Sunday Brunch: What if I cannot afford what I need?

We often mix up what as a society we need, with what we can afford. This is not about blocking sustainability actions. It's about identifying who needs to do what to make something actually happen. And we need to remember that not all decisions are purely financial.

Affordability is really important. If consumers cannot 'afford to buy' the more sustainable good or service, it doesn't matter how much supply grows. Demand will not follow.

There are two sides to this. The first is the obvious financial aspect, can people afford this new product or service? We can describe this as economic decision making. The second, less obvious side is emotional. Do people want to buy the product? Because if they do they will probably pay the sustainability premium.

This has been a bit of an odd blog to write as it combines two very different and often conflicting issues. Financial affordability and the motivation's to pay a premium price. Both impact demand for a sustainable good or service, we just have to decide which one is the most important in our specific situation.

Affordability is an important issue for investors.

If a company we are invested in is proposing a sustainability related investment, we need to get them to clearly set out the business case. And as we review this we need to be thinking about:

- will the new product cost more than the less sustainable version?

- if so, do the benefits the more sustainable version of the product offers to consumers offset the higher price?

- and if the benefits are insufficient, will the government/society plug the gap?

If we get to the end of the business case and it's not clear who pays the price premium and why, then we need to ask some hard questions.

To be clear, this is not an argument to 'do nothing'. It's more about identifying what governments and regulators need to do to encourage consumers to both want, and be able to afford, more sustainable goods and services.

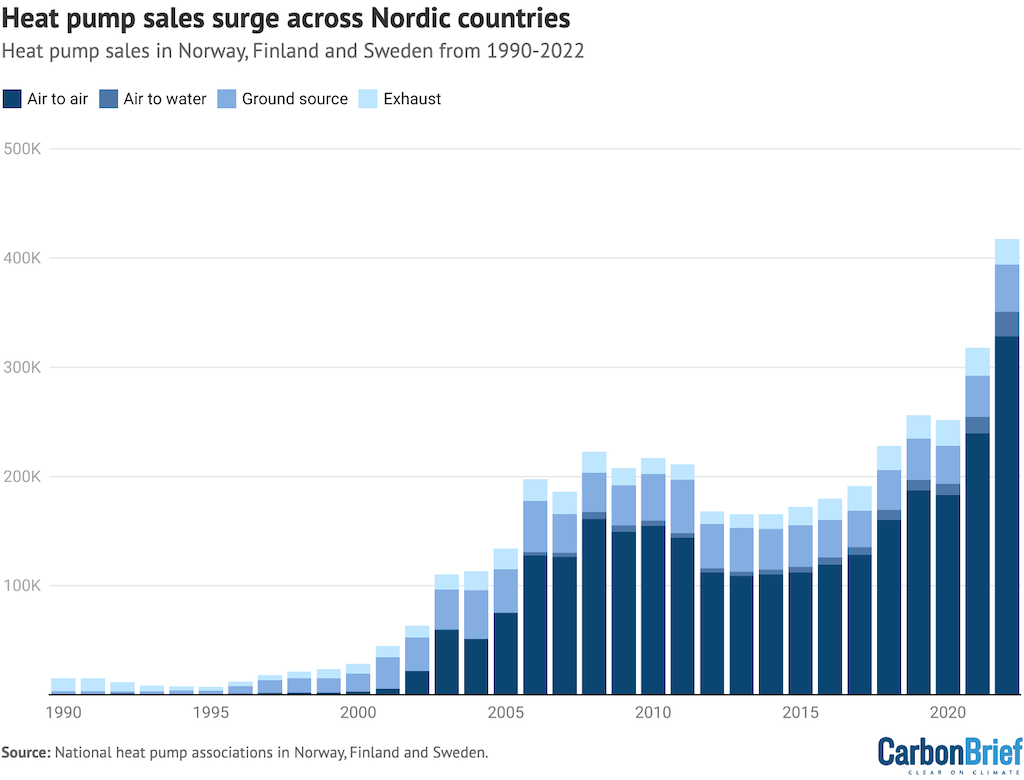

Let's start with a simple economic example - heat pumps.

Heat pumps can work financially but they need encouragement

Heat pumps are great for residential and commercial heating & cooling. As a society we need them to be used more, especially where our electricity is low carbon. Some countries are doing this well. But many are not.

Where I live (the UK) the up front costs for residential heat pumps are generally higher than for gas fired boilers (the fossil fuel powered alternative), even with subsidies. Plus the installation can be complex. And our electricity is so much more expensive than gas that the heat pump may cost more to run as well.

This is not a great combination at a time when many consumers are experiencing material cost of living pressures.

