Sunday Brunch: Should I invest in electric buses ?

Living as I do in Europe, the shift to electric buses looks strong, capturing a growing share of the new bus market. But from an investor perspective is this the full picture. Yes & No. Other questions we also need to ask - how many existing buses are electric, and where are the sales happening?

Being clear upfront, this is not investment advice. What I want to do is use the electric bus transition as an example of how sometimes we need to look beyond the headlines when we prepare a financial investment case. Because sometimes the headlines do not give the full picture. And we need to try hard to avoid relying on data just because we agree with the message it is delivering.

In many situations it is important to emphasise the positive, especially in a world where so many seem to be actively working to block change. But investing isn't such a situation - investing needs a different approach.

Investing in electric buses could be a great opportunity. But it could take until the medium/long term before the business case works to it's full potential. Plus it may not be the European OEM's that benefit. If Chinese companies continue to be successful in gaining material market share, the profit pool could be smaller than we first thought.

Electric buses gaining market share in Europe

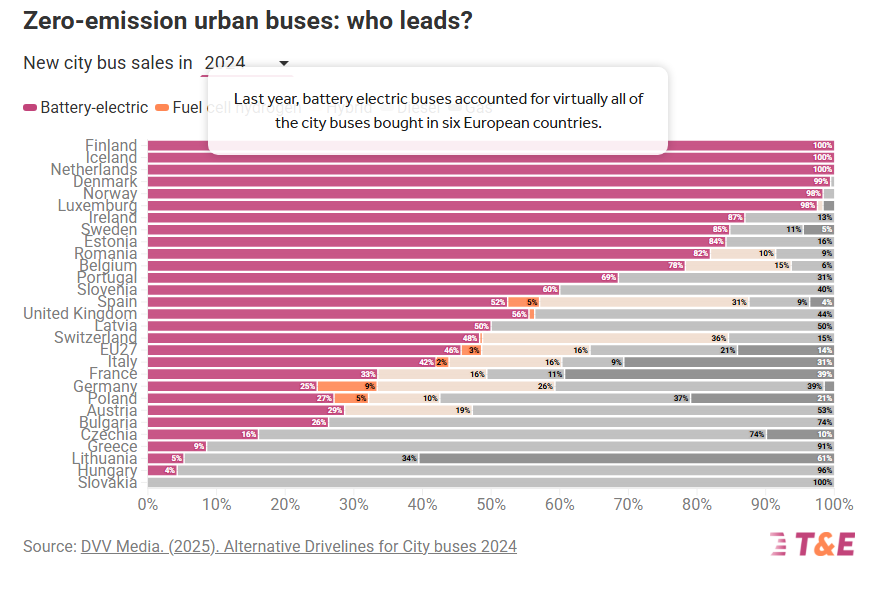

According to the latest data from T&E 49% (as they put it - nearly half) of all new city buses in Europe were zero emission in 2024. This is up from 37% the year before. So dramatic progress.

They report that ... sales of zero-emission city buses have surpassed the EU’s targets for public procurement – and are running ahead of EU vehicle emissions standards. At this pace, 100% of city bus procurement will be zero emission by 2027.

And some countries are showing faster progress. The data showed that in six countries 98% or more of the new urban buses were electric.

So far very encouraging. But does it give the full picture for a potential financial investor?

Thinking about a possible investment case

If I was going to invest in the trend to electric buses there are some extra pieces of information I will need to build my investment narrative (from Numbers & Narrative by Aswath Damodaran). Some big picture questions include:

How important and representative is Europe as a bus market? And what is happening in the bigger European bus markets, are they also shifting to electric buses. Plus, given that the after-market (parts and repairs) are normally more important for industry profitability than new vehicle sales, how big is the electric bus installed base vs diesel buses?

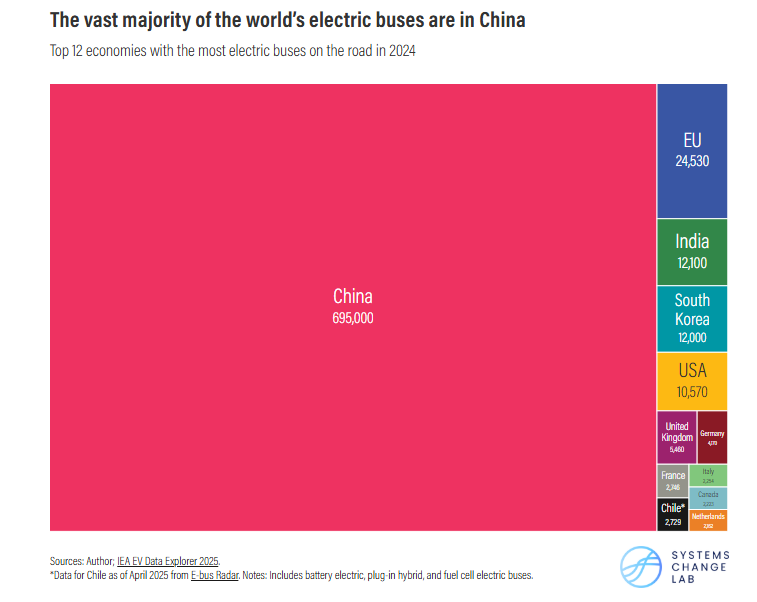

Let's look at the global market for electric buses. According to a June 2025 report from the World Resources Institute, the vast majority of electric buses on the road are in China. And in some of the potentially important markets (such as India and the US), the number of electric buses in operation remains relatively small (c.10,000 buses).

This suggests that Chinese electric bus manufacturers probably have a material advantage due to their economies of scale and how far up the learning curve they are.

