Battery storage - the next transition boom industry?

Battery storage has an increasingly important role to play as we build out an electricity grid dominated by renewables. But, current revenues from filling the generation gaps left by variable renewables are actually small, with the main income stream being from the smaller grid stability market.

Summary: Battery storage has an increasingly important role to play as we build out an electricity grid dominated by renewables. The sector is at a tipping point. Current revenues from filling the generation gaps left by variable renewables are actually small, with the main income stream being from the smaller grid stability market. Is change coming and when?

Why this is important: From a financial perspective, as we shift to the electricity grid of the future, the risks and opportunities will change. The notion of an electricity utility being a safe investment needs to be rethought. Some of the new services will have "merchant " type characteristics, taking more market and price risk than before. This is not a bad thing, its just going to be different from before.

The big theme: As we add more renewables to our electricity generation mix, we create a greater challenge in keeping the grid stable, and in ensuring electricity supply meets demand at all times. These changes are creating some really exciting opportunities for new approaches to grid management, including battery storage, demand management, and interconnectors.

The details

Why this is important

When I first started researching this, this was going to be a blog about how batteries, especially Li Ion batteries, were playing an important role in balancing out the gaps left when renewables such as wind and solar were not generating electricity. This is clearly a really important topic for sustainability professionals (who want an electrified economy), investors and asset owners.

But the more I listened to experts and spoke with investors, the more I realised that this was not what was happening, at least not yet. Outside of a few countries, the use of battery storage is still nascent. And where it does exist, its an industry mostly focused on providing what are called electricity grid ancillary services, basically keeping the grid stable. The market for providing electricity when the wind doesn't blow and the sun doesn't shine is only just starting to emerge at scale. One reason is regulation, another is cost.

But that is starting to change. The longer term forecasts we all read about how big this market has the potential to become, could just turn out to be right. This is something we all need to understand and care about, buildings the right foundations will be critical. As a consequence, this blog became more about the bigger picture, we will dig further down into the detail in a later blog.

The battery storage market is about to boom

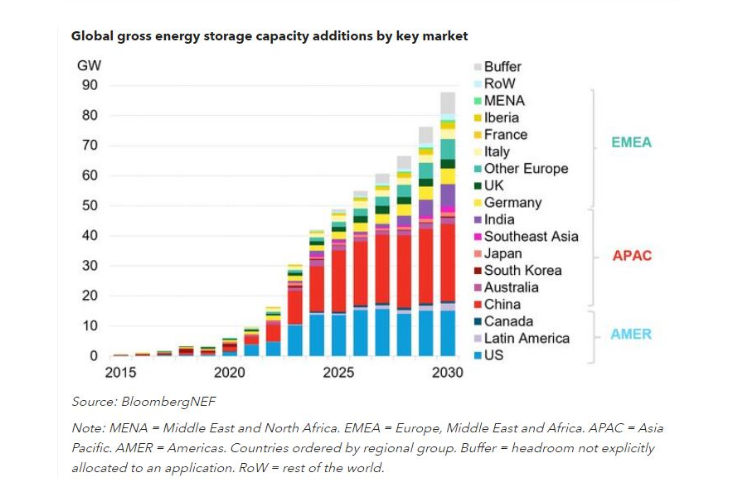

The battery storage market is about to boom, with some forecaster's suggesting that the market could grow from global additions of 16GW in 2022, up to 88GW by 2030. Even this growth is below many countries' targets, so if they end up getting the right incentives and regulation in place, this figure could go higher.

But the picture is actually more complicated than it first seems. What does this mean on the ground, and how should sustainability professionals and investors think about the opportunity?

At the risk of spoiling the surprise - what have we discovered so far ...

First, that despite the fact that most analysts talk about batteries filling in the gaps when renewable generation is not being produced, the reality is that most revenues currently come from the smaller grid ancillary services market.

Second, again despite the talk, most countries do not have the regulatory and incentive structures in place to encourage battery use, even for ancillary services. This is starting to change, but the pace needs to pick up.

Third, this means that the big near term opportunity for batteries is likely to be in geographically expanding their use for grid ancillary services. While this is a smaller market at a country level, the global potential is nowhere near fully tapped.

