What caught our eye - three key stories (week 13, 2024)

UK's diversity drive backfired?; coal's very long goodbye; buying affordable ethical chocolate is hard

Here are three stories that we found particularly interesting this week and why. We also give our lateral thought on each one.

Read in full by clicking on the link below.

'What caught our eye' like all of our blogs are free to read. You just need to register.

Please forward to friends, family and colleagues if you think they might find our work of value.

Has Britain's diversity drive backfired?

We have recently seen 'DEI' come under fire, particularly in North America, but also in Europe. "Britain's diversity drive has backfired?" was the headline of a recent Telegraph article that caught our eye via a LinkedIn post from Paul Sesay.

On 20 March 2024, an independent report on the Inclusion at Work Panel’s recommendations for improving diversity and inclusion (D&I) practice in the workplace was published. Commissioned by the Minister for Women and Equalities and Secretary of State for Business and Trade Kemi Badenoch, the report had three aims:

- identify the interventions that increase fairness, inclusion, and diversity, explaining what works, why, and how; and develop and disseminating resources to promote this

- make the most compelling arguments in favour of good practice, and against bad, with the best evidence and data available

- develop a new Inclusion Confident Scheme, complementing other such kitemarks, embedded first in the Civil Service and public sector

In writing the report, the panel spoke with over 100 people representing 55 organisations, which themselves represent many thousands of people in the public, private and charity sectors. In addition they worked with, and studied the work of, "some leading academics in the fields of behavioural and occupational psychology, neuroscience, and employment law."

Interestingly Kemi Badenoch chose to publicise the report via an article in The Telegraph and her conclusion was that "the majority of spending on equality, diversity and inclusion (EDI) was a waste of money" and had "little or no tangible impact".

There were two things that we thought were interesting here. Before we dive into those, a quick reminder of what we mean by DEI:

- D = Diversity: the presence of a wide range of people with differences, including gender, gender identity, age, race, nationality, religion, ethnicity, sexual orientation, socioeconomic status, physical ability, or even political perspective.

- E = Equity: whilst diversity highlights how people differ, equity is about understanding that different groups of people face different challenges. Note that this differs from equality, which makes no assumptions about people's starting points. Equity is more focused on outcomes than inputs.

- I = Inclusion: creating the right culture and environment so that everyone, regardless of their differences feels that they belong and are valued. They are not prevented from striving to reach their potential. There is also a strong social case for fostering an inclusive work environment. Providing jobs, particularly in leadership positions, to underrepresented people can create a virtuous circle where role models are created and the workforce becomes more diverse over time.

Firstly, the headline article was far more negative on DEI initiatives than the underlying report was. Of course there should be 'value for money' from such initiatives - which can be social and monetary. But there was clearly a spin put on it. There is also something in the language of the article that gives an underlying tone that 'DEI' itself is not a good thing, rather than some implementations of DEI - which in itself obscures what we are really talking about which is corporate culture. A case of throwing the baby out with the bathwater. Which leads me on to the second point.

We can see two key reasons why some DEI / EDI initiatives underdeliver.

Firstly a focus on basic definitions of demographic diversity only. One of the findings of the report was inconsistency in definition of what 'diversity' means.

Secondly, the order of the letters in the acronym. The emphasis is typically on the ‘D’ but the ‘I’ should really come first. Interestingly the panel assembled to produce the report is called the ‘Inclusion at work panel’.

You can create as much diversity as you want but without an inclusive culture where everyone’s contributions are valued you won’t get the desired benefits. There are also problems with target setting - focussing on a symptom of an inclusive culture as if it were the aim. Goodhart's Law: When a measure becomes a target, it ceases to be a good measure.

Equally even in a seemingly undiverse culture, a lack of inclusivity can still mean that you aren’t getting the best out of your people. That pervades through to the recruitment process too.

Badenoch adds: “No group should ever be worse off because of companies’ diversity policies – whether that be black women, or white men … Performative gestures such as compulsory pronouns and rainbow lanyards are often a sign that organisations are struggling to demonstrate how they are being inclusive.”

