Sunday Brunch: automotive outlook - yet more challenges

It's not getting easier for many automotive companies. Sales are will likely remain below pre covid levels for some time, and margin pressure looks unlikely to abate. And EV investment needs are rising. Can we expect them to be able to fund the EV transition - or does the future lie elsewhere?

In some ways you have to feel a bit sorry for automotive companies. It's been a tough industry for many years, and it's 'recently' been hit by the entry of new competitors at a time when investment needs are rising. And the sources of competitive advantage are shifting away from them.

Which raises a question for sustainability professionals and investors - are they really capable of funding the shift to EV's in a profitable and timely manner ? Or should we be looking elsewhere for companies to push the transport transition?

This thought process has been kicking around in my mind for a while now. If electrification of transport is to continue to (re)gain pace in Europe, we need companies to invest. And this investment is not just in the production of EV's. It's also needed in supply chains, battery production, and charging infrastructure. And we know that governments are unlikely to do the heavy lifting.

Which brings us back to the question - how well placed are European automotive companies to fund this investment?

Just a reminder, this is not investment advice. Regular readers will know that the debate about if a company makes a good investment is largely about the price you have to pay for the shares. And how this compares with your estimate of fair value. A company can be poorly placed in it's industry, and still be 'cheap'.

Global industry positioning

The automotive industry has not been a great generator of financial value. One useful measure is the sector's Return on Invested Capital (or ROIC). Just as an aside, I generally prefer to use the Return on Capital Employed (ROCE), which is a similar measure, but there is less good global data for this metric.

My 'go to' source for data like this is Aswath Damodaran at NY Stern. Every year he publishes his calculation of the ROIC for dozens of industries. Auto & Truck companies (industry Original Equipment Manufacturers or OEM's) have one of the lowest ROIC metrics. Last year it was 3.1% (Lease & R&D adjusted after-tax) and the 10 year average is only 5.1%. This is generally below the industries weighted average cost of capital - which tells us that it creates less financial value than it consumes.

Just to put these numbers in perspective, even high capital intensity regulated companies such as utilities score more highly (c. 7%), as do food retailers (a very low margin industry). And while the automotive parts industry still delivers higher ROIC than the OEM's, ultimately the profitability of the industry will be driven by how well the OEM's do in the long run.

Sector outlook - challenging!

What does the sector outlook suggest is coming? Roland Berger and Lazard publish an annual review of the automotive supplier industry, including a look forward. The latest report (May 2025) forecasts that ....

"growth will remain stagnant as the industry grapples with the challenges of transformation. As well as electrification and digitalization, these include the shifting regional and power dynamics in the industry, with Chinese OEMs becoming increasingly important at their Western rivals’ expense."

They describe this as 'stagformation', a combination of stagnating growth and the urgent need to transform its business models.

And it can be argued that the financial pressures faced by both companies and governments is acting as a drag on the growth in EV's. According to the Berger/Lazard report ...

"The BEV market share is now projected to reach 41 % by 2030, a downward adjustment of 12 points compared to the forecast in December 2023. Short-term BEV production forecasts for 2025 show declines across all major regions,

including a drop from 4.2 million to 2.9 million units in the EU. "

This is broadly consistent with the most recent BNEF EV outlook 2025, which also highlighted that some markets are experiencing significant slowdowns, and many automotive OEM's are pushing back EV targets.

Will Europe hit its EV targets?

Looking specifically at Europe, the EU has been mandating EV supply targets for some time now. The original 2023 plan was to require all new cars sold to have zero CO2 emissions from 2035, and 55% lower CO2 emissions from 2030, compared to 2021 levels.

