Sunday Brunch: is failure on climate change really financially harmless ?

We talk a lot about climate models and how GHG emissions impact temperature, but not so much about climate damage function models. And yet this second set of models have a massive impact on financial decision making.

Some economists have predicted that damages from global warming will be as low as 2% of global economic production for a 3˚C rise in global average surface temperature. - The Emperors New Climate Scenarios 2023

We talk a lot about climate models and how GHG emissions impact temperature. But not so much about climate damage function models. These are the models that estimate how much financial damage climate change could cause. Putting it bluntly, the economic climate damage function models have a much greater impact on the behaviour of the financial and economic community than climate science does.

According to a recent report from the Institute and Faculty of Actuaries, the climate damage function models most organisations use are based on erroneous assumptions. As a result, the models say - global warming will have only a insignificant impact on our economic output. Such a conclusion fails the common sense test. The real financial outcome is likely to be materially worse.

And yet, many in the financial community continue to be influenced more by the climate damage function models than the climate science. This is not something we can ignore - we cannot assume that logic will prevail.

This is not me saying this. It's the Institute and Faculty of Actuaries - the financial risk specialists. If you have ever worked with actuaries, and I am guessing most non finance people have not, they are not given to flights of emotion. They are very rational people. A recent report from the Institute, together with the University of Exeter, entitled The Emperor's New Climate Scenarios, quietly takes apart the notion that the financial risk from climate change is minimal.

I strongly recommend all Sustainability Professionals who are involved with the finance industry read this report. And then, spread the word. It's not an easy read, it assumes we understand some of the basic concepts around financial risk. But its worth the effort. And it could lead to us rethinking what we mean by sustainable investing and fiduciary duty.

If you want to read the rest and are not already a member...

Is failure on climate change really financially harmless ?

Before you stop reading this, assuming that this is just nonsense, stick with me for a while. Because many financial institutions believe that it is, or apparently believe this. And they are undertaking investment and strategy actions on that basis.

Finance people focus a lot on the financial impact of sustainability issues. This should not come as a surprise - but it often does. This can mean that while they understand the science around issues such as climate change, biodiversity loss, and water scarcity, their motivation to change the system is driven by what they think the financial impact will be.

Nothing illustrates this better than the mismatch between the science of climate change, and the economics of the impact of climate change on financial and economic metrics, especially Gross Domestic Product (GDP). The economic climate damage function models that estimate this might sit quietly in the background, but they are powerful, influencing the investment actions of insurance companies, pension funds and banks. And indirectly the actions of companies and politicians.

If these models are under estimating the financial harm, we are probably making the wrong financial choices. And remember, we don't have to be certain of the outcomes to take sensible precautions. A lot of the time managing risk is about asking, what if this (possible event) actually happened ?

I used to work in the gas industry. Specifically Liquified Petroleum Gas (LPG). It was a possible replacement for petrol (this was back in the days of oil embargo's - when fuel security was a big deal). It had one big drawback - if it exploded it caused material damage (just google boiling liquid expanding vapor explosion or BLEVE). So we made a lot of investments to make sure this didn't happen. Disasters were thankfully infrequent, but we knew that to cut back on investment in safety was a false savings.

Good news : the use of climate damage function scenarios is rising

First, the good news. The Global Association of Risk Professionals (GARP) has carried out four global surveys of climate-risk management at financial firms, providing a useful summary of market practice. The 2022 survey showed that over 80% of firms are now undertaking climate-scenario analysis, an increase of over 30% since the 2019 survey result.

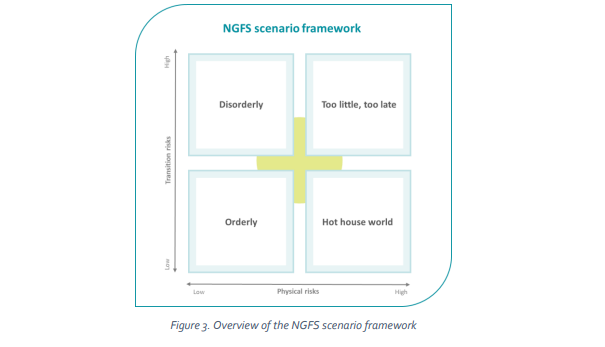

And 95% of firms surveyed use scenarios to assess the financial impact of climate change. The most commonly used scenarios for transition risk are those from the Network for Greening the Financial System (NGFS). These are currently: an orderly transition, a disorderly one, Too-Little-Too Late, and what is called the Hot House.

So far, so good.

Bad news: some of the most commonly used models seem to have material flaws.

