Sunday Brunch: sustainability is an intangible asset

Sustainability can be like a good brand. Without it your business can lack the quality that gives it a viable long term future. Intangibles may be invisible, but it doesn't make them any less real.

Just because you cannot see an intangible asset doesn't mean it isn't critical to the long term success of your company. Brands are the life blood of our business. - CEO of a major global spirits company

We need to find better ways of ensuring that Sustainability Professionals and finance people properly communicate. As part of this we all need to learn a new language, a new way of communicating. Finance people, like all professionals have their own frameworks. If we can slot our sustainability transition pitches into them, we stand a better chance of raising the money we need.

One really useful framework for Sustainability Professionals is what finance people call intangibles.

In simple terms they are assets that you cannot see. They are the opposite of tangible assets, which are physical things such as factories, equipment, and power stations. Intangible assets by contrast are invisible things like brands, reputation, intellectual property, and human skills/relationships. While they are invisible, hopefully it's clear how important they are to the success of an organisation.

Sustainability can be like a good brand. Without it your business can lack the quality that makes consumers happy to pay a premium price, for employees to keep going that extra mile, and for the providers of capital to continue to support you. Not just today or tomorrow, but way out into the future. But, in the same way that creating a good brand means making hard choices, not all sustainability issues are material to creating a valuable intangible asset.

If you want to read the rest and are not already a member...

Sustainability is an intangible asset - that we need to invest in

Before we start let's make something clear. In the words of Alison Taylor at NYU Stern, finance is not the only issue in making the sustainability transitions happen, but it is an important one. Without finance, many of the changes we want to happen will just fade away, and remain just good ideas.

If we are to raise the finance we need to make the sustainability transitions happen, then Sustainability Professionals need to be able to talk with finance people, in a way that both sides understand each other. This is going to increase the chances that the finance flows. Part of this is understanding the limitations of relying totally on private finance (which takes us toward Blended Finance).

But a big element is going to be presenting sustainability ideas in a financial context. Which is where intangible assets come in.

We talked about narrative in a Sunday Brunch a few weeks ago. Today, let's dig a bit more into how we construct a narrative that finance and strategy people can relate to. The topic - the importance of intangible assets and why pitching sustainability as being like a brand can help us make the sustainability transitions happen faster.

Why intangibles are important

Let's try a simple thought experiment. A company that you are invested in decides that starting from today, it's not going to invest any more in building it's brands, developing new systems, and training it's staff. And they say, think of all the money we can save by cutting all of these 'costs'.

I am guessing that you would think they were mad. Companies clearly need to invest in soft assets (intangibles) if they are to have a future.

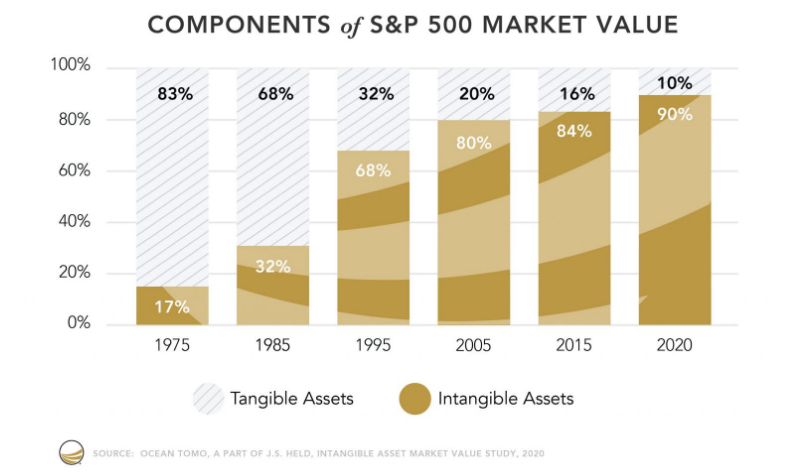

While we tend to think about investing to create future value as being mainly about physical structures such as wind farms, or new EV factories, it turns out that intangibles are more important to long term financial value creation. A study by Ocean Tomo identified that c. 90% of the market value of the companies in the S&P 500 is due to intangible assets. And this is not just a US phenomenon. The percentage for the S&P Europe 350 is 74%, smaller but still material.

There are a couple of aspects of intangibles that we need to talk about.

First, most finance people accept that the link between spending on intangibles and financial value creation is fuzzy. We know that investing in intangibles creates financial value, but a bit like the famous quote about advertising, we don't exactly know which exact investment is good, and which one might be 'wasted'. But, it doesn't stop us investing.

‘Half the money I spend on advertising is wasted; the trouble is I don't know which half.’ John Wanamaker

And the second point. We also don't know how much investment in intangibles is good. We know for instance that the best spirits companies spend highly on brand creation. But it's often hard to answer the question "is spending 20% of sales on brand building too little or too much ?" But again, this doesn't stop us investing.

What does this have to do with Sustainability as an intangible?

Let's try the example above of the company that cuts it's spending on intangibles as a starting point. What if the company said ....

- I am not bothered about where my raw materials come from, and how they are produced. I obey local law and that is enough. And if local law changes, I will adjust my supply chains, but only then, not in advance.

- I know my mine tailings are potentially dangerous and they could materially harm local people downstream, but if they collapse, I will just pay the fine. It's just a cost of doing business.

- I know my workforce is disillusioned, and that as a result my customer service is poor, but it's not worth investing in a more motivated and diverse workforce.

- I know that at some stage we will have to change our production processes, but I cannot be bothered investing in greener alternatives until I have to.

Most sensible investors know that investing in any of these would create intangible value for the company. We don't exactly know how much value, and we don't exactly know how much investment we need. But, this is no different from brand building, or staff training, or building new processes or systems.

Investing in sustainability intangibles is not just about making changes because they are the right thing to do. It's also because investing in these changes will future proof your business, making it more sustainable and protecting your long term financial viability.

We will be digging into these issues in more detail in future blogs, including the complex question of what is material from a financial perspective, and what is a political/ethics issue. But, to finish with the Alison Taylor point (again).

Finance is not the only issue in making the sustainability transitions happen, but it is an important one. Without finance, many of the changes we want to happen will just fade away, and remain just 'good ideas'. And by reframing our investment ideas in finance speak, in this case intangible asset creation, we can increase the chances that good ideas turn into good projects.

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.