Sunday Brunch: Sustainability, creative destruction, and Nobel prizes

Hoping that incumbent companies will change can lead to disappointment. Incremental is ok, but big changes sometimes need a new entrant. Incumbents have too much to lose. So maybe our first question should be 'will the incumbents deliver the change we want or do we need creative destruction'?

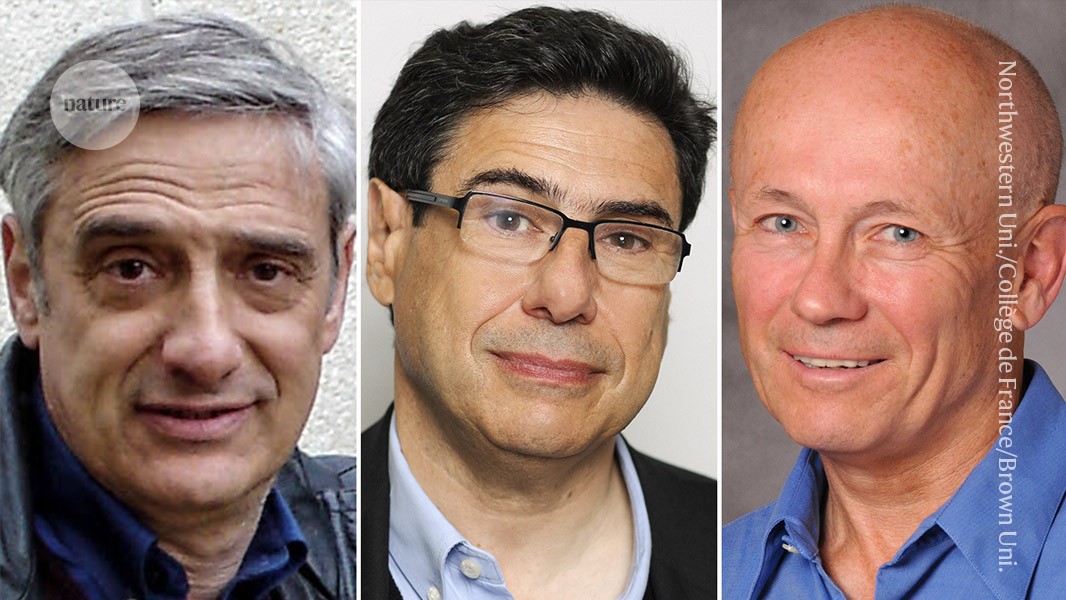

This blog was partly prompted by the recent Nobel prize for economics. Half of the 2025 award went to Philippe Aghion of the College of France, INSEAD, and the London School of Economics and Peter Howitt of Brown University for their work elucidating how technological innovation allows companies to outcompete one another, a process called “creative destruction”

Before exploring this some more - what does this have to do with sustainability, and especially sustainability engagement? That's easy.

We really want to make sure that we are spending our scarce engagement resource on companies that will realistically make the changes needed. I often argue that it's not sensible to engage with companies that are unable (or unwilling) to change, at least in the current political/regulatory environment.

The only real exception to this is where we can see a realistic path to the company adapting a different position in the future. For this to happen they normally need to be acquired or for the board/management team to be replaced. Having done this for a living - change like that is tough. Active engagement like this often involves material cost and a willingness to keep persisting in the face of often aggressive defence of the status quo.

In saying this I am obviously looking at it from my own perspective (that of an investor wanting to do the most I can to drive change). My world is mostly about sustainability adaptation, and transition risks (and opportunities). Basically getting companies to anticipate and prepare for changes we know are coming. Others come at this from the perspective of sustainability mitigation - actions that need to be taken to create the future world that we want and need. This is more about policy and governments - outside the scope of my expertise and experience.

Retaining the status quo or unleashing creative destruction ?

Let's start at the beginning. Incumbent companies can have a very real financial incentive to slow down change. They have often invested heavily in the infrastructure needed to run the systems 'their way'. And at a personal (cultural) level, management teams have developed certain skills and expertise, often over decades. The 'new' way of doing things can often make this investment valueless (stranded assets), and the same can also apply to the skills and expertise of incumbent management teams.

This can create a real barrier to change, especially if the company doesn't have the skills and expertise to operate in the 'new world'. Think companies that used to make older style mobile phones (like my old Nokia 8210) , and how many of them were able to transition to smart phones?

The recent Nature article on the Nobel prize award quotes Ufuk Akcigit, an economist at the University of Chicago, who puts it rather neatly - "when a new entrepreneur emerges, they have every incentive to come up with a radical new technology. As soon as they become an incumbent, their incentive vanishes” and they no longer invest in R&D to drive innovation."

Interestingly this is not a new concept. The original research by Aghion and Howitt dated back to Jan 1990. But the concept still holds as much now as it did then.

How about some possible real world sustainability related examples? To me an obvious one is Oil & Gas companies. As we said in a blog back in early 2023 ...

It's highly unlikely that any publicly listed upstream O&G company can be persuaded to do something that clearly destroys financial value. Leaving aside arguments about fiduciary duty, if they announce a value destroying plan, their share price will likely fall, and another company can then come in and buy them at a discount, reverse the old plan and make a profit. That's just how our financial system works.

A less obvious but still very real example is in the automotive industry. If your competitive advantage comes from building and selling good (or even not so good) internal combustion powered cars. And the world wants you to switch to making only EV's, which require very different skills and most importantly different manufacturing facilities, then you might be tempted to try to delay the change. Which is what we are apparently seeing with the European Union's regulations on EV's and emission reduction.

In my opinion this is only delaying the inevitable. But given that the automotive OEM's currently only generate low Returns on Invested Capital (ROIC), and many of them have limited free cashflow to invest in EV's AND keeping their current offerings competitive, then you can appreciate the dilemma they face.

The good news is that there are many industries where preparing for a more sustainable future makes good financial sense, and also provides benefits to the wider society. So how about we focus our engagement resources on them, and leave the others to face a world of creative destruction?

One industry where it makes sense for everyone to act is food & agriculture. Food companies need to focus on healthier diets and climate resilient supply changes. It makes good financial, as well as sustainability, sense.

Just a reminder, this is not investment advice. Regular readers will know that the debate about if a company makes a good investment is largely about the price you have to pay for the shares. And how this compares with your estimate of fair value. A company can be poorly placed in its industry, and still be 'cheap'.

One last thought

We frequently hear that 'this company can afford to change - look at the profit it generates'. Or sometimes 'look at the level of dividends they are paying to shareholders'. But these are often not a good measure of their ability to pay for change. Regular readers will know that we think ROIC is a more useful starting point. Companies with low competitive advantage may be among the last to be willing, and able, to change.

Grant me the strength to accept the things I cannot change, the courage to change the things I can, and the wisdom to know the difference. Reinhold Niebuhr - a Lutheran theologian in the early 1930's

Please read: important legal stuff. Note - this is not investment advice.