Now the bad news. The assumptions used in some of the economic climate damage function models seem to be flawed. or to put it in the language of the report, they disregard the fact that the future could look very different from the past. It's a bit like sitting on the Titanic the night before it hit an iceberg and saying, based on the journey so far, we can foresee no risks.

To quote the Institute and Faculty of Actuaries report. The NGFS estimates a reduction in global GDP from chronic physical (climate related) risks but caution that this does not include:

‘impacts related to extreme weather, sea-level rise or wider societal impacts from migration or conflict. For given countries these would likely strongly increase the physical risk. These estimates also do not fully capture adaptation, which would reduce impacts but require significant investment.’

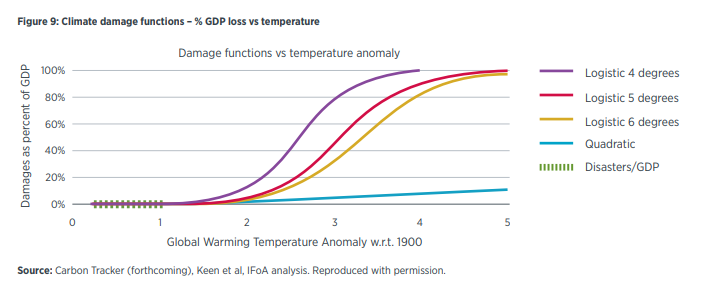

The report goes on to say that some of the models use what is known as a quadratic damage function, which the report describes as being based on "an extrapolation of damages in the past ‘when it got a bit warm’. This damage function excludes

tipping points and many of the risks we expect to face."

Now you might think that extrapolating from the past makes sense. But only if the future is expected to be similar. And if the consequences of being wrong are not material. Neither of these assumptions seems to hold true.

To illustrate. The chart below shows the difference between the quadratic assumption (the blue line - where the future looks similar to the past) and a logistic damage function that assumes pretty much total economic destruction at various levels of global warming (the purple, red and orange lines).

The lines are similar up to about 2 degrees of warming. But they they massively diverge. Or putting it another way, if the Logistic models are correct, we could expect to see material damage to our economies.

From a financial risk perspective it's important that we avoid taking an overly optimistic perspective. That can make us blind to the risks, and unprepared for changes. The role of Actuaries is, in part, to help us prepare for what 'might' happen.

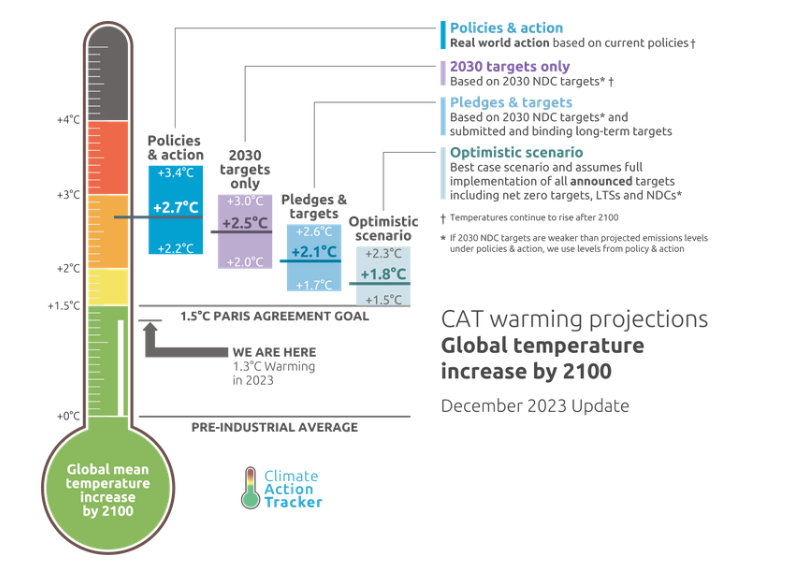

As a reminder, the latest Carbon Action Tracker 'thermometer', has us on a track that could deliver anywhere between 2.2 degrees and 3.4 degrees of warming (the Policies and Actions scenario).

Based on this, more than 3 degrees of warming is possible. And as we know from recent experience, policy reversals are possible, which could actually make this scenario optimistic. And if the politicians believe the economists, they are more likely to say, lets push back the hard decisions, after all the economic damage is small.

I want to leave you with one thought. Insurance leaders have unequivocally stated that if climate change raises average temperatures to 4˚C above pre-industrial levels most assets will be uninsurable. Without insurance, investment, finance,

business slow to a halt – we will no longer have an economy.

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.