European automotive - a sustainability strategy case study in slow motion?

Strategy is an area where sustainability professionals have the most to add to the long term success of their organisation. But sometimes the best strategy conflicts with the outcome we want - we need to stay true.

"If I had an hour to solve a problem, I'd spend 55 minutes understanding the problem, and 5 minutes on the solutions" - attributed to Albert Einstein

Summary: Strategy is an area where sustainability professionals have the most to add to the long term success of their organisation. But, strategy is not what most people imagine it to be. It's not about what we would like to happen. To misquote Richard Rumelt, it's an insightful diagnosis and reframing of a situation, often warts and all, that we use as a starting point to coherently focus our organisations resources, actions and policies. At it's most basic it's about deciding where, and how, we will allocate capital to deliver our target returns. How we get from where we are now, to where we need to be.

Why this is important: Successfully identifying an upcoming change can be the starting point that enables a business to become a long term success. And on the flip side, the failure to anticipate change is arguably one of the most important contributors to business collapse. As a sustainability professional, ethics might be your starting point, but to make change deliverable, we need to draw in multiple themes, including finance, operations, marketing and psychology.

For this blog I want to begin to explore situations where there is no easy answer. Where many of the possible strategies that get us to where we would like to be are bad, not good strategies. And where the optimal strategy might be one that conflicts with our ethics.

Sometimes we get so tangled up in where we want to get to, in finding ways of allowing the organisation to keep going, that we lose sight of the fact that the pathway we have chosen makes no real financial sense. We unconsciously have shifted from hard headed strategy to wish fulfillment. So, sadly, one of the key roles of the sustainability professional in the strategy process is to be able to say 'the emperor has no clothes'.

For this blog, we start with the European automotive industry. In many ways it looks like the classic case of 'change is coming, we need to act'. And at one level that is true. A combination of the shift to EV's, the rise of the Chinese automotive threat, and domestic energy, environmental, and cost issues, mean that change is needed. But, exactly what change, how fast, and where do we allocate our scarce capital ? And in the longer term, where will our sources of competitive advantage come from? These are key questions sustainability professionals need to be resourced to consider, if they are to really make a difference to their organisation's strategy.

But, sometimes the answers are not what we would want. Sometimes we just have to accept that we cannot sensibly get to where we would like to be, at least not in a way that makes financial sense. To prosper in the future we may need to give up some activities, often ones that have been the heart and soul of the organisation in the past. If we are in this place, one alternative is to get someone else to foot the bill, normally the government. We can argue that the activity is so economically important that to lose it would risk the regions economic future, or cause massive job losses. And that argument might be so politically attractive that the government actually financially contributes. And sometimes that approach can work - especially if the government funding gets us to the point where the activity becomes financially viable again.

But if we go down this route we need to be honest with ourselves. To admit that this activity is not core any more. That the day the government support ends, is the day that we exit.

The details

Summary of an article published by McKinsey:

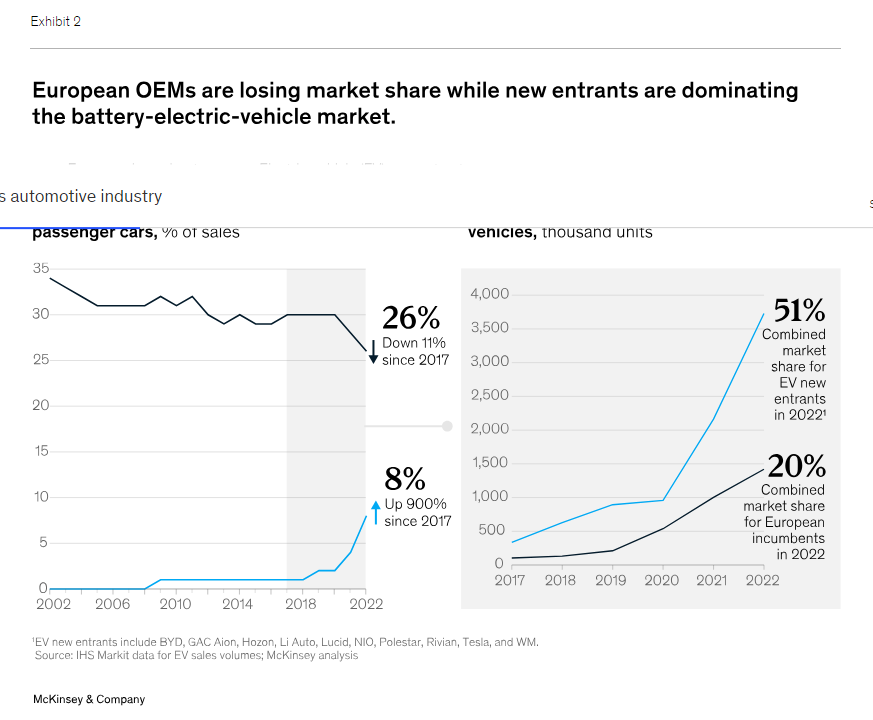

The automotive industry is an important contributor to Europe’s economic growth and prosperity, accounting for almost 7 percent of the region’s GDP and being directly or indirectly responsible for employing almost 14 million people. But, it's also an industry facing massive change. The shift toward electric vehicles, and the associated shift from hardware to differentiation through software has allowed new entrants, including those from China, to take market share.