Fourth, and this is a but, batteries seem to very quickly saturate the ancillary service market, so the next market to push for is load shifting (selling electricity when renewables are not generating or when prices are higher).

And Fifth (for now), there are still some unanswered questions about exactly how this will work. Some are to do with cost, some are to do with technology, but the big one is about business model (traders vs data geeks).

Let's take a look ...

What do we currently use stationary storage batteries for?

Most people I have spoken with think about batteries as being used to provide electricity when renewables are not generating. You can imagine the scenario. As we move into a world of more renewable electricity generation, we will have more periods when, to put it simplistically, the wind doesn’t blow and the sun doesn't shine. So, we need something like a battery to step up and meet the demand.

And on the flip side, there are an increasing number of periods when too much renewable electricity is being generated - by this we mean we are producing more than we are consuming. During these periods the grid managers currently reduce production to keep the electricity system in balance (more on why this important later). This is called curtailment, and you can read a bit about it here ...

And so it's easy to picture batteries filling this gap, storing electricity when it's cheap and abundant (and probably currently being curtailed), and releasing it when renewables are not generating (price arbitrage).

But, this is only part of the picture and at least until recently, the least important part from a revenue perspective. This might seem counter intuitive, after all why do you have battery storage if not to fill in the gaps in renewable electricity supply. Well, it turns out that batteries can also play an important part in keeping our electricity grids stable. In fact, in many countries this is currently their main role.

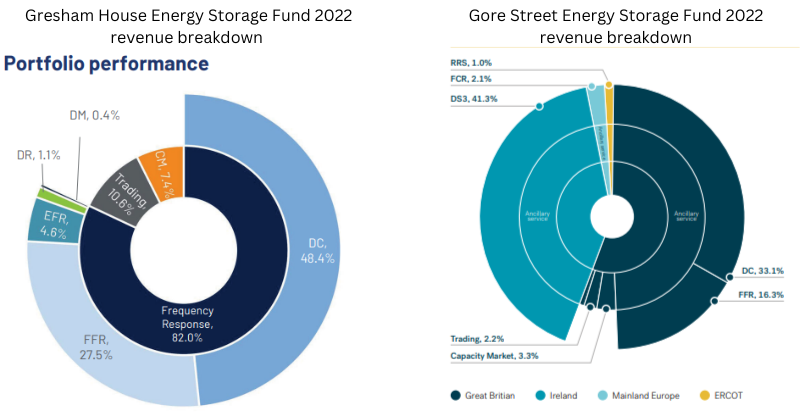

For instance, the 2022 revenue breakdown for the Gresham House Energy Storage Fund (GRID) was heavily tilted toward grid ancillary services, with 82% coming from frequency response and only 10% coming from trading (price arbitrage). There was a similar trend at the Gore Street Energy Storage Fund, where only 2% of UK revenues came from trading.

Yes, in the future we expect battery storage to help with load shifting - along with demand management, interconnectors and other electricity storage solutions such as pumped storage hydro and potentially geothermal. But that application is yet to emerge at scale.

What is the grid stability market?

To best understand grid ancillary services, we need to start at the beginning. Why is grid stability important, how is it achieved now, and what role are batteries playing?

We discussed some of this in a blog last year. So we will not repeat the full explanation, but you do need to be aware that its important the the electricity grid operates within tight bounds.

