Sunday Brunch: Sustainability targets are just goals

Sustainability targets without a meaningful delivery strategy are just goals. And without good disclosure we cannot judge if they are deliverable (or not).

Your Strategic Plans Probably Aren’t Strategic, or Even Plans - Graham Kenny 2018

Many company's and governments have net zero and climate related targets. But without a detailed delivery strategy to back them up, they are just goals. Or even worse they are just hopes. Or even worse again, potentially a way of 'kicking the can down the road' a bit further - so that it becomes someone elses problem.

Which is where sustainability disclosures come in. These are where the company sets out, via the audited Report and Accounts, their sustainability transition strategy. And where they should give detailed plans for delivering the targets. And their financial implications.

Sustainability disclosures are where we can measure progress.

We argued last week that sustainability disclosures matter to traditional investors as well. This week I want to set out why sustainability professionals need to care about good sustainability disclosures. Why targets are not enough.

Governments and companies mostly disclose alignment with the Paris Agreement, often via long term targets. And they frequently provide limited detail around what concrete actions they plan to take, and what the financial implications might be of the choices they have made. And most do not have meaningful short and mid term milestones.

It's all out there in the distance. And it can only be many years later than the lack of progress is revealed.

So, if a company or government promises some appealing net zero target, don't take it on trust. Demand to see the strategy - in detail, including the financial implications.

If you want to read the rest and are not already a member...

Targets are just goals, or sometimes even just hopes

I want to start talking about why sustainability professionals should care about good sustainability disclosure with a simple example. It's a government that had a target, but that failed to actually have a strategy for delivering it. This has a really close read across to company's. I picked Scotland, simply because it happened last week.

It all started back in 2019 with an announcement from the Scottish Government ...

"Scotland’s ambitious climate change legislation sets a target date for net zero emissions of all greenhouse gases by 2045. Our contribution to climate change will end, definitively, within one generation."

And as part of this they committed to target of reducing greenhouse gas emissions by 75% by 2030. Pretty punchy. And sadly, not really backed up by what you could reasonably describe as a well thought out and costed strategy.

Given that they missed eight of the last twelve annual targets, and failed to publish the plan they promised under their own legislation, last weeks news could not have been a real surprise to anyone.

The 2030 target was scrapped as now being "unachievable".

Or putting it another way - no real plan meant the targets were exposed for what they really were, just goals and hopes. For sustainability professionals this means that five years on, we still of no clear idea if the Scottish plans are deliverable.

How realistic was the plan?

"Ever since the first Climate Change Act, I've said that world-leading targets are not enough, especially if there aren't credible and robust plans in place to deliver them." Scottish Greens co-leader Patrick Harvie 2024

Actually it wasn't really a plan at all, just a target. And as we said at the beginning, targets are just goals.

It can be the same with company targets.

While many company's set targets, few disclose detailed transition strategies. And even fewer are clear about the financial implications.

