The return ripple from impact investing

Impact investing will be an important driver of the sustainability transitions. 'Doing well by doing good' is a careful balance with potentially direct and immediate sacrifices of some return resulting in longer term benefits to society as a whole.

Summary: Impact investing has seen massive growth and is now more than a US$1 trillion market size. We look at an example of where the strategy can have the wrong focus and execution (Home REIT), as well as examples of where the longer term benefits can be material (Clean water and sanitation, domestic violence services and the Mectizan Donation Program).

Why this is important: 'Doing well by doing good' is a careful balance with potentially direct and immediate sacrifices of some return resulting in longer term benefits to society as a whole.

The big theme: Impact investing seeks to improve lives either through social or environmental projects. It has grown materially in the past decade and can have important leveraged impacts developing local communities, reducing the draw on social services, improving lives and providing economic sustainability.

The details

What is impact investing?

The Global Impact Investing Network (GIIN) defines impact investing as “investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return.”

The Impact Management Project (IMP) brought together more than 2,000 organisations to build consensus and define what impact investing is and the five dimensions of impact:

- What outcome does the effect drive and how important are they for stakeholders?

- Who experiences the effect and how under served were they beforehand?

- How much of the effect occurs and for how long?

- How does the effect compare and Contribute to what the market would likely do anyway?

- Which Risk factors are material and the likelihood that impact will be different than expected?

The IMP also illustrates three ways in which organisations, both corporates and investors can align their strategic decisions or investments with their intentions - the 'ABC'

Act to avoid harm

Benefit stakeholders

Contribute to solutions

The 'C' is generally thought of as 'Impact Investing'

Big Society Capital is a financial institution set up for the purpose of building the market for social investment in the UK. It's goal is to "...improve the lives of people in the UK through investment with a sustainable return."

'Social impact' through 'investment with a sustainable return'

The order is important. Home REIT is an example of what can happen where the order may be reversed.

Link to blog 👇🏾

How big is the impact investing market?

The global impact investing market size is estimated to be US$1.164 trillion and estimated to be £7.9 billion in the UK alone as at the end of 2021. It has grown more than 10x in the past decade.

What are the returns from impact investing?

'Doing well while doing good' means a willingness to sacrifice some return for achieving social or environmental outcomes. This is termed a 'willingness to pay'.

A 2019 paper from University of California researchers Barber, Morse and Yasuda found that the median IRR for private equity VC and growth impact funds was 6.4 percent compared with the median IRR for impact-agnostic VC and growth funds at 7.4 percent.

But impact investing drives longer term benefits to society as a whole and these can reduce the overall risk environment as as well providing economic stability.

Let's look at some examples of these broader impacts.