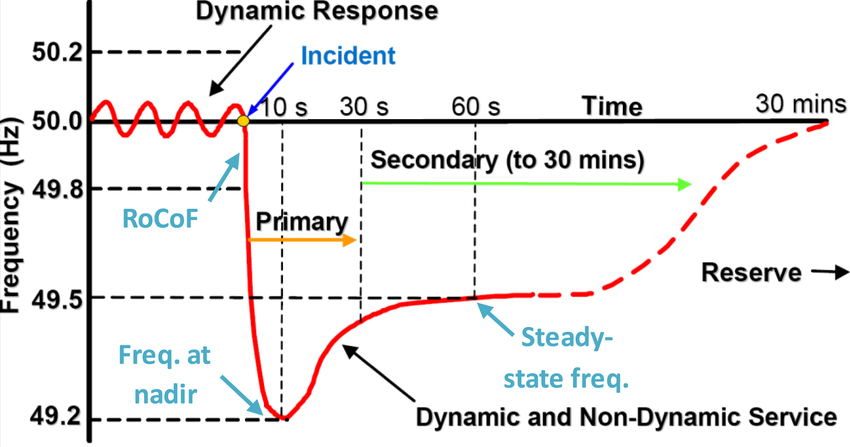

The best example of this is frequency response (which is a material element of the revenues for both Gore Street and Gresham House - see chart above). Because electricity in must equal electricity out, sudden changes in either demand or supply can unbalance the system. In the UK, the system operator has a license requirement to keep the grid operating at a frequency of 50Hz plus/minus only 1%.

This is because the electricity generation and distribution system is designed to work at this level, and any material deviation from this can result in damage to the equipment. In most cases the system has failsafe trips, which means that if the system frequency moves too far from 50Hz, plant begins to shutdown. If this is not contained it can result in a blackout.

An example of this was the widespread loss of electricity across the south east of the UK in August 2019. The incident report ....

"... pinned the blame on lightning strikes causing two power stations at Hornsea and Little Barford to go offline. Combined with other smaller embedded distribution generation totaling around 500 MW disconnecting, the unexpected loss of power caused a drop in grid frequency. National Grid initiated more than 1 GW of reserve services. However, this didn’t prevent frequency falling again to 48.8 Hz. This led to the Low Frequency Demand Disconnection (LFDD) protection mechanism kicking in. As a result, more than 1 million customers across Britain had their electricity cut." from the National Grid ESO incident report

Historically this obligation to keep the grid stable was met by "instructing" flexible electricity generators (mostly fossil fuel power plants) to increase or decrease generation. Plus, the system had a degree of inertia, which slowed down (no pun intended) any deviation from the 50Hz target. This inertia came from the heavy rotating mass of the steam powered electricity generators (nuclear and fossil fuel generation happens via steam turbines) and from the mass of hydro generation turbines.

By now you can see the challenge. As we gradually shut down fossil fuel electricity generating plant, the grid operators lost some of tools they used to manage the system frequency. Which is where battery storage came in. They balance the system by injecting electricity into the grid when required, something they can do in seconds (well actually faster than that).

National Grid separates out the frequency response services into two parts. The first is what they can dynamic response, the continuously provided service used to manage the normal second by second changes on the system. The second is non-dynamic response, which is usually a discrete service triggered at a defined frequency deviation, such as the unexpected loss of a generating unit.

You can see the difference between the two (the red line) in the chart below, which shows the response to a generic frequency deviation incident.

Where is this happening now using batteries?

You might be wondering why we keep using UK examples. And no, its not local bias. Its because one of the most developed battery markets for grid stability is the UK. The main reason for this is that it's an island, not just in the geographic sense, but also in the electricity sense. While it has some interconnectors that bring electricity in from Europe, its mainly dependent on its own actions. You can read a bit about this in a blog we wrote on why interconnectors are important.

And, to an extent, this is why the market is rightly getting excited about Texas. Like the UK, Texas (the grid is called ERCOT) is also an electricity island. The reasons behind this are complex and historic, but basically it appears to us that they don't want to connect to the other electricity grids across the US, as that would bring Federal regulation into Texas. Battery installations in Texas are also growing fast.

So, while the technology underlying the grid stability role is well developed, the market is still still in its infancy, in part because for many countries the right regulatory framework does not exist. So outside of the UK, Germany and parts of the US, there is still a lot of growth to come in ancillary grid services via batteries.

But you have to also be aware that batteries do such a good job of meeting the demand for ancillary services, that they end up saturating the market. Which in turn pushes down prices, and project returns. In the UK, some European countries and potentially soon Texas, the frequency response market is now full. There is more battery capacity than the small frequency markets can cope with.

What happens next?

As they say, this is the $64,000 question. The obvious answer is rolling out ancillary grid services into new countries. But the big win, for both the battery industry and the transition to a low carbon electricity grid, comes from load shifting. You put the two markets together, and you can see why many analysts expect the battery storage industry to become materially bigger over the next decade.

At this stage we want to pose some questions for you to reflect on - we will be coming back to our thoughts on the possible answers in a later blog. This one is already getting too long.