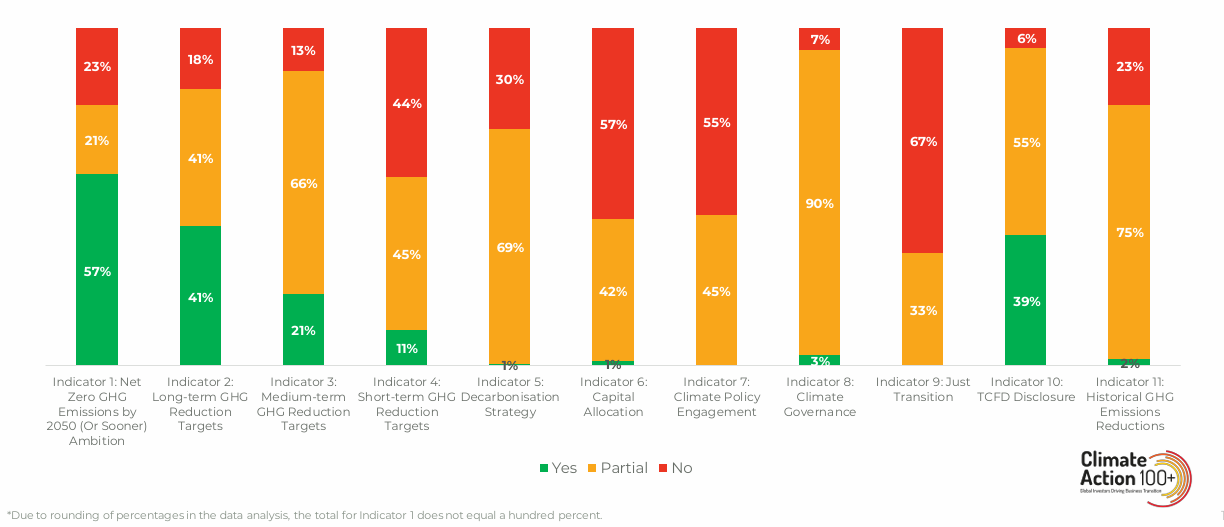

The latest CA 100+ benchmark report (October 2023) assesses how companies are performing against the key area of net zero transition disclosures.

For those of you who do not know CA 100+ they are an investor-led initiative that exists to ensure the world’s largest corporate greenhouse gas emitters take necessary action on climate change. They have 170 focus companies, spread across all of the high emitting sectors including Oil & Gas, Transport and Utilities.

The 2023 results show that while 57% of the 170 companies have a target of net zero by 2050 or sooner, only 21% have medium term GHG emissions reduction targets. And only 1% meet all of the decarbonisation strategy and capex allocation targets.

And if we look at how well companies met the criteria for financial reporting, only 37% of assessed companies now partially meet the criteria, with 7% of assessed companies showing a real improvement in their overall scores.

Its also not great on auditing. 82% of auditors do not currently provide evidence that they have incorporated material climate-related risks into their audits of focus companies. Only 2% of auditors have improved their disclosures in this area this year.

Why does this matter - starting with investors?

It's simple. Last week we argued that without such disclosures, shareholders and potential shareholders will not have sufficient information to properly evaluate a company's ability to deliver on its climate related targets, and the financial impacts that this would potentially give rise to. This includes both the costs of delivering on the company’s strategy, and the potential financial impacts of a failure to act.

And disclosure matters for sustainability professionals

A lot of sustainability professionals quite rightly celebrate when companies set net zero targets. It's a step forward. But without detailed strategies, including a detailed assessment of the financial impact, there is a very real risk that we look back in five years time and find that we are no closer to the aim of net zero by 2050. And we have 'lost' five years.

We should see targets, even mid term ones, as being a starting point, not an end point. And we should demand much better sustainability disclosure, including proper reporting via the annual Report and Accounts. Plus proper oversight and reporting by the auditors.

Every year companies ask their shareholders, one way or another, to effectively approve their financial statements. Sometimes it's a direct vote, and other times shareholders are asked to sign off on the actions of the management board.

If the financial Report and Accounts don't provide good disclosure of the sustainability transition strategy, including the financial impacts, and there is no sign of improvement, why should shareholders vote for these resolutions ?

And every year, shareholders are asked to approve the appointment of the auditor. A similar question applies. If they are not commenting on material climate related matters, and how they impact the company. Plus, if they are not reviewing the consistency of the sustainability targets as against other elements of the company strategy, why would we vote for their appointment? Or at a minimum ask for changes to their terms of reference.

One last point to leave you with. The objective here is to improve disclosure, so that as shareholders we are getting the information we need. The objective is not to 'show the company that we disapprove'. If through engagement we can improve disclosure, this should be the first priority for our efforts.

If you want to understand more about why financial reporting is important for sustainability professionals, you should read a recent Sunday Brunch ...

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.