Sunday Brunch: What does a CSO actually do? Part 2

Many companies seem to want the upside that comes from better sustainability optics, without doing the hard work involved in integrating sustainability into their operational processes and strategy formulation - Alison Taylor

Many companies seem to want the upside that comes from better sustainability optics, without doing the hard work involved in integrating sustainability into their operational processes and strategy formulation - Alison Taylor on recent Salesforce webcast.

Despite the best of intentions, most Chief Sustainability Officers (CSOs) are not really engaged (enough) in key company activities such as strategy formulation and financial value creation. Which raises questions around why this is (are we focused on the 'wrong' aspects of sustainability), and what can we do to change the situation?

We can make the CSO role more impactful

Yes, we can. But to do so we need to change how we pitch sustainability to companies. Yes, values, regulation, data, compliance, and reporting are important. But the bottom line is that for nearly all companies, the sustainability transitions need to be financially viable if they are to be adopted.

The good news is that they can be. If fact, we would go further and say that anticipating the changes that the sustainability transitions will bring can be massively financial value enhancing for companies.

We collectively talk a lot about sustainability risk. And as the recent report from Robert Eccles & Alison Taylor shows, we also talk about its impact on reputation, brand and recruitment. But we don't talk enough about sustainability opportunity. How companies that embed material sustainability issues into their operations, their strategy, and their culture, have a very real opportunity to create competitive advantage. And from that create long term financial value.

Coming back to what a CSO actually does and what they could do more of. Let's work on making sustainability more relevant to how companies create financial value. Maybe then there will be less of a gap between aspiration and action.

If you want to read the rest and are not already a member...

The Sorry State Of Sustainability Today - or what do most CSOs actually do?

That title is not ours. It's from a recent research report authored by Robert Eccles and Alison Taylor. The full title is The Best And The Rest: The Sorry State Of Sustainability Today. What are the key messages?

While some CSOs are making a real difference to the financial and sustainability performance of their companies, recent research suggests that many are not. And this is despite the vast majority of senior management teams identifying sustainability as a key driver of future value creation. A cynic might say that this is because companies only pay lip service to sustainability.

Our take is different. We argue that the main reason for the aspiration gap (between what companies think and what they do) comes down to how we pitch sustainability. For many sustainability professionals it's about values. And this gets interpreted by company management teams as impacting them via reputation, brand, and recruitment. To them it's about how they message their sustainability efforts.

The sustainability transitions (and a just transition) will only happen if it makes good financial sense for companies to act. We are not arguing for sustainability professionals to abandon their values. But, we are saying that if we want companies to act, we also need to pitch sustainability in a way that shows the business opportunities. That shows how acting on sustainability can positively impact the companies bottom line, and enhance their ability to generate a fair financial return to their investors.

The evolving role of a Chief Sustainability Officer - part 2

Back in November 2023 we wrote a blog entitled "The evolving role of a Chief Sustainability Officer". In it we discussed the question of who you as a CSO report to, and why this is important.

The blog was very much based on a Harvard Business Review article by Robert Eccles & Alison Taylor. In it they argued that CSOs "once focused on optics and reputation. Today many are interacting with investors and helping set strategy."

Perhaps un-surprisingly, it was one of our most read blogs. Feedback suggested this was for two reasons. One was it tapped into a sense of frustration by sustainability professionals that they were not fully involved in key corporate decisions around value creation. And the second was a desire to understand what was possible - where could this CSO role potentially go? How could it be made better?

The good news part

The good news that came out of the Taylor & Eccles study (we are going to alternate the names as both of their inputs are equally important) was that some companies seem to have found ways of integrating (or starting to integrate) sustainability into their value creation process. As we said in our November 2023 blog .....

By corporate strategy we mean all of the decisions an organisation needs to make about where it invests its resources and capital (both physical/tangible and intangible). And remember, strategy is as much about the art of choosing what NOT to do. Not everything can be material.

Regular readers will know that we see sustainability as a key foundation for a company's strategy formulation and implementation. Plus it's one of the big drivers of how companies create competitive advantage and financial value. Yes, there are sustainability related risks - mostly around regulation and a companies social 'right to operate'. But there are also massive opportunities - to invest our capital in ways that drive value creation and improve sustainability.

Extending the survey results from the specific to the general

So back to Eccles & Taylor's work. How much of the shift they talked about in their 2023 article was specific to the group they selected?