These shifts are being compounded by the European macro environment including rising energy costs, inflation, and geopolitical tensions. A prosperous future for the European automotive industry will therefore depend on how well and quickly it responds and how European stakeholders can shape the necessary conditions for future success. The need for action is urgent.

Why this is important

For most sustainability professional's their No 1 aim is to make a real difference to the long term sustainability of their organisation. And that means helping to drive strategy. The 'obvious financial levers' are risk reduction, and the exploiting of new market opportunities. Your sustainability expertise can be invaluable in identifying the choices, helping to answer the question of what should your organisation look like in five or ten years time, what new activities will be started, and which old activities will be terminated.

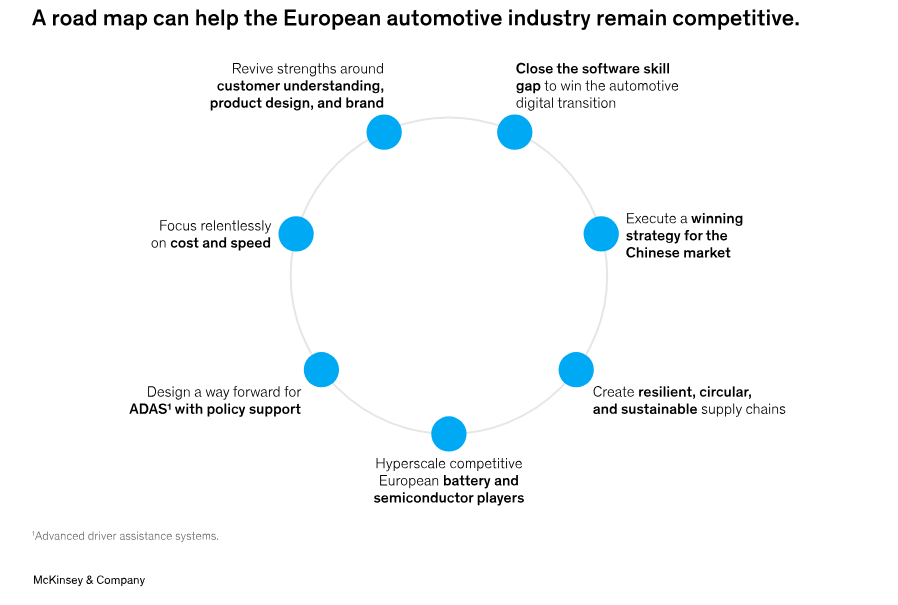

For the European automotive OEM's the answers seems obvious. Pivot to building more EV's, grow their software expertise, build new sustainable supply chains (including maybe vertically integrating into mining, battery and even semiconductor production), and increase their focus on cost reduction (and speed to market). And the good news is that this is consistent with our desire to support the transition to a more electrified and sustainable transport system. And there are always consultants who will advise you.

At this point I want to say something that might seem counterinitiative. Lets stop and pause for a moment. Before we rush into the solutions, in the spirit of the Albert Einstein quote above, lets take our 55 minutes to understand the problem.

We all know that EV's are growing in importance. And we all know that software is becoming more important than hardware. And, if we are being brutally honest, which we need to be if we are to develop good strategy, Europe is currently weak in both. Plus, we know that European supply chains need massive change. So, the hard question is, should the industry keep going as it is, just in a greener way, or are there activities that we just cannot make financially viable ?

Lets start with what strengths does the industry have? Great brands is one. As the McKinsey report says "five of the ten most valuable car brands worldwide are European". And a skilled workforce is another, as are the network of supplier relationships. But, the challenges are material, and the time scales in which we need to make decisions are short, suggesting that hard choices might be required.

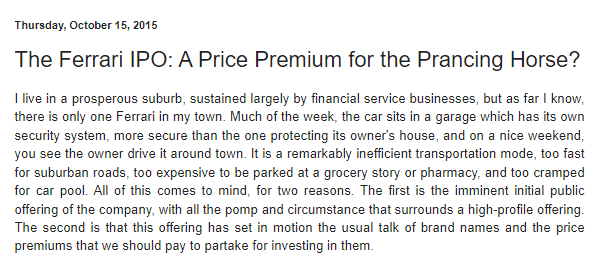

So a reasonable question is, can the industry keep its market share in all price segments, or should they focus only say on premium, where their brands have the most value? And would this shift to lower volume premium markets relieve some of the pressures on supply chains? In thinking about these questions I keep being drawn back to a piece of analysis Aswath Damodaran did back in 2015, at the time of the Ferrari IPO. Yes, some of the numbers are dated, but the blog approach still gives us some useful information. Put simply, premium automotive is, from a financial perspective, a good space to operate in. Mass market automotive is a lot tougher.

In this introductory blog we can only ask questions, but we argue that this process is still valuable for sustainability professionals - as the challenges being faced by the European automotive sector mirror those being experienced by many other sectors. Examples here include electricity generation, steel, cement, and chemicals. And with a slight shift in terminology, the solutions being proposed are similar. They need to pivot to building/producing the green alternative (or making products in a greener way), rebuild supply chains to make them more sustainable, focus on software skills and move to better control your upstream supply chain.

In thinking about a good strategy for your organisation, it's important to remember that substantial market disruptions have been observed in other industries, with serious outcomes. As the McKinsey report highlights, European manufacturers lost more than 90 percent of their share of the smartphone market in just six years. And leading players in the film camera industry lost similar market share over nine years. My experience has been that sometimes getting out of an operation can be the best plan, and if it needs to be done, do it early.

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.