There are all sorts of solutions to this, including subsidies, carbon taxes and regulation, plus increased research into technological innovation, and smarter product design and specification. Plus of course, creating economies of scale and learning. We know that consistently applied, these measures work. They bridge the affordability gap.

Consistency is important, it gives investors and companies the visibility to invest. By contrast constantly changing the rules, and frequently backtracking on regulatory change has the opposite effect. This is what has happened in the UK.

This has not stopped heat pump installations, but it has slowed them down.

If you were thinking of investing in the home heating industry, which country/region would you prefer to have an exposure to?

But, as we highlighted above, not all purchase decisions are based solely on price. Some are based on feelings, both positive and negative.

Falling birth rates ... and the link to sustainability investment

Sometimes people make decisions that are not based solely on financial benefit.

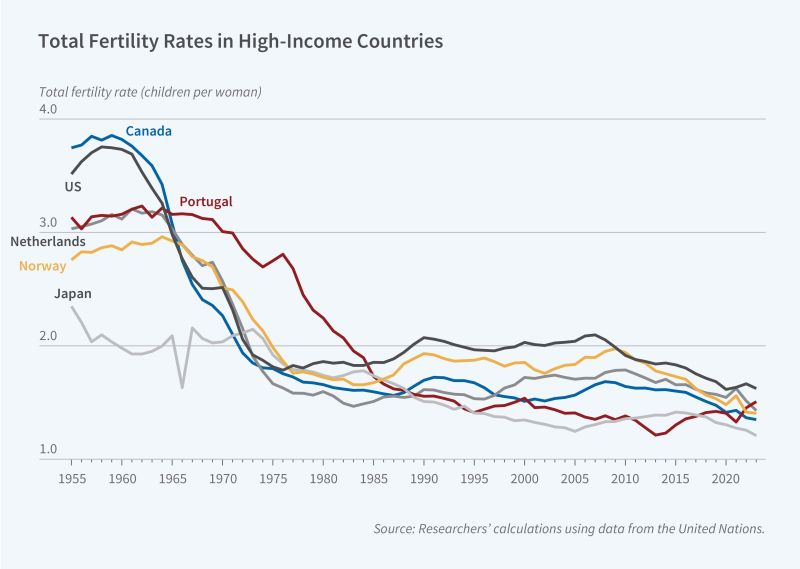

Rather oddly this part of the blog was originally prompted by a recent NBER working paper by Melissa Schettini Kearney & Phillip B. Levine. They considered why fertility has fallen to historically low levels in virtually all high-income countries. Basically, why are we not having enough children, even to remain at replacement rate.

To quote the working paper summary ..

They considered that explanations focused on short-term changes in income or prices cannot explain the widespread decline. Instead, the evidence points to a broad reordering of adult priorities with parenthood occupying a diminished role.

It's not just financial, it's cultural. Even if they could afford children, they still might not do so. There are other things they prefer to do instead.

The flip side also works. People often spend more than would be financially rational. We see this a lot in high end wines and spirits, and in luxury goods such as handbags.

And to an extent we are seeing this in consumer behaviour around the purchase of EV's.

Setting aside the people who buy a car solely based on how it makes them feel, for most of us the decision is largely financial. Based on this we might expect that price would be the main factor that would prompt a non EV owner to switch.

Based on the latest McKinsey annual mobility survey, this is only partly true. Topping the list of switch factors is range (despite most of us only using our cars for relatively short journeys), then price, and then two factors relating to charging speed and ease.

In other words some of the resistance to buying an EV is less about price and more about feeling.

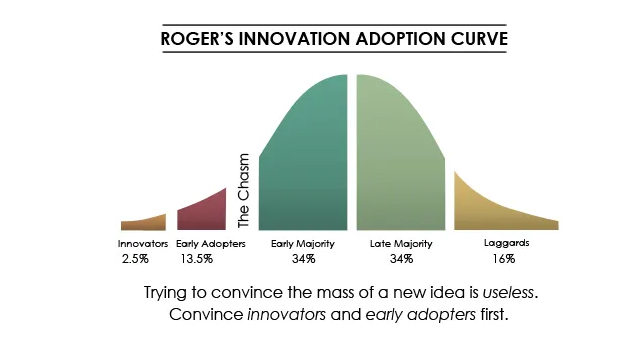

Which makes you think - as an investor what support from the government etc would you want to see to get markets moving across the chasm from early adaptors to the mainstream ?

One last thought

Most politicians follow not lead. And so we need to think less about our message, and more about if our proposal speaks to the values and aspirations of the wider population. Or as Peter Block put it "change from the top down happens at the will and whim of those below" .

Grant me the strength to accept the things I cannot change, the courage to change the things I can, and the wisdom to know the difference. Reinhold Niebuhr - a Lutheran theologian in the early 1930's

Please read: important legal stuff. Note - this is not investment advice.