What caught our eye - three key stories: week 48.

EU reverses pesticide phase out; green buildings also offer financial gains; impact investing generates financial returns.

Here are three stories that we found particularly interesting this week and why. We also give our lateral thought on each one.

Read in full by clicking on the links below.

'What caught our eye' like all of our blogs are free to read. You just need to register.

Please forward to friends, family and colleagues if you think they might find our work of value.

EU reverses proposed pesticide ban - a future trend?.

Sustainability transitions create financial winners and losers, and if we don't make it attractive for the losers to adapt, they can block change.

The European Parliament has outright rejected a proposal on the EU’s pesticide reduction plan, effectively killing off the regulation, at least for now. The move has disappointed green groups but was celebrated by EU farmer associations. The sustainable use of pesticides regulation (SUR), which was part of the EU’s flagship Farm to Fork strategy, aimed to slash the use and risk of pesticides in half by 2030. But, it's been heavily contested right from the start. And, after months of effort, the European Parliament ultimately voted to reject the text entirely.

We flagged reports that suggested this was a possible outcome back in August, when watering down looked the most likely scenario. But the scale of the amendments proposed meant that the core provisions of the SUR were effectively gutted. So, in the end, even the Green's could not support the amended text. Green MEP Sarah Wiener said that the resulting text was “not one we could in good conscience vote for”.

Farmers groups have opposed the move from the start, and the EU farmers’ association COPA-COGECA welcomed the vote result, saying “With [this rejection], MEPs sent a decisive message: the lack of dialogue, the imposition of objectives from above, the refusal to assess the impact and the lack of funding for agricultural proposals must end now” (our emphasis).

At this stage it's not clear if the European Union executive will withdraw the proposal entirely, or if they will have another try. The obvious concern among green group's is that this reversal is, if not permanent, then at the minimum a major setback.

The good news is that social pressure for change is slowly rising, and many people on both sides of the debate recognise that change is needed. The next attempt will probably need a bigger package of assistance for farmers, plus support for more sustainable alternatives. Someone needs to pay the necessary cost for implementation, and many farmers are currently poorly placed financially to take another hit to incomes.

Regulars followers of sustainability related regulation will have noted that such setbacks have been more frequent recently. Part of this comes from tougher economic times. When money is tight, priorities change. But some of it is political, such as the recent decision by the new 'right of centre' New Zealand government to reverse the smoking ban, enacted by the previous 'left leaning' Labour government. This is a move where the benefits were material, and the group negatively impacted is small, but it went down well on 'talkback radio'.

Our view is that if we are to make regulatory changes permanent, a greater focus is needed on the costs of sustainability related regulation. Yes, we understand the longer term benefits, but every change will create financial losers, and we need to get better at funding the transition periods.

One part of the solution in agriculture and natural capital will be precision ag. Some of the big wins in agriculture will come from changing livestock farming and rice production, but outside of this “just” producing the same or more food using less inputs also has an important role to play. Which is where precision ag comes in, targeting the resources where they are needed.

Link to blog 👇🏾

Green buildings offer good financial value as well?

We know we need greener buildings, but the 'how' is often less clear. And we need to better understand the financial implications. A recent report from the engineering consultancy ARUP, for the World Building Council for Sustainable Development, highlighted the important role that making buildings greener will play in achieving our net zero targets. As they highlighted "representing around 40% of global carbon emissions, the built environment is a critical sector to tackle on the road to net-zero".

But how do we do this ? Buried deep within the report (page 43 of 59) was a short section on the NABERS Energy rating system, first launched in Australia, but now slowly spreading. For those less familiar with it, NABERS Energy originated from the Australian Government’s drive to better understand and measure the energy efficiency and greenhouse gas intensity of office buildings. Over the last 25 years, NABERS has evolved to provide greater visibility of environmental impacts including water, waste and indoor air quality and ratings for different building types.

It is reported that, over the last 14 years, Australian offices rated using NABERS Energy have benefitted from average energy savings of 42%, and have reduced greenhouse gas emissions intensity by 53%.

