp higher). Not totally unsurprising to anyone involved in managing money. A smaller investable pool will likely result in more volatility.

Second, while private equity outperformed over the total period, it had a period of underperformance (roughly from from 2020 to early 2022). Third, the real estate funds showed much smoother performance than the benchmark (FTSE EPRA NAREIT Global Index). They also had periods of underperformance.

So having a longer time horizon is key. But then that makes sense as well - sustainability is a long term theme, not a short term money maker.

The report is a really useful contribution to the debate, it's well worth a read as there is a lot more information that we could cover here.

Back in March we wrote a blog on what we called 'the return ripple from impact investing'. In it we made the point that 'doing well by doing good' is a careful balance with potentially direct and immediate sacrifices of some return resulting in longer term benefits to society as a whole.

Link to blog 👇🏾

This article featured in What Caught Our Eye, a weekly email featuring stories we found particularly interesting during the week and why. We also give our lateral thought on each one. What Caught our Eye is available to read in full by members.

If you are not a member yet, you can read What Caught Our Eye when it comes out direct in your email inbox plus all of our blogs in full...

Please read: important legal stuff.