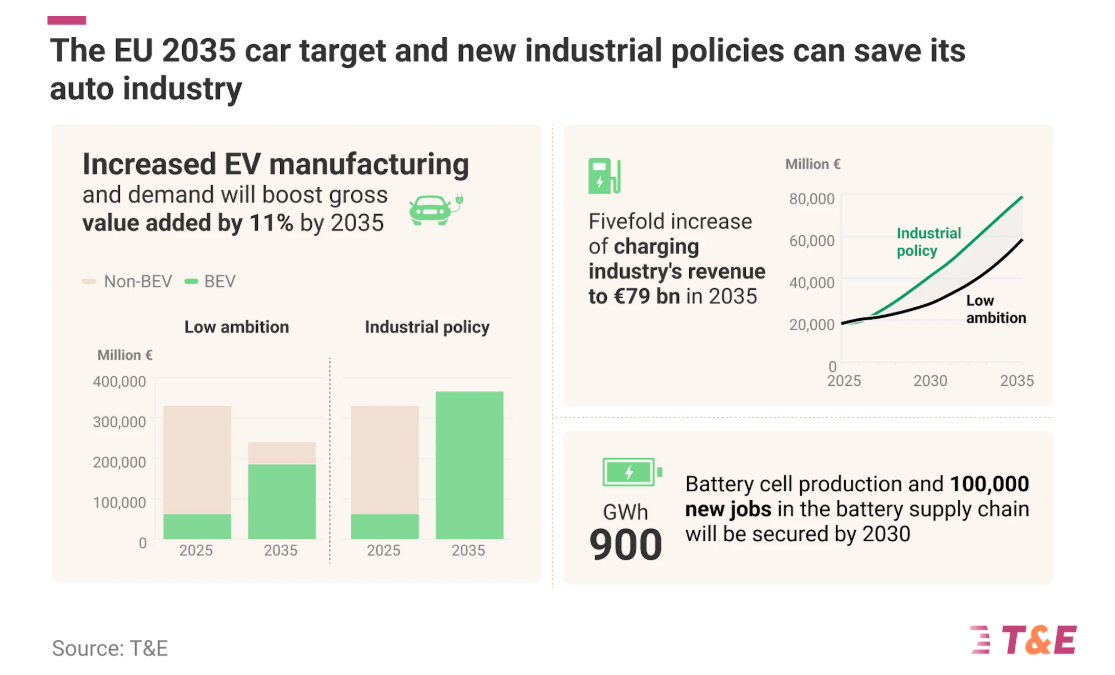

As early as 2024 many industry groups were arguing that the 2025 and 2030 targets were unachievable, and that as a result the industry would end up paying massive fines. T&E published an interesting briefing that pretty much took that argument to pieces, but the lobbying continued.

More recently, the industry push back seems to be achieving it's aims, with an request from the European Parliament that the emission rules be relaxed. The changes would allow manufacturers to meet their emissions targets for 2025, 2026 and 2027 by averaging their performances over the entire three-year period, rather than on a yearly basis. And this feels like the beginning of yet another political rollback.

Can European OEM's afford to sell more EV's

It seems to us that the crux of the debate is not can the industry deliver on the original EU targets, but instead can they do it profitably. And if they cannot, who pays the difference?

It's not easy to disentangle the profit margins on EV sales, but various statements made by company CEO's suggests that many do not break even and even when they do, the margin is (materially) lower than on traditional internal combustion engine sales.

And then of course, on top of all of the other challenges, the US tariffs arrived. Some estimates (such as one in a recent FT article) suggesting the cost to the big 3 US automakers could total as much as $7bn.

This tension forms the backdrop against which we expect (hope) that the major automotive companies will step up and financially support sector electrification.

Is this expectation unrealistic?

