Has the outlook for green hydrogen got better?

Green hydrogen has been in the news recently. Does this mean that it's becoming more real? Or is much of it still hype - which risks creating a bubble? The short answer is (somewhat surprisingly), from an investment perspective, not much has really changed.

From an investor perspective green hydrogen can be a real solution to real problems, but it can also be overhyped. Patience and a questioning approach will be key for investors. And while moves such as the US IRA will be short term positive, the underlying investment case is pretty much unchanged.

Summary: Green hydrogen has been in the news recently. Does this mean that it's becoming more real? Or is much of it still hype - which risks creating a bubble? The short answer is from an investment perspective, not much has really changed. Yes, green hydrogen has a real role to play in decarbonisation. And yes, recent announcements on subsidies will help get some projects off the ground. But progress will still likely be slower than many hope, and it's still not the painless panacea.

Why this is important: From a financial investor perspective it's easy to think, it's green, some forecasts suggest massive end demand, and it's now getting a lot of financial support, so it will make a good investment. And if we add a sustainability overlay, then it seems to be a solution to many of our more pressing transitions. But, we still have the reality to consider - will this investment potentially deliver us a fair financial reward? So, we need to look hard at the underlying economics. And the financial winners might not be the ones you expect.

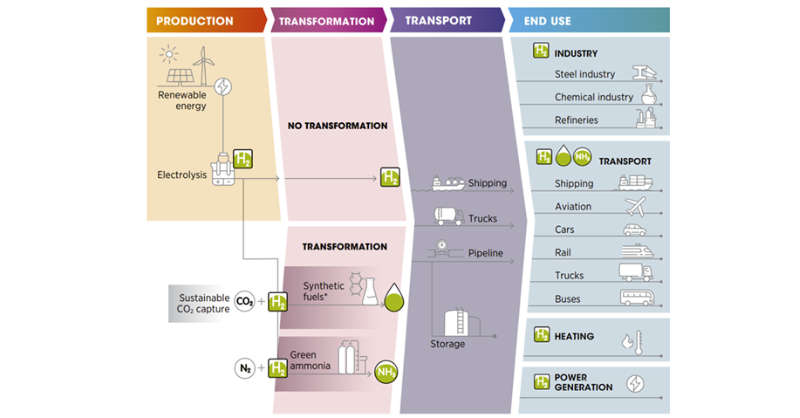

The big theme: The simple plan to electrify everything, combined with the decarbonisation of electricity generation, will get most countries a fair way toward their net zero targets. But it still leaves a large gap, mostly from what are commonly called the hard to decarbonise sectors. This is where green hydrogen and other technologies can play a part. But we need to be realistic about issues such as cost, timing, and the practicality of many proposed end uses.

The details

Summary of a story published in the Financial Times:

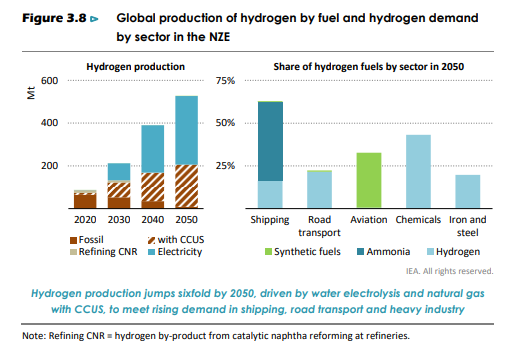

The appeal of green hydrogen can be seductive. It's possible to create a narrative where it penetrates many corners of our energy economy, replacing fossil fuels and hence reducing GHG emissions. And according to its supporters, it can be stored for long periods, and transported great distances. According to analysis from McKinsey for the Hydrogen council, a net zero system could require up to 500 million tonnes of green hydrogen annually. This is over 5x the current demand for grey hydrogen produced from fossil fuels.

