What caught our eye this week

Natural farming for yields; shortfalls in raw materials; Sustainability engagement by needs to be proactive

Here are three stories that we found particularly interesting this week and why:

- Natural farming for yields, livelihoods and health.

- Where are the shortfalls in raw materials for the energy transition?

- Sustainability engagement by companies needs to be proactive rather than reactive.

If you are not a member yet, to read this and all of our blogs in full...

Natural farming for yields, livelihoods and health.

'Natural farming' - the phrase seems to provoke strong reactions. On one side it leads to lower yields, and from there to an inability to feed the world, with rising agricultural prices and increasing levels of starvation. On the other side, it’s seen as the solution to the damage that industrial scale farming, with its over reliance on fertilisers and pesticides, and the damage its monocultures can do to biodiversity.

As regular readers will know, the answer is always 'it depends'. We have highlighted before the importance of soil and biodiversity. We have also touched on studies that show that in certain environments, natural farming can improve the productivity and profitability of farms.

Link to blog 👇🏾

(Agriculture / Natural Capital, Premium and Professional)

A recent study from GIST Impact, undertaken in India, explored the benefits of what is known as Community Managed Natural Farming or CNF. This is a farming practice that depends on the natural growth of crops without the use of any synthetic fertilisers and pesticides and with less consumption of ground water. It has dramatically reduced the net cost of production, as there are additional gains to farmers by growing inter crops, border crops, multicrops, etc.

The few significant inputs that are used for seed treatments and soil inoculations are all locally available. They include cow dung, cow urine, handfuls of soil, jaggery, pulses flour, and botanicals for bio pesticides.

The study found that on average the farms saw an 11% increase in yields, while still maintaining crop diversity. There were additional social benefits. It’s not a silver bullet, but it should be part of the solution. It needs help to take root. Farmers need to be trained, and new ecosystems need to be set up.

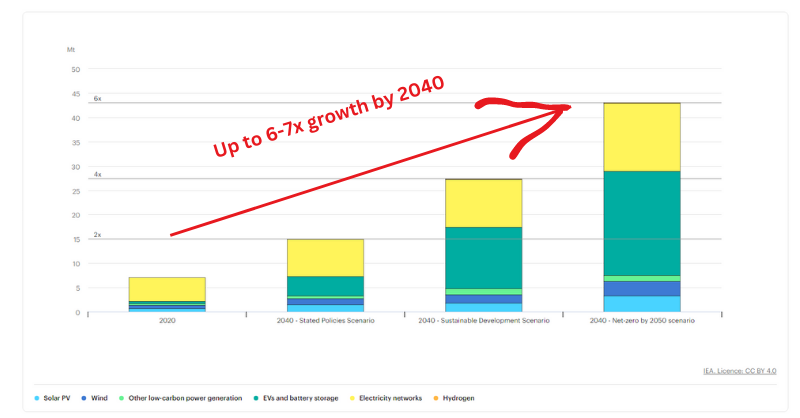

Where are the shortfalls in raw materials for the energy transition?

Mining is considered by some to be a dirty industry. The reality is that we are going to need a lot of mining, of some specific materials, if the energy sustainability transition is going to happen. We largely know what we need to do to make mining more sustainable. Although to be fair, there is not a clear consensus on which path is the best one to follow.

Surprisingly, there doesn't seem to be a clear view on where the raw material shortfalls are. This makes deciding where to invest challenging. A recent study from the Energy Transitions Commission is bringing some clarity to this.

It kicks into the long grass some popular fallacies, including those about land use and water requirements. It scopes out where the big gaps are in reserves and those gaps are maybe not where you expected.

We are pretty well set up for steel, aluminium, graphite and polysilicon. We are going to need more, but not beyond the possible level of resources. However, there are a number of materials where the reserves we know about are insufficient. A couple of these get a lot of attention - specifically lithium and cobalt. But others, such as copper (which goes into a lot of technologies), nickel and silver, could become problematic.

We need to bear two points in mind when we look at this analysis. First - changing the design of the product can make this analysis dated. The best example is cobalt, where new (ish) battery technologies such as LFP and low-cobalt NMC could be a game changer.

The second is that just because something is in short supply now does mean it will be so in the future. Supply has a habit of filling the gap, especially if there is money to be made.

We discussed these points in a recent Quick Insight

Link to blog 👇🏾

(Greener Energy Applications, Premium and Professional)

Sustainability engagement by companies needs to be proactive rather than reactive.

Much of what we read about sustainability engagement looks at what investors need to do. And by investors, they generally mean asset managers, rather than the asset owners (the underlying providers of the capital, who employ asset managers).

Outside of specialist publications, we see little on what companies should do. Yes, there is a lot on ESG data and reporting, but much less on engagement with a company's investors and potential investors. For this reason, a recent article in IR magazine by the financial team at the World Benchmarking Alliance, is welcomed.

Their message is simple. Engagement by companies needs to be proactive rather than reactive. Investors who you are actively engaged with are more likely to become long-term supportive partners rather than short-term profiteers. It needs to be followed up by action. Reporting is a good start but getting both senior management and the board skilled up and involved is better.

For many IR professionals this will be what they do day to day. For many others, sustainability is still seen as a bit of a tick box process rather than a fundamental contributor to strategic value creation. It raises the parallel issue of upskilling. As someone recently said to me “a good sustainability professional not only knows about sustainability, they understand the numbers as well as the finance department, and the social issues as well as HR.

Our mission at The Sustainable Investor is to help you make the time with your clients, advisers and colleagues more impactful. For corporates that includes helping you to be better engaged with your investors.

- We help you think holistically, laterally and see new insights.

- We help sustainability people understand how the world of finance thinks to enable them to mobilise financial support to make sustainability projects viable.

- We help finance people understand sustainability and transition themes so their investment decisions will solve society's biggest challenges while delivering a fair financial return.

We enable you to have expert conversations.

Please forward

to a friend, colleague or client

If this was forwarded to you, click the button below and sign up for free to get 'What caught our eye', 'Bridging the gap' and the 'Sunday Brunch' in your inbox every week.

Please read: important legal stuff.