Sunday Brunch: The importance of the Cost of Capital - part 1

The Cost of Capital is a powerful financial concept, but one that hides a lot of complexity. The phrase is often mis-used. One common mistake is to believe that if a sustainability investment is lower risk, it means it's a better investment.

You cannot have your cake and eat it too - Ancient proverb

The Cost of Capital is a powerful financial concept, but one that hides a lot of complexity. The phrase is often mis-used. In fact I would argue it's probably the most misunderstood and most mis-used financial concept.

One common mistake is to believe that if a sustainability investment is lower risk, it means it's a better investment. I see this a lot in discussions about sustainable investments. Making your company more sustainable will lead to higher returns for your financial investors. And the mechanism for this is a lower cost of capital.

This is not just semantics. Using the concept incorrectly can mean that Sustainability Professionals lose creditability in discussions with their financial colleagues, and that really good sustainability projects don't get the consideration, and finance, they deserve. Too strong a focus on Cost of Capital as the lever to deliver more private capital takes attention away from other important factors such as cashflows and allocating risk.

Correctly understanding how the Cost of Capital concept should be applied can help you make better sustainable investing decisions. If you want to get more capital into sustainability focused projects, and hence make a real difference on the ground, it's a concept you need to understand.

How the cost of capital fits into the investment case process

A couple of weekends ago I wrote about the importance of a good narrative in creating an sustainability investment case that finance professionals can support. What the narrative gives you is a good foundation. And as an engineer turned banker I can confirm, without a good foundation, your building (or investment case) will fall over.

The same applies to the Cost of Capital. Properly applied it strengthens your financial case. Incorrectly used and you start off on the back foot.

If you are not a member yet, to read this and all of our blogs in full...

What is the Cost of Capital?

My simple working definition as an investor is it's:

the (expected) rate of financial return I need to earn to compensate me for the risks of investing in this project or company.

If the project is low risk, I am willing to accept a lower financial rate of return than if its high risk. Illustrating this with an example - I expect a lower rate of return from investing in (safer or lower risk) US government bonds, than I would if I invested in a (higher risk) speculative start up.

You may be asking at this point, what does this have to do with sustainability? As it turns out, rather a lot.

The sustainability Cost of Capital debate

Many finance people argue that a more sustainable business has a lower cost of capital. And if we follow the logic of the math's above, a lower cost of capital means the investment opportunity is 'worth more'. And if it's worth more, it makes a better investment.

And some people even go further and argue that this means that sustainable investors can not only do good, they can also earn better financial returns.

Let's start with the argument that the main mechanism by which ESG and sustainability factors impact the financial world is via the cost of capital. To quote a recent World Economic Forum article:

"The cost of capital is a major determinant of the total cost of different energy technologies and reflects the risks financial markets perceive, it acts as a key transmission mechanism between the financial system and the real economy, affecting the investment decisions of both financial institutions and corporates."

This sounds pretty clear and it seems logical. And it's consistent with my 'investor's' working definition above. Sustainable investments and companies are lower risk. And hence investors demand a lower financial return before they will invest in them.

How does this magical Cost of Capital number get used.

To understand this we need to start with future cashflows. Every investment opportunity (hopefully) creates future cashflows. We have the upfront capital we need to 'build' the project (capex), and then we have the cashflows that result from operations. Together they are the investment opportunities future cashflows.

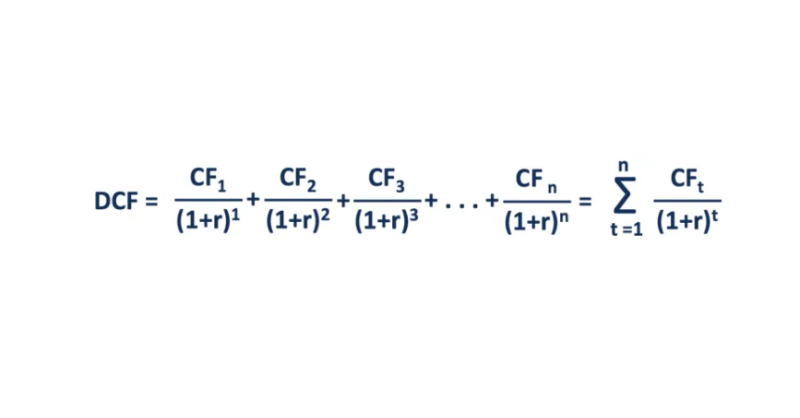

Our Cost of Capital is the figure that we use to discount the investment opportunities future cashflows back to today's value, using what is called a discounted cashflow (or DCF). And the present value (PV) this calculates is what most investors take as the 'fair value' of the investment. This means that for the same future cashflows a lower Cost of Capital mathematically results in a higher fair value.

Why do we discount the cashflows. It's to do with the time value of money - if I offer you $100 now or $100 in a years time, which one would you choose? Nearly everyone wants the $100 now. Why? Because of the time value of money. Over the next year inflation etc erodes the value of your money.

And we can use the fair vlaue we estimated from our DCF to decide if we undertake an investment or not. If the price you have to pay for this investment opportunity today is greater than the estimated fair value, the investment opportunity is too expensive (it's worth less than you have to pay for it). And if it's lower, then it's cheap (worth more). This applies as much to debt and private equity investments as it does to publicly listed shares.

But hang on, don't lower risk investments earn a lower rate of return?

Well spotted. Let's go back to my definition ...the (expected) rate of financial return I need to earn to compensate me for the risks of investing in this project or company.

As we highlighted above a lower risk investment (in our example a US government bond) is expected to generate a lower financial return than our higher risk investment. This is worth repeating, as it's the opposite of what many sustainability professionals expect.

Or going back to our starting quote - you cannot have your cake and eat it too. If your sustainable project is lower risk, and it's priced correctly, it will generate a lower financial return.

A quick round up of where we have got to

My editor is now shouting at me to round this up, so what have we learnt ?

First, that the Cost of Capital is important in calculating what a (sustainable) investment opportunity is worth, it's fair value.

Second, that the Cost of Capital is the (expected) rate of financial return I need to earn to compensate me for the risks of investing in that project or company. So, if the project is low risk, I am willing to accept a lower financial rate of return than if its high risk. And, so lower risk investments, such as US government bonds, will likely generate you a lower future financial return.

So, if it's true that sustainable investments are lower risk, then we should expect them to generate a lower future financial return.

And right at the end we introduced a new idea. All of this is dependent on the financial markets correctly pricing the investment opportunity.

What do we still need to cover - or what have I left hanging?

We need to talk about how the Cost of Capital is calculated. It's often backward looking - which makes no sense when the future will look different from the past.

And we need to talk about what lower risk (and hence a lower cost of capital) actually means. Sometimes people use this phrase when what they actually mean is that future cashflows are more uncertain/will be lower.

And finally we need to talk about portfolio construction and why this means that for most investors the cost of capital debate is not as important as you may think. Lot's of topics for future blogs !

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.