VW - Europe's largest OEM but feeling the pain

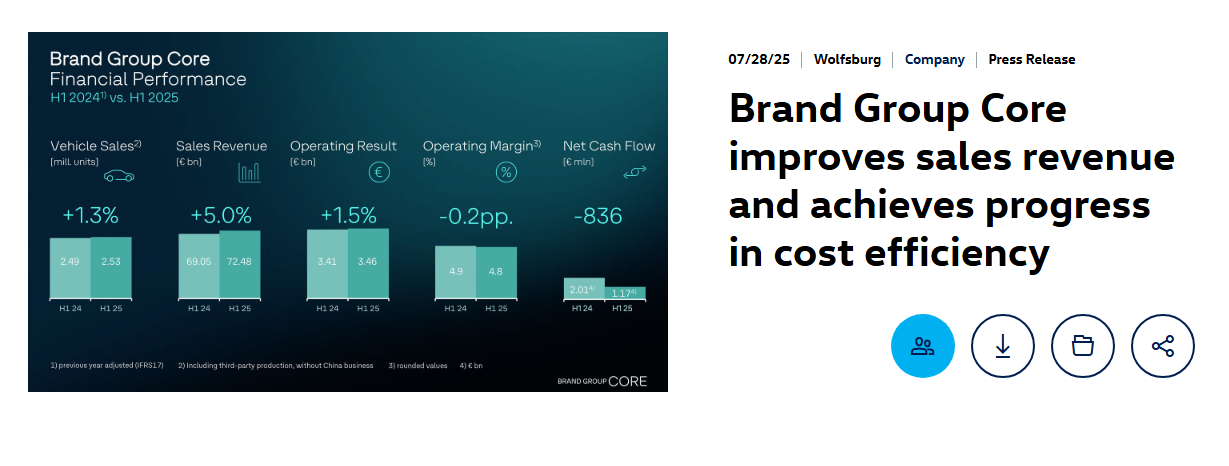

Let's take VW, European largest automotive OEM, as an example. Recent 1H 2025 results support the views expressed by Roland Berger/Lazard about the challenges faced by the industry in Europe. Sales growth was weak (ex China, which saw more declines) and the operating margin slipped modestly.

Perhaps equally importantly, net cash flow for the full year in the automotive division is now forecast at €1 billion to €3 billion, down from €2 billion to €5 billion, versus consensus of €1.6 billion. And this was before the latest round of US tariffs (which may or may not get changed). This means the company will have less to invest, at a time when investment needs are rising.

And on the US tariff front, they said that the cost in just the first half of the year was E1.3bn. Again, less cash for investment.

At the same time the company is at the start of a long slog to restructure it's German manufacturing operating. Back in December 2024 VW management and labour leaders struck a deal to cut German production capacity by more than 700,000 units and reduce headcount by 35,000 jobs by 2030. Sister brands Audi and Porsche are also cutting jobs to reduce costs. We know from experience how much management energy and time this process will take up, pushing other issues into the background.

All of this suggests that many European OEM's would rather that the EV transition happened later rather than sooner.

If not the legacy automotive companies then who ?

If we want EV sales to grow in Europe, we have a limited number of choices. And none of them are without pain.

One is to switch to China. Chinese manufacturers are continuing to grow market share, reaching a record 5.1% of the European market in 1H 2025.

But this of course puts all of those well paid European jobs at risk (or should that be more at risk?)

The other choice is to hope that the tech companies take up the slack. Foxconn, one of the world largest contract electronics manufacturers, has been accelerating it's efforts to move into EV's. But as a recent FT article highlighted, many of their production initiatives are at an early stage. So this alternative could take years to come to anything. And we still have the job loss issue.

And finally, we could step up and provide financial and other assistance to the European automotive industry. But this is going to cost real money - at a time when EU budgets are stretched. A recent detailed report from T&E digs into this a bit more - it's really worth a read.

One last thought

Strategy is an area where sustainability professionals have the most to add to the long term success of their organisation. But, strategy is not what most people imagine it to be. It's not about what we would like to happen. To misquote Richard Rumelt, it's an insightful diagnosis and reframing of a situation, often warts and all, that we use as a starting point to coherently focus our organisations resources, actions and policies. At it's most basic it's about deciding where, and how, we will allocate capital to deliver our target returns. How we get from where we are now, to where we need to be.

Grant me the strength to accept the things I cannot change, the courage to change the things I can, and the wisdom to know the difference. Reinhold Niebuhr - a Lutheran theologian in the early 1930's

Please read: important legal stuff. Note - this is not investment advice.