Whilst I disagree with Badenoch's overall tone, the last part of the above quote does resonate. Creating an inclusive culture is difficult and does take time. The best demonstration of it is feedback from employees.

Edmans, Flammer and Glossner have written some insightful research on this. Here are our thoughts on that here:

Link to blog 👇🏾

Coal's (very) long goodbye

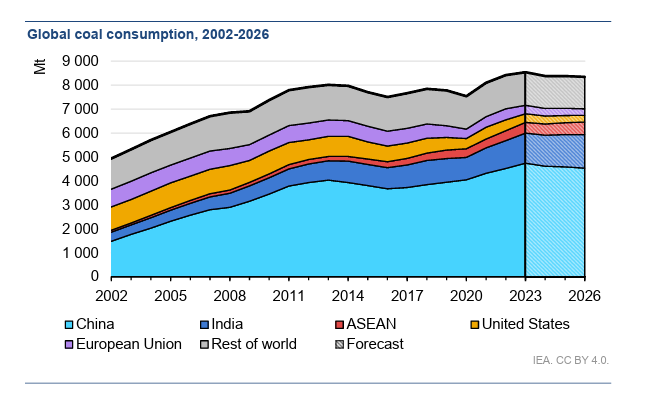

Bloomberg (republished in various newspapers) recently highlighted coal's recent period of resurgence, on the back of China's energy insecurity, rising Indian demand, the fallout of the Ukraine war, and " faltering international programs to wean developing economies off fossil fuels".

If we go back a few years, many analysts had predicted 'peak coal', with demand expected to plateau and then start to fall. And then, as the Bloomberg article says, the opposite happened.

Coal is the most carbon-intensive major fossil fuel in use today and it is deeply entrenched in the power system. Coal is responsible for over 40% of all energy sector CO2 emissions. Various IEA reports have highlighted that drastic reductions in its consumption are required to achieve net-zero emissions. Which is why it's seen as a litmus test for countries commitments to actually delivering net zero.

And in some parts of the world, less coal is already being used for electricity generation. For instance, the Ember European Electricity Review 2024 highlighted that Coal generated 12.3% of the regions electricity in 2023. This puts it back in No 4, behind Nuclear (22.9%), Wind (17.6%) and Gas (16.8%). And it reflects a long term drift downwards that dates back decades, only broken by the 2020 & 2021 upward blip.

But this is not a universal trend. As the IEA Coal 2023 report predicted "in absolute terms, coal demand in 2023 is estimated to have increased most strongly in China (up 220 Mt, or 4.9%), followed by India (up 98 Mt, or 8%) and Indonesia (up 23 Mt, or 11%)."

And according to Global Energy Monitor these three countries combined started operating new coal power plants amounting to 59 gigawatts last year, and either launched or revived proposals for another 131 gigawatts — about 93% of the world’s total.

It's all about energy security, something that is not going away any time soon.

So what is the future for coal? As the Bloomberg article says "coal’s days are numbered, of course. Advances in solar and wind have made those technologies far cheaper than coal power in most parts of the world, and similar gains for batteries and energy storage systems could finally make around-the-clock renewable power affordable enough to transform the energy mix."

But don't expect the end of coal to happen quickly, unless we are prepared to take dramatic and expensive actions. A recent IEA report, Accelerating Just Transitions for the Coal Sector, sets out some of the issues we face.

The biggest one is that favourable economics for renewables will not, on their own, be sufficient to achieve the rapid transition away from coal power. Coal as an energy source for electricity generator will only stop when the total cost of renewables is lower than the operating cost of an existing coal plant. This was something we highlighted recently in a What Caught Our Eye blog, prompted by the work of Jim Murchie at Energy income Partners.

But that is not the only challenge. On top of the need to accelerate the role out alternative electricity generation sources (mostly renewables), we also need to shift the most efficient coal plants from baseload to more flexible operation, we need to fund the shut down of some existing coal plants, and we need to ensure the outcomes are fair for all (including electricity consumers and workers in the coal industry).

And one final thought. When we wrote about this topic back in November 2022 we highlighted that investing is a forward-looking activity. Yes, it's possible that we may see the use of coal for electricity generation remaining high for a while. But those analysts who see the surge in coal as a failure of renewables, and therefore a portent of the future, are likely to end up missing a trick. And misallocating their capital.

