Bridging the gap 28.23

In case you missed it ...

Not a subscriber yet? Click here ('Bridging the gap' is free)

Here is a selection of recently published Quick Insights, Deep Dives or Perspectives that our subscribers get to read in full.

- Sweden's wooden city (Built Environment)

- Has the outlook for green hydrogen got better? (Greener Energy Applications)

Plus a few from the archives:

- Innovation in feeding cattle (Agriculture / Natural Capital)

- Human Rights - it's not just a values issue (Transitions / Human Rights)

- Decarbonising chemicals - ShareAction report (Geener Energy Applications)

What subscribers are reading this week

Sweden's wooden city

(Built Environment, Premium and Professional)

We have been using wood in construction for centuries. Indeed the five-storey pagoda of the Horyuji Temple near Nara in Japan is 1,323 years old and still standing.

That may be the oldest wooden building in the world, but the largest in Asia is Gaia in Singapore's Nanyang Technological University which uses 43,500 square metres of timber.

Now Stockholm real estate developer Atrium Ljungberg has unveiled plans to expand the '5-minute city' neighbourhood of Sickla with the world's largest wood-based urban construction project - 250,000 square metres!

We look at the development in more detail, wooden construction more broadly including benefits and things to watch out for from a sustainability perspective.

Wooden construction could be an important decarbonisation and health and wellbeing solution in certain areas and for certain constructions. Sustainable management is key.

The big theme: The built environment, including residential and commercial buildings, communal areas such as parks and supporting infrastructure such as energy networks and water supply, generates almost 40% of energy-related GHG emissions and it consumes 40% of global raw materials.

Link to blog 👇🏾

Has the outlook for green hydrogen got better?

(Greener Energy Applications, Professional)

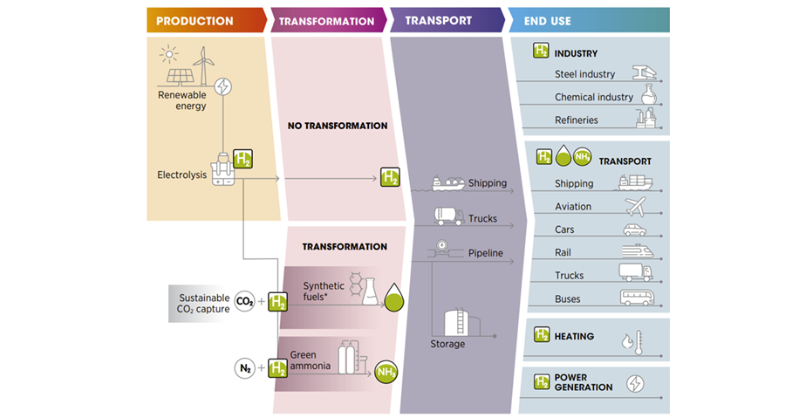

Green hydrogen seems to be having its 'day in the sun'. It's an important element of the US IRA programme. And countries such as Germany are not only offering subsidies, they are creating contracts for differences. These are the financial instruments that were an important contributor to building the momentum in solar and wind.

And yet, while much seems to have changed for the positive over the last 6 months or so, the underlying financial reality is still much the same. We still need to build a vast amount of renewable electricity generation to make the green part of the 'green' hydrogen description true. This is going to take a lot of time and a lot of capital. The potential uses for green hydrogen are still being over hyped.

While subsidies will help with the short- and mid-term cost differences, the main use of green hydrogen is realistically as a replacement for fossil fuel or grey hydrogen. The companies that currently use grey hydrogen, the fertiliser producers and the oil refineries, need to think a long way into the future. They have very long life, high investment assets, so they are not expected to rush into replacing equipment that still has a long and productive life ahead of it. While green steel, the next most likely green hydrogen consumer, is developing fast, it's still a nascent industry.

All of this means that green hydrogen, at least at scale, is likely to be an investment for the end of this decade and into the 2030's. By all means learn about it, but patience and a questioning approach will be key for financial investors.