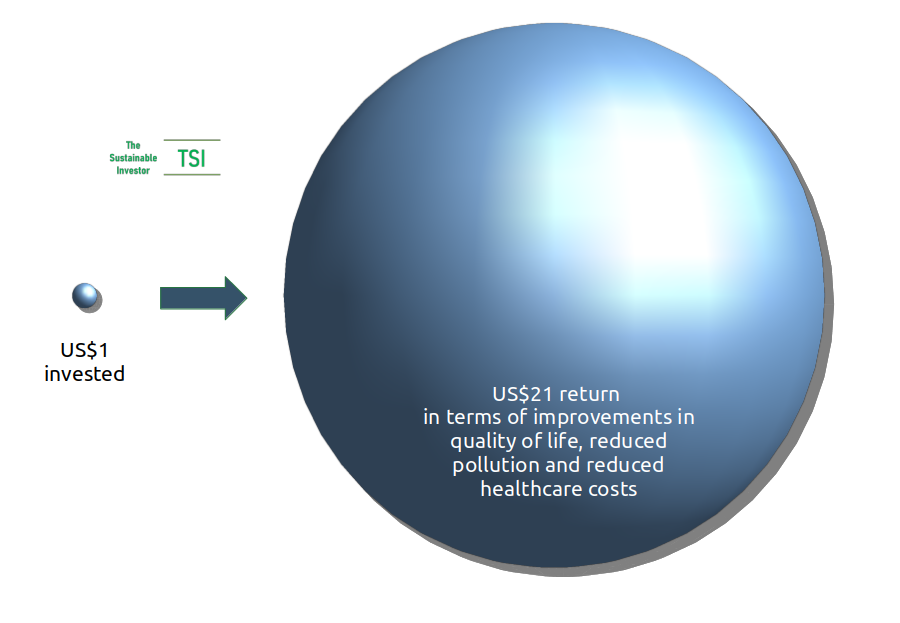

Investing in clean water, sanitation and hygiene

Domestic violence services

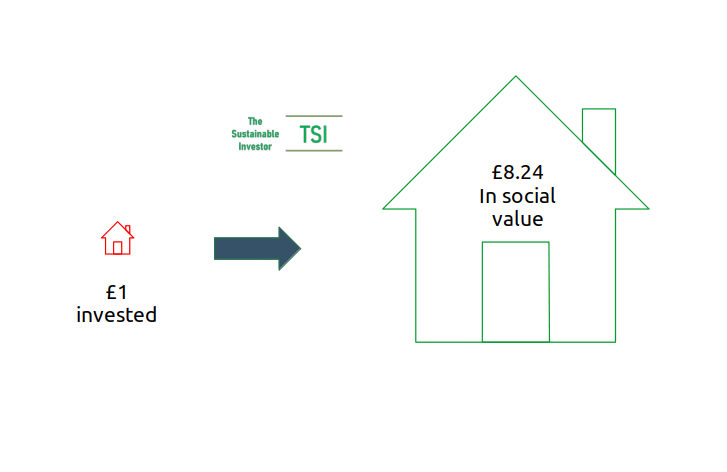

Refuge provides specialist domestic violence services in the UK supporting thousands of women and children, helping them to rebuild their lives after suffering violence and abuse. Returns come in the form of safety, social and economic well-being and improved health.

Mectizan and river blindness

In 1987, Merck established the 'Mectizan Donation Program' (MDP) giving away the drug, a treatment for onchocerciasis or 'river blindness', and has resulted in the condition even being classified as eliminated in some countries (e.g. Colombia, Ecuador and Mexico) and declines in transmission and impact in a number of African countries. There were costs involved in distributing the drug to, in some cases, remote towns and villages but there were economic benefits as a result including farmers being able to work more productively and children being able to attend and complete schooling.

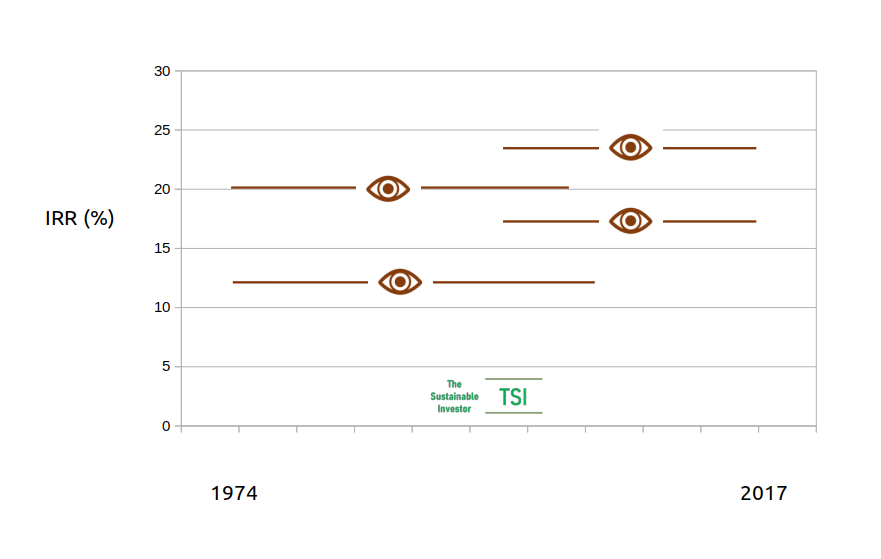

The chart below shows various estimates for the internal rates of return (IRR) of different intervention projects from a 2019 systematic review. The horizontal lines represent different estimates with the lengths showing the period of the intervention. The conclusion from the research was that "The cost benefit and cost effectiveness of onchocerciasis interventions have consistently been found to be very favourable."

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.