Link to blog 👇🏾

Buying ethical and affordable chocolate is really hard

Those of you who celebrate Easter will have noticed that your easter egg has either got smaller or more expensive. But spare a thought for those who want to buy ethical chocolate - they have a different problem. How do you know your chocolate is ethical, and how much extra should you be paying?

This was the topic of a recent article in The Conversation entitled Buying affordable ethical chocolate is almost impossible – but some firms are offering the next best thing.

What causes the challenge? It's the long and messy supply chains. To quote Michael Rogerson who wrote the article ...

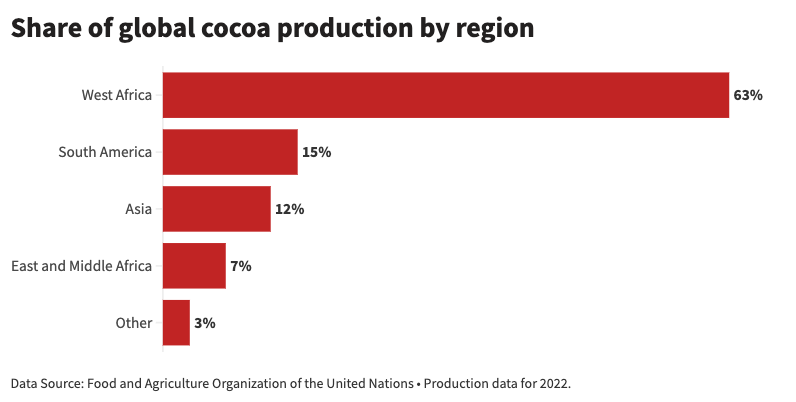

"Most of the world’s cocoa is grown in west Africa, where more than 2 million farmers work on around 800,000 farms. Many of these farms are remote and served only by motorcycle due to poor infrastructure. This contributes to the long and fragmented nature of cocoa supply chains."

In other words, monitoring production in remote areas is tough. But that is only part of the challenge.

The other issue is that cocoa is traded as a commodity. It's effectively traded by weight. And while some cocoa is ethically grown, it's often mixed with cocoa of an unknown origin before it reaches the chocolate manufacturer.

Now this doesn't mean companies shouldn't set up better systems. The big issues are human rights (including child labour and worker rights), and biodiversity loss. These are things that are measurable. For instance Tony's Chocolonely publishes the number of cases of labour abuses it finds every year. And UP-UP surveys every worker in its supply chains and states which single-estate plantation its cocoa comes from on its packaging.

So it's a problem with a possible solution. But the surging price of cocoa is making implementing this even more challenging. Bloomberg recently wrote that traded cocoa prices have surged by more than 250% over the last year. And higher cocoa prices means consumers pay more at the supermarket. Price sensitivity means that the chocolate manufacturers cannot easily pass on these price rises, and so they make the chocolates smaller.

Hannah Ritchie (of Our World in Data fame) wrote a good blog on this recently.

But, this debate also miss an important issue - making sure that cocoa growers receive a fair price. According to Enveritas, as of 2019, 44% of the world's smallholder coffee farmers are living in poverty and 22% are living in extreme poverty. The majority of coffee farmers living in poverty are concentrated in six East African countries.

Sourcing single-origin cocoa enables checks of working conditions at known sites. It’s better for the environment and leads to substantially higher pay for farmers. (Editors note - this is why I buy my coffee from Yallah in Cornwall).

But that is a solution that often struggles to work at scale. One alternative (or maybe parallel) approach is to learn from the wine and spirits industry, specifically cooperatives and appellations/protected region of origins. This could allow farmers to create a premium tier for their product, partly based on their ethical standards. This could help ensure that some of the brand value shifts from the brand owner to the cocoa or coffee grower. Helping the grower earn a fair wage.

We wrote about this back in July last year. It's not an easy proposition to deliver, and it's going to need cooperation between governments, growers and NGOs. But then the current approach doesn't seem to be working.

Link to blog 👇🏾

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.