The authors were very upfront about the fact that their first survey sample of CSOs was small. For that article they interviewed 29 leading CSOs and 31 investors. And many of the CSOs worked for companies that were, to use the phrase from the original article, "in challenged industries". So they had greater incentives to get sustainability right.

This begged the obvious question? What did the CSO function look like elsewhere?

To answer this, Taylor & Eccles, together with GlobeScan and Salesforce, carried out a bigger survey, this time with 234 responses.

There is a lot of really useful detail in the report, but the short answer to the question 'are most CSOs actively involved in strategy and financial value creation' seems to be - not really.

Where are the gaps between aspiration and action?

The good news from this bigger 2024 study was that 93% of respondents said 'sustainability is very or fairly important for the commercial success of their organisation'.

But, there seemed to be little follow through on this. Over half of the senior management teams say they focus on sustainability risks. But only 21% allocated significant capital and resources to overcoming them. It's a bit better for sustainability opportunities, at 26% of resources allocated, but both figures suggest a material gap between aspirations and delivery.

You can watch the presentation of the report via the link below. If you are short on time, you might end up doing what I did first time around, skip to the bits where Eccles and Taylor are speaking.

Are we pitching sustainability in the wrong way?

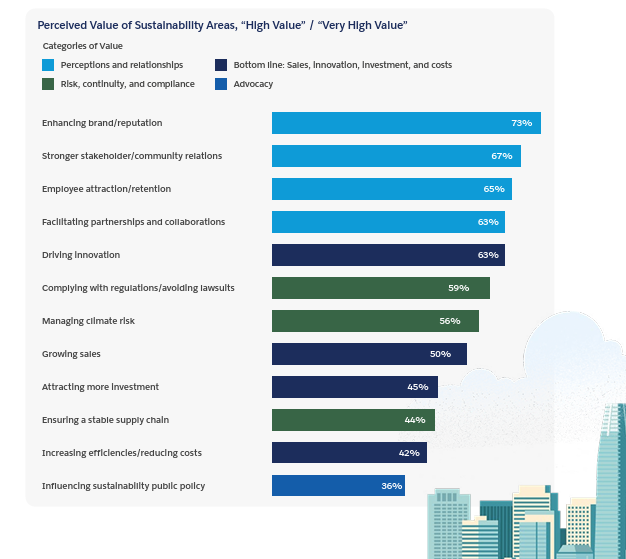

The chart below might give a real clue as to why this mismatch between aspiration and action exists.

This shows the perceived value of sustainability initiatives to the organisation. The initiatives at the top are mainly about perceptions and impressions - brand, reputation, stakeholder relations, and employee attraction. What Alison Taylor called messaging. Actions that can create financial value, but often in an indirect way.

Down the bottom, we have the very direct financial value creation activities - a stable supply chain, growing sales and reducing costs.

Given this, is it any wonder that organisations see sustainability as being more about communicating the right message, and less about long term financial value creation?

There are better ways.

One important action is to make the sustainability debates more about long term financial value creation.

In a recent Sunday Brunch entitled "can the real sustainable investor please stand up?" we outlined the main motivations of companies to act:

- Threats to their licence to operate. This includes society imposing extra costs or even blocking certain activities - we are increasingly seeing this in mining.

- Anticipated regulatory changes. This covers everything from supply chains to human rights to carbon pricing.

- Technology. A big one in some sustainability themes including EVs and electricity grids. This can take years to prepare for, and then arrive very suddenly.

- New customer demands, including new foods, green steel/cement and more sustainable buildings. And then, the most interesting of all ...

- Using soft assets (intangibles) to create different types of competitive advantage. This includes branding, R&D but also operational processes and staff/community motivation.

All of these are sustainability transition issues.

So, as well as the values aspect, let's make sure that when we talk about sustainability issues we identify which ones are important to the financial success of this particular company. And where they have leverage to make a difference (if at all). And, perhaps most importantly, what positive actions the company can take. And how these actions can create long term financial value.

By doing this we can move management attention to include the issues that are currently lower down the chart that we showed above. The activities that have a very direct impact on financial value creation - a stable supply chain, growing sales and reducing costs.

And we can get them thinking about how issues such as brand value, and a more diverse and motivated workforce, can improve innovation and customer service. And how this can lead to stronger financial value creation. Putting it another way, why the activities and issues at the top of the chart are about more than just messaging.

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.