Yes, we need more mining but how much investment do we need?

Yes, decarbonisation of our economy is going to require a lot more of certain minerals. But, how much more, and how much will this cost?

Summary: Yes, decarbonisation of our economy is going to require a lot more of certain minerals. But, how much more, and how much will this cost? For this blog we start with what are the biggest investment needs. Estimating what new production we will need, and when, turns out to be more complicated than you might think. And the biggest barriers are likely to be political rather than financial.

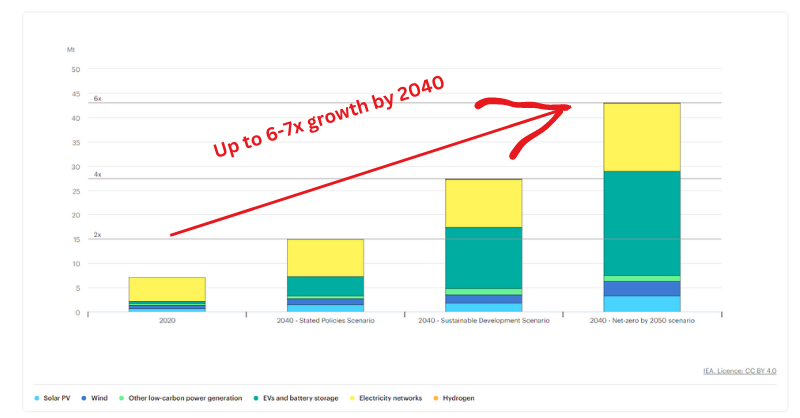

Why this is important: We all know the numbers. According to the IEA, mineral demand for clean energy technologies will grow by up to 7x compared with current production. But what does this mean? Is this a realistic target or will supply chain blockages and price volatility act as a brake on sustainability and net zero targets ? While the growth rates might seem daunting, we need to remember history. With the right incentives, production can be scaled up rapidly.

The big theme: Decarbonising our energy system is going to be one our most material sustainability challenges. Along with new technologies such as electric vehicles, and renewable electricity generation, we are going to need to scale up new supply chains. In doing this we will often rely on countries or regions with whom we sometimes have a troubled political relationship.

The details

Summary of a McKinsey report: Regulatory efficiency will be essential for the energy transition

- The International Energy Agency (IEA) estimates that renewable energy will need to account for at least 65 percent of global electricity generation by 2030. At the same time, industry will have to increase electricity demand (as a share of the total energy mix) to 35.0% in 2030, up from 28.5% in 2019. And electric vehicles (EVs) will need to account for anywhere from 35% to 95% of light-vehicle sales by 2030 (up from 8.3% in 2021).

- Crucially, this transition can’t happen without the availability of certain metals that are essential to battery electrification, including copper, lithium, nickel, cobalt, and some rare earth elements. Annual copper production (the foundation of electrification infrastructure) will need to increase by 11.5 million metric tons (45%) by 2031—equivalent to doubling production from the top four copper-producing countries. Demand for lithium, nickel, and cobalt (the core battery metals) is expected to increase by 8x, 2x, and 1.8x, respectively. And the availability of rare earth metals (a crucial components of electric motors) will need to double.

