Thematic Thoughts

Real world sustainability linked changes and what they might mean for companies and investors

Impact investing can align with fiduciary duty

A frequent debate is the one around impact investing and fiduciary duty. More specifically, does impact focused investing deliver financial returns that are similar to those of a meaningful benchmark? A recent Pensions for Purpose report helps with this question. At the risk of ruining the surprise - listed global

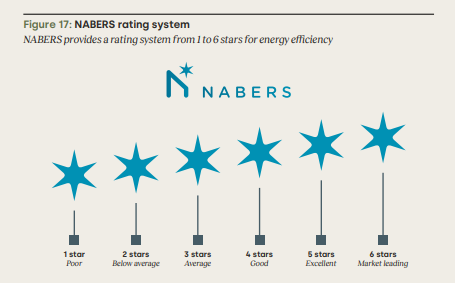

Green buildings offer good financial value as well?

We know we need greener buildings, but the 'how' is often less clear. And we need to better understand the financial implications. A recent report from the engineering consultancy ARUP, for the World Building Council for Sustainable Development, highlighted the important role that making buildings greener will play

Is the real issue with nuclear different from what you think?

If you talk to most sustainability professionals about nuclear, the most common concern is safety (Three Mile Island, Chernobyl, and perhaps most importantly Fukushima), followed by build cost (ie OL3 in Finland and others). But as well as these issues, should we also be thinking more about decommissioning costs? According

Insetting - defining and implementing at scale

Organisations can reduce their net greenhouse gas emissions (GHGs) to zero ('net zero') by either making changes to their businesses that mean they produce no net emissions themselves or they can offset any net emissions they have to some degree by purchasing carbon offsets. Carbon offsets are programmes

ESO becomes the terminator of phantom projects

Getting new energy generation projects up and running and delivering energy to people who need them in the form that they need may seem to hinge on getting the technology to work and/or getting the required financing and other resources in place. However, it can often hinge on approvals.

Why are we not cutting fossil fuel use?

A recent podcast from Rachel Donald (interviewing Ketan Joshi in an episode entitled Climate Delay and the Fossil Fuel industry) contained the following answer to the question - why is fossil fuel usage not falling? "The answer is complex, of course. One part, though, is that governments are the

New milk fridges could help farmers cut carbon and costs

Dairy farmers need to chill their milk to below 6oC within hours of carrying out milking. As we highlighted in a recent blog, there are some sustainability issues with fridges, freezers and chillers. Link to blog 👇🏾 Cooling food - regular, salty and constant volume.Modern fridges and freezers do a

Nature-related risks: almost certainly one for the board

We have known for a while that in many countries climate related risks should be considered by company directors. Now, in an Australian legal opinion commissioned by global climate/nature investment and advisory firm Pollination, in collaboration with the Commonwealth Climate and Law Initiative (CCLI) directors also have a similar

Nigeria solar adoption boosted by the end of fuel subsidies?

A Bloomberg Green article discussed the potential for the ending of fuel subsidies in Nigeria to drive the adoption of solar in households and communities. Whilst Nigeria is Africa's biggest exporter of crude oil (the world's 7th biggest), its lack of refining capacity means that it

Is climate risk becoming uninsurable?

Insurers are withdrawing from higher risk regions. And the situation is likely to get worse.

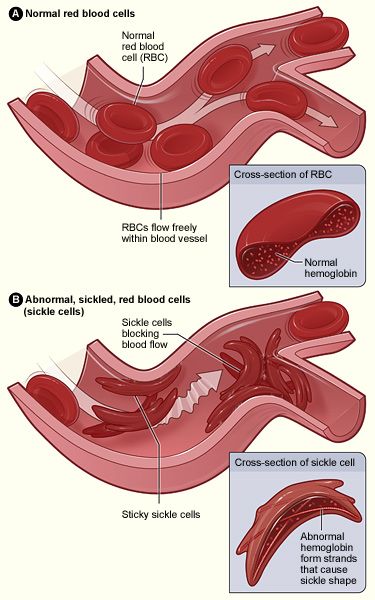

Health equity: FDA panel support for sickle cell disease cure

The potential approval of a treatment for a historically under-served community is important.

Risk of taking ESG data as gospel

ESG data is useful as part of the decision-making process. However, it is not THE process.