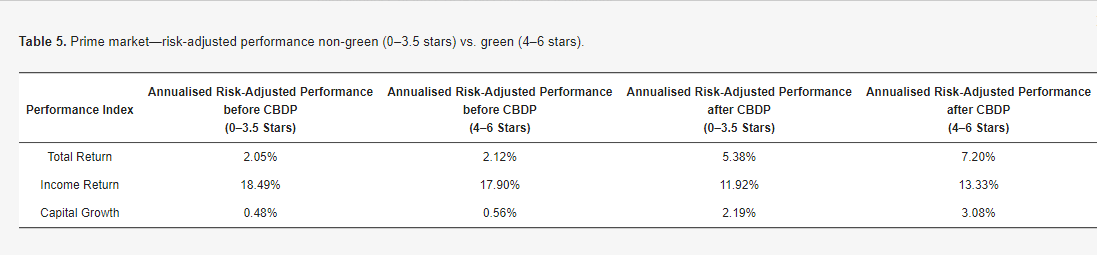

But that is not all, there also seems to be a financial benefit for the building owner. A recent study published by MDPI assessed the premium of green buildings by considering the role of mandatory energy efficiency of commercial building disclosure program (CBDP) using the MCSI/IPD NABERS data over 2005–2020. The results of the study showed that, in Australia, buildings with NABERS rating of 4 stars and above, delivered a higher total return compared with buildings with lower NABERS ratings.

This will come as little surprise to regular readers of our blogs. Back in September, we highlighted a study by Julian Zehner of University College London, which looked at 2,537 property sales and 2,907 rental transactions, between 2010 and 2021. The headline result - anything between a 8.3% and 26% premium for green buildings (as measured by the BREEAM certification).

Link to blog 👇🏾

Impact investing can align with fiduciary duty

A frequent debate is the one around impact investing and fiduciary duty. More specifically, does impact focused investing deliver financial returns that are similar to those of a meaningful benchmark?

A recent Pensions for Purpose report helps with this question. At the risk of ruining the surprise - listed global equity, private equity and real estate funds beat their benchmarks, while infrastructure and bond funds were broadly inline.

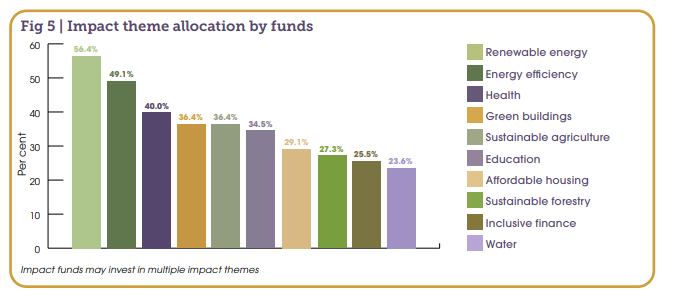

So, what did they study? They gathered investment performance data from 17

asset managers with UK pension fund clients, based in either Europe or the US. This collectively came to £18.6bn in impact assets under management (AUM). The assets were mainly invested globally (only 16% of AUM was in the UK).

The largest impact themes were renewable energy, energy efficiency, health, green buildings, and sustainable agriculture. The smallest, somewhat disappointedly, was water.

There were a couple of interesting outcomes, beyond the headline issue of cumulative performance. First, for listed equities, while the average quarterly net returns of the impact funds was higher, so was volatility (103 bp higher). Not totally unsurprising to anyone involved in managing money. A smaller investable pool will likely result in more volatility.

Second, while private equity outperformed over the total period, it had a period of underperformance (roughly from from 2020 to early 2022). Third, the real estate funds showed much smoother performance than the benchmark (FTSE EPRA NAREIT Global Index). They also had periods of underperformance.

So having a longer time horizon is key. But then that makes sense as well - sustainability is a long term theme, not a short term money maker.

The report is a really useful contribution to the debate, it's well worth a read as there is a lot more information that we could cover here.

Back in March we wrote a blog on what we called 'the return ripple from impact investing'. In it we made the point that 'doing well by doing good' is a careful balance with potentially direct and immediate sacrifices of some return resulting in longer term benefits to society as a whole.

Link to blog 👇🏾

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.