Why this is important

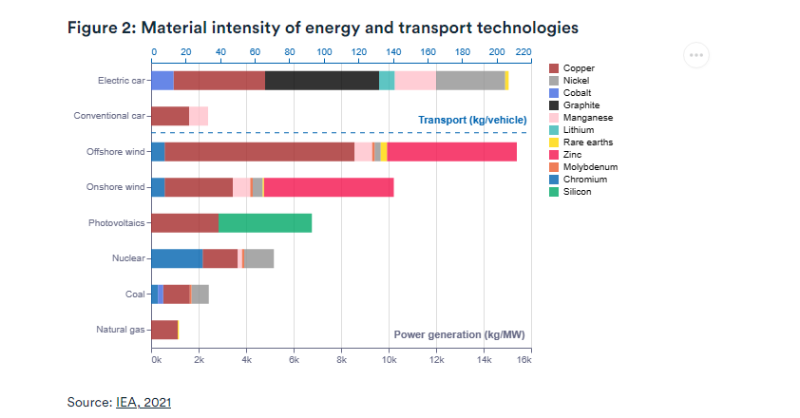

- Let's start with the easy bit - why will we need 'extra' minerals? Most of the key technologies we will rely on to decarbonise the global economy use very different inputs from the systems they will replace. For instance, in 2021 the IEA estimated that the production of an EV uses approximately six times more minerals than a conventional car. The differences are even greater for renewables. Offshore wind technology requires 12 times more metals and minerals for every megawatt (MW) of electricity it produces compared with producing the equivalent amount of electricity with natural gas. Solar (or photovoltaics) is not as mineral heavy, but they still require a lot more than a natural gas plant. And expanding our electricity networks to accommodate the surge in electricity demand is going to need a lot of copper and aluminum.

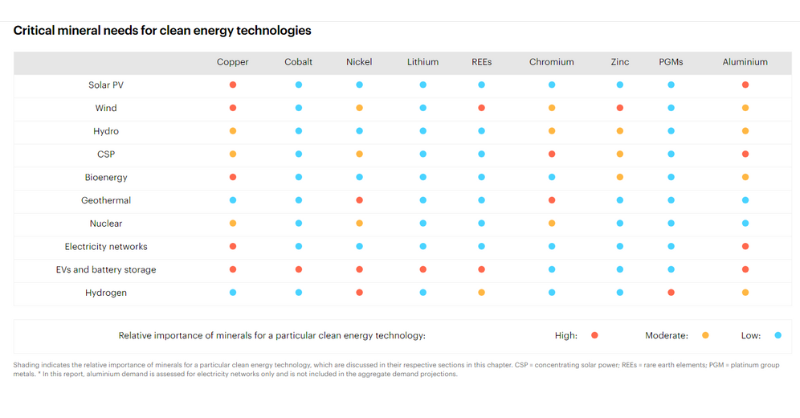

- So how much more minerals will we need? To understand the big picture, we need to start by focusing on the technologies with the biggest demand change impact. According to a 2022 study, electric vehicle production will be responsible for 50-60% of the demand for energy transition metals, followed by electricity networks and solar photovoltaics (35-45%), and then other technologies (5%). What are the key mineral raw materials used in EV's, electricity networks and solar PV? As the red dots in the table below (from a recent IEA report) illustrates, its mostly about copper and aluminum, plus cobalt, nickel, lithium and rare earths (REE's) for batteries.

What is the investment shortfall?

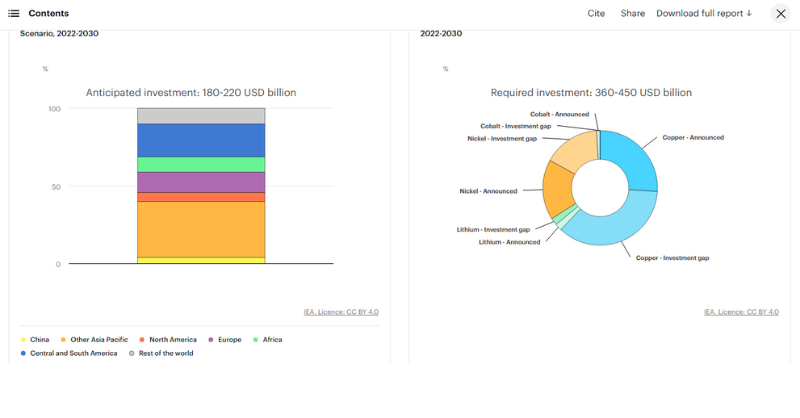

- Putting this together. The IEA estimates that, to be on track for net zero by 2050, we will need to spend some US$360-450 billion between now and 2030. This compares with anticipated capex of c. US$180-220 billion. So, a roughly US$180 billion shortfall, or c. US$23 billion pa. And the biggest shortfalls (by US$ capex requirement) are for copper and nickel.

- This might surprise some people. After all potential shortages of rare earths, cobalt, and lithium are getting a lot of press coverage. But then, when you think about it, copper is used in solar, wind, EV's and electricity networks. So we should expect demand to rise sharply. And nickel plays an important role in increasing the energy density of EV batteries. And as we highlighted above EV batteries, will make up 50-60% of the demand for energy transition metals.