But, the numbers involved in meeting this apparent demand are mind boggling. Just looking at the electricity needed to produce this amount of green hydrogen, the article estimates that this will require almost 25,000 TWH. To give this context, this is 100x the current electricity demand in the UK. And it's all got to be green, so mostly wind and solar. The investment needed for the electricity alone could total $8 trillion. But, there is good news on the horizon. A combination of subsidies, carbon pricing, and falling costs could make the economics look better.

Why this is important

We have written on green hydrogen fairly frequently over the last couple of years.

Regular readers will know that we are cautious sceptics. On the plus side, there are some really clear and obvious applications for green hydrogen. We just need to avoid becoming distracted by what might be, but probably never will happen. And why cautious - because it's not going to be easy, and for many proposed applications green hydrogen makes little economic sense? And the cost equation is going to be tougher than most analysts seem to be suggesting.

The bottom line is that there will be a place for green hydrogen. And for an investor interested in sustainability, this could be a good theme in which to commit capital. But, do it with your eyes open.

Let's start with the positives.

We are comfortable with the notion that at some point around 2030 (without subsidies) green hydrogen will make financial sense for some applications in some parts of the world. And subsidies, such as in the US IRA, could bring this date forward (a bit).

But, as financial people, we are also pretty comfortable that end demand growth will NOT look like this (a scenario that is frequently used to build positive end demand forecasts).

Scenarios matter.

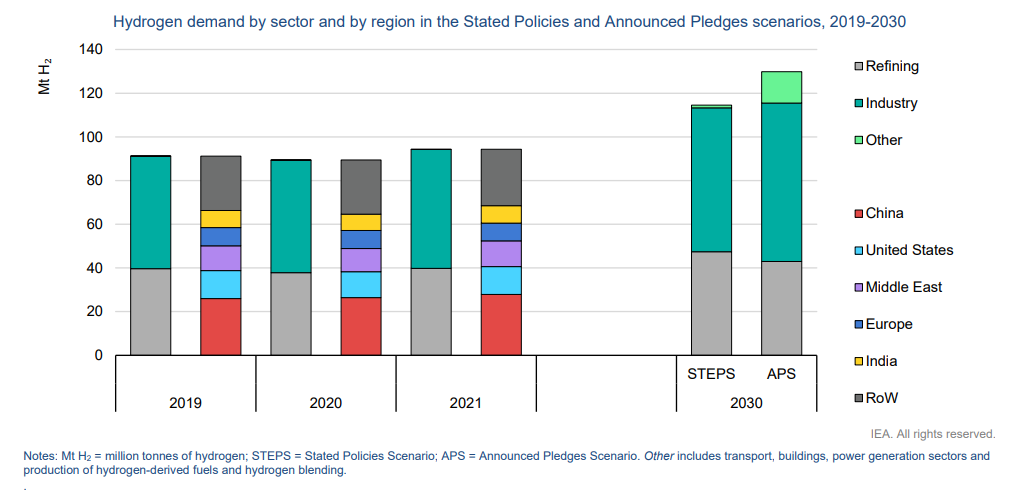

If instead of the IEA Net Zero by 2050 case, you take as your base the IEA STEPS scenario, based on countries stated policies, or even the more optimistic Announced Pledges scenario (all pre COP27), the picture for total hydrogen demand looks different. Instead of over 200Mt of hydrogen demand by 2030, its +/- 120Mt. And nearly all of it (bar the pale green bar in the APS scenario) is for refining or industry.

Why is this - because for many of the proposed applications better alternatives to green hydrogen exist.