How about the big European bus markets ? The chart above shows that progress there is a bit slower. Spain and the UK have just over a 50% market share of new sales being for battery electric buses. Germany and France are lower again, with France at 33% and Germany at 25%.

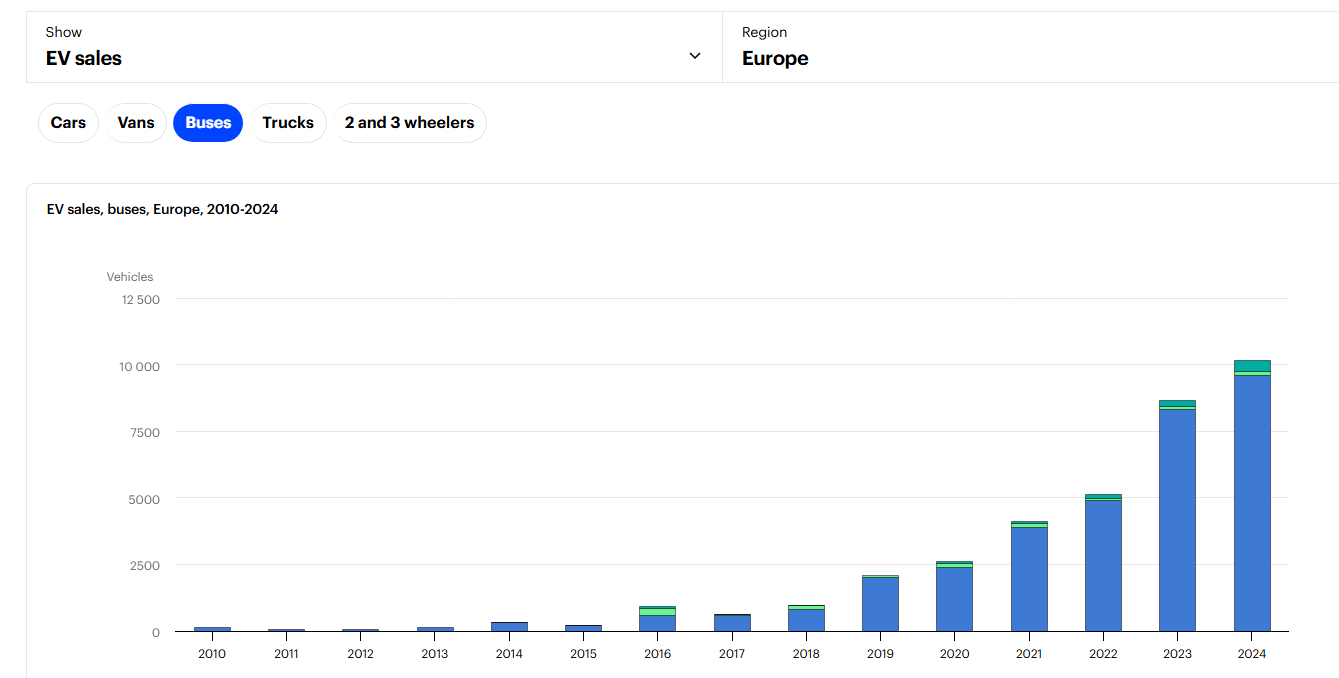

The good news is that electric bus sales in Europe are growing strongly. The chart below is from the IEA Global EV data explorer.

You could argue that this suggests good growth potential, but before we could be sure we would need to check public procurement incentives in the relative 'laggard' countries. After all most new bus sales are either direct to public bodies or at a minimum are impacted by public body contract incentives and rules.

And how about the fleet on the road. What % of existing buses are electric?

According to the acea there are just over 720,000 buses on the road in Europe. The average age of the bus fleet is c. 12.5 years, and so we would expect on average around 58,000 new buses to be purchased in a typical year (just to replace existing life expired vehicles), plus maybe a bit more for market growth.

Actual bus sales were lower than this. Again based on acea data, bus sales in 2024 were 35,579 units. This was up 9.2% y/y. This suggests that operators may be running buses a bit longer, not so good for new bus sales but positive for parts and repairs.

Going back to how many electric buses are currently on the road as a percentage of the total, according to the WRI data referenced above, there are around 24,530 electric buses in Europe. This is c. 3% of what we could think of as the installed base of buses.

This is relatively low, and while it should grow strongly in the coming years, we would need to think about how this could impact the profitability of the parts and repair operations.

Pulling all of our high level data together

- Nearly half of all new urban bus sales in Europe are electric, and this could rise to around 100% by later in this decade - positive. But this will require a material pick up in sales in some key markets such as Germany, France, UK and Spain, which will largely be driven by public procurement policies - need to check what might change, why this hasn't happened already.

- The installed base share is currently low at c. 3% (call it sub 5%?), which could negatively impact the profitability of the important parts and repairs segment - potential for improvement

- Most electric buses on the road are in China. This suggests that Chinese electric bus manufacturers probably have a material advantage due to their economies of scale and how far up the learning curve they are - this needs checking.

Overall, this suggests that while electric bus sales in Europe are showing a positive and improving trend, the initial headline suggests an overly positive outlook when viewed from the perspective of an investor.

One last thought

Life is not easy for European automotive companies. Sales will likely remain below pre covid levels for some time, and margin pressure looks unlikely to abate. And EV investment needs are rising. Can we expect them to be able to fund the EV transition - or does the future lie elsewhere?

Grant me the strength to accept the things I cannot change, the courage to change the things I can, and the wisdom to know the difference. Reinhold Niebuhr - a Lutheran theologian in the early 1930's

Please read: important legal stuff. Note - this is not investment advice.