Decarbonising chemicals - ShareAction report

ShareAction has recently published a report we wrote for them on the financial case for decarbonising the Chemicals sector. Its going to take a lot of money, but the good news is that Europe already provides this for renewables.

Summary: Share Action has recently published a report we wrote for them on the financial case for decarbonising the Chemicals sector. We all know this is a challenge we need to fix, that it's going to take many years, and that it's going to need a lot of government support. The good news is that Europe already provides this for renewables, and in green steel we have a pathway to how this could work for the chemicals sector.

Why this is important: Sorting out the so called hard to decarbonise sectors is going to be a big challenge. They are big contributors to GHG emission etc but they are also linked to fossil fuels for good economic reasons. This is going to take us many years to resolve, which is why it's best to start now, rather than "kick the can" down the road.

The big theme: Europe wants to decarbonise its so-called "hard to decarbonise" sectors, which includes much of our heavy industry. If you add the GHG emissions from the impacted sectors together, you get to roughly 1/3 of all global emissions. So working out how to fix this is one of the big challenges. They are not called hard to decarbonise for nothing! There are good reasons why many of them currently use fossil fuels, so decarbonisation is going to need a lot of government assistance.

The details

Summary of a report from ShareAction

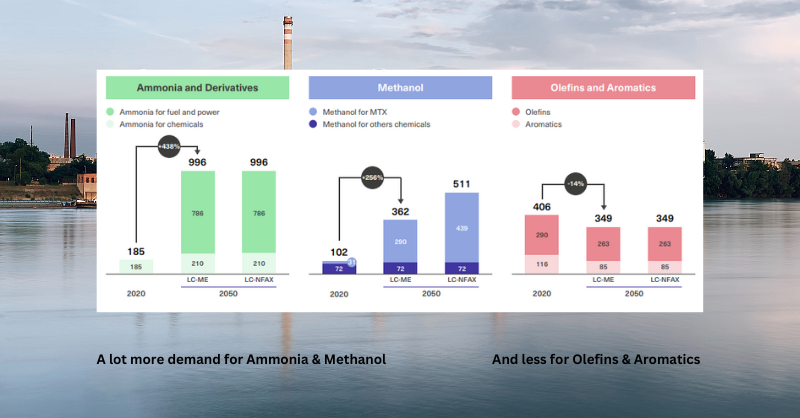

As a society, we understand the need to decarbonise the chemicals sector. It currently contributes (scope 1,2 & 3) more than 2 Gt CO2e pa, or somewhere close to 4% of our global GHG emissions. We wrote on this in a long blog back at the end of February, but with the publication of the report we wrote for ShareAction (which you can download here) we thought it would be useful to revisit the topic. And of course encourage you to read the report.

Why ths is important

As we said in the long blog, the transition for the Chemicals sector is going to take time, and it's going to be expensive. So a question for our wider society is how much are we willing to pay to make this happen? Because we will need to pay, either via more expensive fertiliser and plastics or through government assistance. The products that the industry produces are not going away any time soon. Yes, we might find ways of using less, or of producing them in less carbon intensive ways, and the circular economy will help - but the demand is not going away.

We propose to tackle the technology issues in future blogs, for now we want to talk about cost. This has two parts. As we highlight in the ShareAction report, the first element of spending is identifying the best technologies and starting to build pilot plants to get the processes working, end to end. It's important to recognise, while we have the elements we need for a green hydrogen/green methanol based system of production, no-one has yet put them all together in a single process. So, this is something the Chemicals companies can start on now. It's “only” going to cost sub €100m pa (or so), meaning that this is financially viable already. We see this part of the process taking us through to the later half of this decade.

It's what happens next that gets expensive. The new ways of producing low carbon fertiliser and plastics are going to need new production processes. And that is going to be expensive - think in the Euro billions. As we highlighted in the long blog (which you can read here) there are a combination of circumstances that mean that the solutions stand a good chance of being implemented.

First, governments are understanding the challenge. Second, solutions such as green steel (and the carbon border adjustment mechanism (CBAM) - which we wrote about here) are showing us (and them) a viable pathway. Third, the age of their plant means that the European Chemicals sector needs to either upgrade or replace a large proportion of their plant this decade. And fourth, jobs, or more strictly, the loss of jobs.

While recent talk from European Chemicals giants such as BASF might be partly lobbying to get more government support, their underlying point has some validity. Energy costs in Europe are high compared with their rivals (although longer term more wind & solar should help this). And the region's support systems are more fragmented and complex than say the US IRA or in China (something we will write on next week).

The bottom line is if we want to keep the well paid jobs in the region, and avoid outsourcing our chemicals production to countries with lower environmental standards, we need to provide a lot of financial support. But let's keep this in context - a recent Bruegel report estimates that in the period out to 2031 Europe will spend nearly €250 billion (yes, you read that right) on subsidies and financial support for renewables and clean tech manufacturing. And that excludes any indirect spending as part of the CBAM.

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.