First question - while the growth of the market looks "assured", does this guarantee profits. On its own a stationary storage battery is a commodity. As we described above, battery owners are starting to move into what is known as merchant arbitrage - buying electricity when its cheap and selling it when it is expensive. And this is often being done without the "safety net" of an off take agreement or a Power Purchase Agreement (PPA). When it comes to profit generation, the difference is not in the battery, its in the management software, and the ability of the asset owner to maximise returns.

Our question is which market participants have the right skills for this. Will it be the battery owners (and the data geeks) or will it be the traders from the utilities, financial services, and the O&G companies?

Second Question - which technology will come to dominate. We suspect Li Ion batteries, but as grid forming investors develop, it becomes possible for wind and solar farms to better respond to grid changes. Plus we have flow batteries, which have the advantage of being able to scale up to longer durations, but that struggle to compete on cost in the current short duration market. And then there is pumped storage hydro. And new (and sometimes strange) technologies are also emerging.

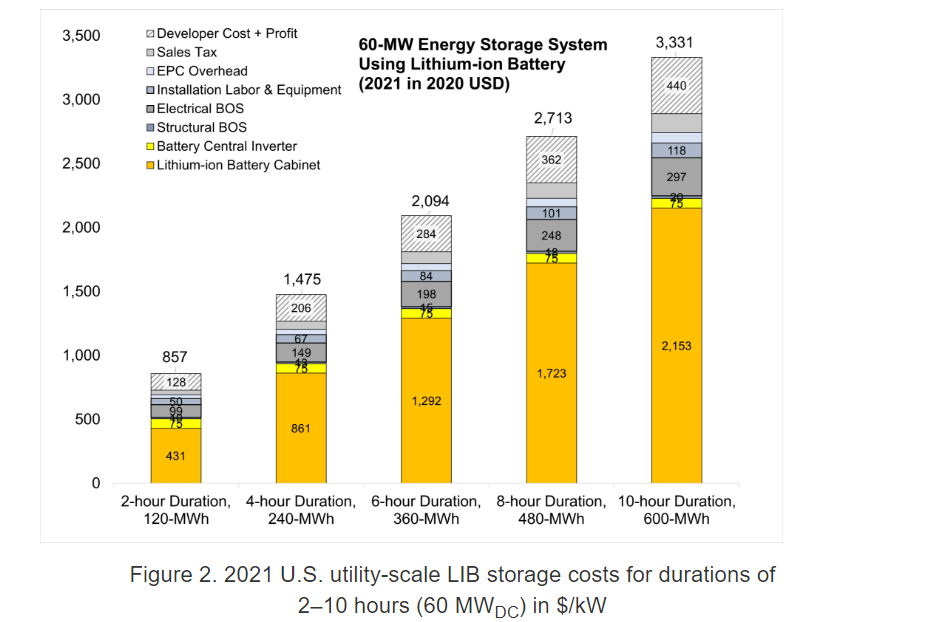

We talked about duration, which is basically how long can the battery respond for before it needs to recharge, in an earlier blog. You have probably already worked out that for Grid ancillary services, we only need short (ish) duration (maybe up to four hours), but for load shifting, we need duration to get longer.

It's a topic we will come back to in future blogs, but its worth highlighting this chart (from last year) that shows the current cost implications of pushing Li Ion batteries out to longer durations. For this example, a 10 hour duration battery was c. 4x as expensive to build as a two hour duration one.

Our question is which technology will dominate, will it be Li Ion for shorter durations and other technologies for longer ones, and will home or local networks, including roof top solar, play a role ?

Third question is cost. Its a big topic in its own right. And there are a lot of moving parts. In looking at the cost of production, we have to be really careful about using average costs (either across regions or across time periods). Trading electricity is about being able to buy low and sell high, which might conflict with societies objective of electricity security of supply at the lowest practical cost. There are already suggestions that some participants in electricity markets are gaming the system.