Link to blog 👇🏾

From the archives

Innovation in feeding cattle

(Agriculture / Natural Capital, Professional)

This week the results of the longest trial using seaweed as a feed supplement for beef cattle recorded lower reductions in methane than previous studies. There are some nuances to this trial and the methane produced by the cows in the study was still cut by almost 30%.

Agriculture, forestry and other land use generates 22% of global greenhouse gas (GHG) emissions and utilises 72% of global freshwater supplies. Meat is responsible for a big part of that impact and how cattle are fed is a significant aspect. The UN’s Food and Agriculture Organization estimates that methane from burping cattle releases approximately 2.1 billion tonnes of CO2-equivalent a year.

It is also an important battleground in the fight against antimicrobial resistance as antibiotics have been historically overused in concentrated animal feed.

We wrote about innovation in feeding cattle back in April. It covers a number of areas including minimising their impact on the environment, improving their health, and in the logistics of feeding.

Link to blog 👇🏾

Human Rights - it's not just a values issue

(Transitions / Human Rights, Professional)

Procurement and supply chain consultancy Proxima have revealed in a report that almost 70% of CEOs they surveyed worry about human rights abuses in their supply chains. The retail sector is even more concerned with almost 80% of CEOs highlighting it as a key concern.

Human rights are a big theme in their own right. What is sometimes less appreciated is that they are intrinsically linked to a series of wider social and environmental topics. Companies and investors need to stay ahead of the curve on this. These are not just good corporate citizen topics anymore; they are becoming a critical driver for a company's long term financial success or failure.

We discussed human rights as an investing issue (December 2022), one that can have a very direct impact on a company's long term value creation. Companies that do not prepare will lose competitive positioning; it's not just about paying fines anymore.

Responsibility for supply chains and the impacts of international agreements can lead to legal action in your home country for acts elsewhere.

Link to blog 👇🏾

Decarbonising chemicals - ShareAction report

(Geener Energy Applications, Professional)

ShareAction published a report this week looking at the limitations of biomass as a raw material in the chemical sector.

We wrote a report for them in March on the financial case for decarbonising the Chemicals sector. We all know this is a challenge we need to fix, that it's going to take many years, and that it's going to need a lot of government support. The good news is that Europe already provides this for renewables, and in green steel we have a pathway to how this could work for the chemicals sector.

Sorting out the so called hard to decarbonise sectors is going to be a big challenge. They are big contributors to GHG emission etc but they are also linked to fossil fuels for good economic reasons. This is going to take us many years to resolve, which is why it's best to start now, rather than "kick the can" down the road for a bit longer.

The big theme: Europe wants to decarbonise its so-called "hard to decarbonise" sectors, which includes much of our heavy industry. If you add the GHG emissions from the impacted sectors together, you get to roughly 1/3 of all global emissions. So working out how to fix this is one of the big challenges. They are not called hard to decarbonise for nothing. There are good reasons why many of them currently use fossil fuels, so decarbonisation is going to need a lot of government assistance.

Link to blog 👇🏾

Become a subscriber

Click here to joinPremium subscribers get to read in full...

- 'Quick Insights'

Designed to be short, easily digestible summaries to educate and stimulate thought and further exploration. 3-5 minute reads.

Professional subscribers get to read in full everything that Premium subscribers get plus...

- 'Perspectives'

Our unique perspective, based on our decades of financial and sustainability experience, on a key news story, development or report that is impacting sustainability investing, decision-making and transitions. We encourage you to think laterally. 5-6 minute reads.

- 'Deep Dives'

Setting the scene in more detail to aid understanding of how the transitions will develop and thinking laterally. 10-12 minute reads.

Please forward

to a friend, colleague or client

If this was forwarded to you, click the button below and sign up for free to get this email, 'What caught our eye' and the 'Sunday Brunch' in your inbox every week.

Please read: important legal stuff.