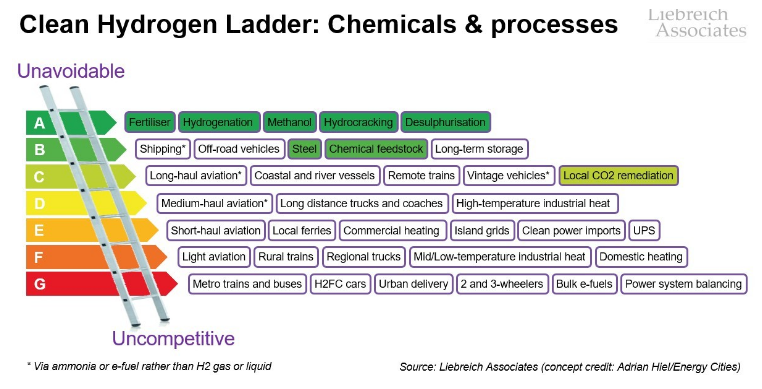

As Michael Liebreich so eloquently expresses in his Clean Hydrogen ladder, now on version 4, some uses of hydrogen make sense, but for many applications, we have better (electrification) alternatives. Anything below say C on the ladder looks unlikely - so from the IEA Net Zero emissions scenario above, we should probably discount road transport, plus home heating and short haul aviation (among others).

And then we have timing.

Some of the possible applications above are likely to happen at scale well into the 2030's - here we are thinking of shipping and maybe long haul aviation.

So looking at realistic investible time horizons, we are left with fertiliser, hydrocracking, chemicals and steel. Together, these could generate an end demand for green hydrogen of c. 100 million tonnes pa by c. 2030, which is a little more than the current usage of grey hydrogen. In other words green replaces grey.

For the green hydrogen market this would be a massive increase on the less than 5 million tonnes currently produced. This looks really exciting? Yes, well not quite.

Our main concern is about cost.

The industrial applications above are all in brutally cost competitive industries. Where investment in new equipment lasts decades. So, to either switch from dirty fossil fuel hydrogen to green hydrogen (for fertiliser and hydrocracking) or to build new facilities that run on green hydrogen rather than coal (for steel) or gas (chemicals) will require green hydrogen to be broadly cost competitive with existing fossil fuel alternatives.

This is a tough ask. Most hydrogen in the world (nearly all) is currently made using fossil fuels (often called grey hydrogen). This currently costs between $1/kg and $2/kg to produce, depending on where in the world you are located. By contrast, the cheapest green hydrogen (made using electricity and water) costs close to $2/kg, and in most parts of the world it's more like $4-6/kg. And in Europe, its closer to $7/kg. And remember, the green hydrogen costs are guesstimates - we don't yet produce much of it.

So, what needs to change

One solution is subsidies. Here the recent US Inflation Reduction Act (IRA) is a big deal. As part of this, a clean hydrogen credit, called 45V, will provide up to $3 per kilogram in tax credits after adjusting for lifecycle greenhouse gas (GHG) emissions and producers’ compliance with prevailing wage and apprenticeship requirements.

Let's back up a second - at a subsidy of at least $3/kg, it could mean that green hydrogen could become cost competitive with grey hydrogen, at least in the US. And other countries, such as Germany have similar financial support systems (in their case contracts for differences).

And of course, Europe has it's Carbon Border Adjustment Mechanism. This starts in October 2023 (on a phased basis) and in 2026 "EU importers of iron and steel, cement, fertiliser, aluminium, and electricity, will start paying a financial adjustment by surrendering the amount of carbon certificates that correspond to the emissions embedded in their imports".

The bottom line for us as financial people, as investors, is that over the coming 5-6 years green hydrogen (especially with subsidies and other financial support mechanisms) will become more cost competitive with grey (fossil fuel) hydrogen. Which means that it could start to be a viable replacement for grey hydrogen in fertiliser and hydrocracking, and as a new feedstock for the production of chemicals and green steel.

Five years doesn't feel that far into the future.

But, we need to remember that building new facilities to produce or use green hydrogen will be a big step for the industrial companies. So, they will want to see more than just plans before they commit to material new investment (ie beyond pilot's).

And, leaving you with one last thought, who will benefit from the expected surge in investment in the 2030's. Will it be the manufacturers of the hydrogen electrolyser's, or will it be the large industrial gases companies, who have experience of project integration? My bet would be on the later - but that is the subject for a future blog.

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.