- On the subject of nickel, the substitution effect in battery design is something we need to take note of. As recently as 2019, many analysts thought that the demand for cobalt would soar. But as the cost of cobalt rose, EV manufacturers redesigned battery chemistries. Low cobalt batteries, such as those with higher nickel content, and lithium iron phosphate (LFP) batteries are now increasingly dominating. So, if we are thinking of investing in nickel production on the back of growing EV demand, we need to keep one eye on advances in battery chemistry.

"The switch to higher nickel content, as well as the rapid uptake of lithium iron phosphate cells, means less cobalt will be used in batteries than previously anticipated. BNEF’s latest forecast is that cobalt demand will grow by 28% between now and the end of the decade to over 150,000 tons. However, this is less than half what was estimated back in 2019". Race to Net Zero: The Pressures of the Battery Boom in Five Charts

- Coming back to the total investment needs, US$23 billion pa sounds like a big number, especially when you take account of the long lead times for new mines (which make bridging the gap, at least quickly, challenging). To give this some context, the Cummins mining team estimated that in 2021 the total capex of the world’s top 40 mining companies was US$78 billion. So our US$23 billion pa capex gap is still material, but maybe not as big as we first thought. And, being slightly cynical, this figures are based on us reaching the IEA Net Zero scenario, something that is looking tougher as each year goes by.

- We know that scaling up production of minerals such as copper and nickel will be tough. New mines can take years to get permitted. And, as we highlighted in an earlier blog, increasing mining activity will potentially conflict with other societal priorities. As a society we need to decide what is important, or more strictly, what is more important.

- As the McKinsey report we highlighted at the top of this blog says ...

Important factors in addressing the energy transition include adopting best practices for efficient decision making around permitting, matching incentives to policy priorities and equitable division of benefits across all parties, and supporting responsible environmental practices.

- Or putting it another way, we will need to make tradeoffs. As we frequently point out, while there are solutions that get us most of the way to where we want to be, there will be tradeoffs and compromises. And we expect it will have to be the mining companies, not the politicians, that take the lead.

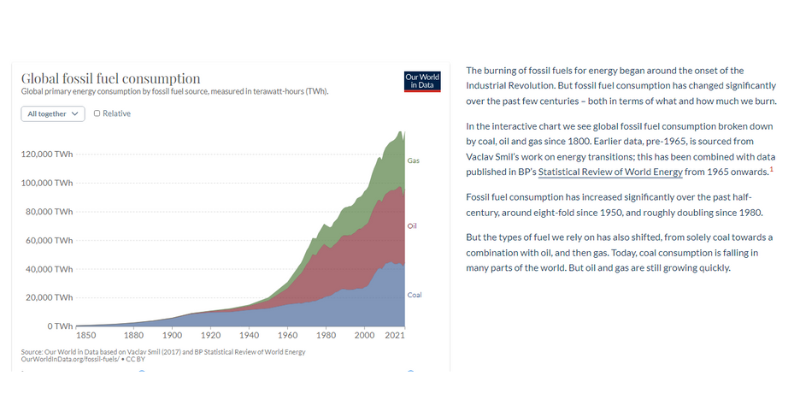

- Before we leave this topic, a last piece of context. The world has gone through a similar transition, as we ramped up production of oil and gas in the second half of the last century. As the Our World in Data chart below shows, in 1950 gas consumption was 2,092 TWhr. By 1970 it was nearly 5x greater (10,293 TWhr) and it doubled again by 2000 to reach 23,994 TWhr. So, transitions of this scale are possible.

Any blog can only be a snapshot of what is a massive challenge. For today we focused on where the biggest investment needs are. But, as with all of the transitions, its a multifaceted issue, so we also need to consider product design (substitution), and recycling. And there are a number of really important measures that can be taken to ensure that any mining we carry out is done to the best standards. In this regard we need to watch for the out of sight, out of mind problem - just because mining takes place in other countries, doesn't mean we don't need to care about standards.

Plus, while the capex needs for other minerals such as lithium and rare earths are smaller - they are still important, especially given where the materials are currently sourced from. These are all subjects we will be coming back to in future blogs.

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.