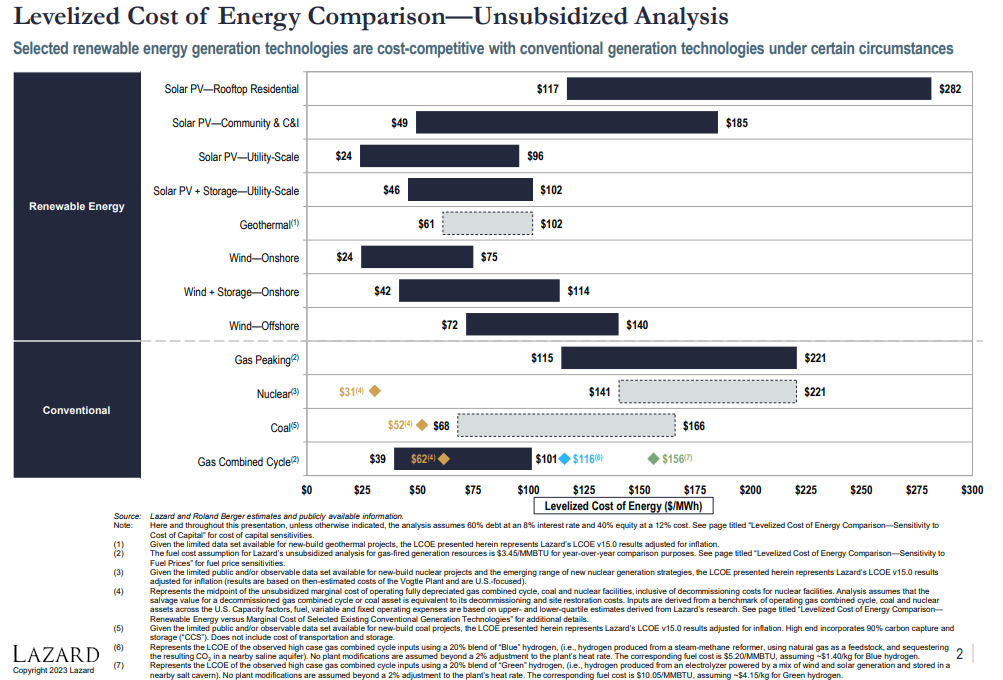

For those who are not renewable electricity geeks, the main data source (or at least the one that gets the most widely quoted) on the full cost of the various electricity generation technologies is the Lazard LCOE+ report (2023), which estimates what is known as the Levelized Cost of Energy (hence LCOE) for funding, building and operating various electricity generation technologies. It has a number of well understood weaknesses, including not being project or location specific, and perhaps more importantly, not reflecting the wider costs to the system (such as battery storage etc) of adding variable renewables.

Many of you will be familiar with this chart from their analysis. It gets quoted a lot, mainly to show that new renewables are often cheaper than new fossil fuel powered generation. Note that this chart is unsubsidised ie ex support such as from the US IRA.

What Lazard added this year is a more detailed analysis of what extra costs would be incurred to make renewables less variable. It's what they call the "cost of firming intermittency". The data published is for the US, and the calculations are complex, but what it broadly shows is that (take a deep breathe as this sentence gets a bit convoluted) ...

when you add "firming costs", the total LCOE cost for renewables, is higher in some parts of the US, and lower in others, than the equivalent fossil fuel powered Combined Cycle Gas Turbine (CCGT) generator.

Which means the short answer is "it depends on where you are". If you are in the MISO (Midcontinent Independent System Operator) & SPP (Southwest Power Pool) grid areas, renewables can be all in cheaper, and if you are in CAISO (California) & PJM (the North Eastern region), the all in cost can be higher.

And, as we flagged before, it also depends on the time of day and the volatility in the market. Remember that the profitability for the battery owner is driven by the price they pay for their electricity, compared with the price they get when they resell it. Both move around a lot over time, and so even if the average cost calculation shows its more expensive, its still possible to make a profit through smart trading (which comes back to Question 1).

Conclusion

The uses of stationary battery storage are actually different from those that most people imagine. Load shifting is still a small market, while ancillary grid services dominate. But even these are only in some countries. So, we have a growth opportunity as they expand geographically. For load shifting, it's still an emerging opportunity. We have some idea how it will work, but there are still a number of questions. One is around cost, and the other is which companies will bring the right mix of skills to make it happen.

And one last thought to leave you with - how do we design a system that encourages price arbitrage, without compromising our wider objective security of supply in the cheapest practical way?

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.