Electricity ducks being seen in Spain

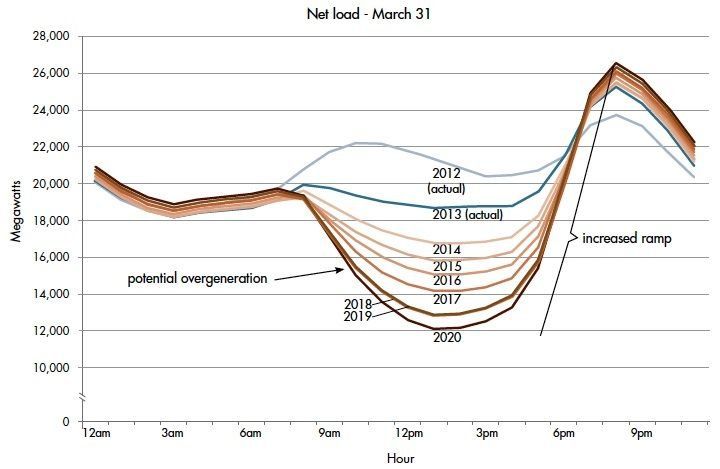

Solar electricity generation offers the potential for low electricity prices, at least when the sun is shining. Data shows that there is a decent correlation between the market price of electricity and what is called the residual load (demand minus supply contributions from wind and solar). The best way to illustrate this is the now 'famous' duck curve, so called because it looks (a bit) like a duck.

The chart was first publicised in California, with a deeper and deeper duck belly (lower residual load = more solar) showing up between 2012 and now.

We wrote about this back in June 2023 (link below). But this does not just happen in California. A couple of weeks ago, GEM Energy Analytics wrote a really interesting blog on what is happening in Europe.

Across Europe, solar power is showing a surge in growth. According to SolarPower Europe "in absolute terms new additions between 2024 and 2027 will contribute 313 GW. This will take total installed Solar PV capacity to 576 GW by the end of 2027, an increase of 119%".

To give this some scale, between April and October, when solar will be producing at its peak, the average load (demand) ranges between 270 and 300 GW. One obvious potential consequence of this high level of supply could be that solar becomes the price setter for material parts of the year.

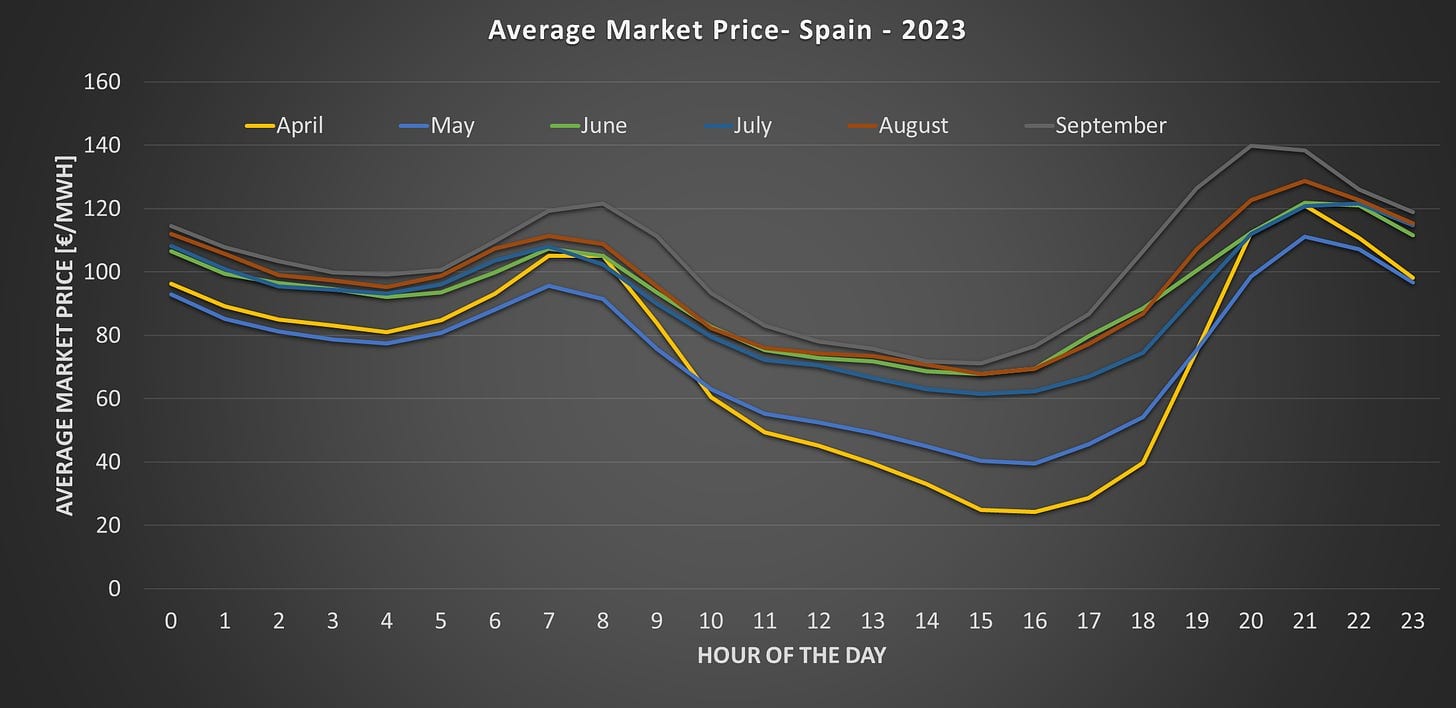

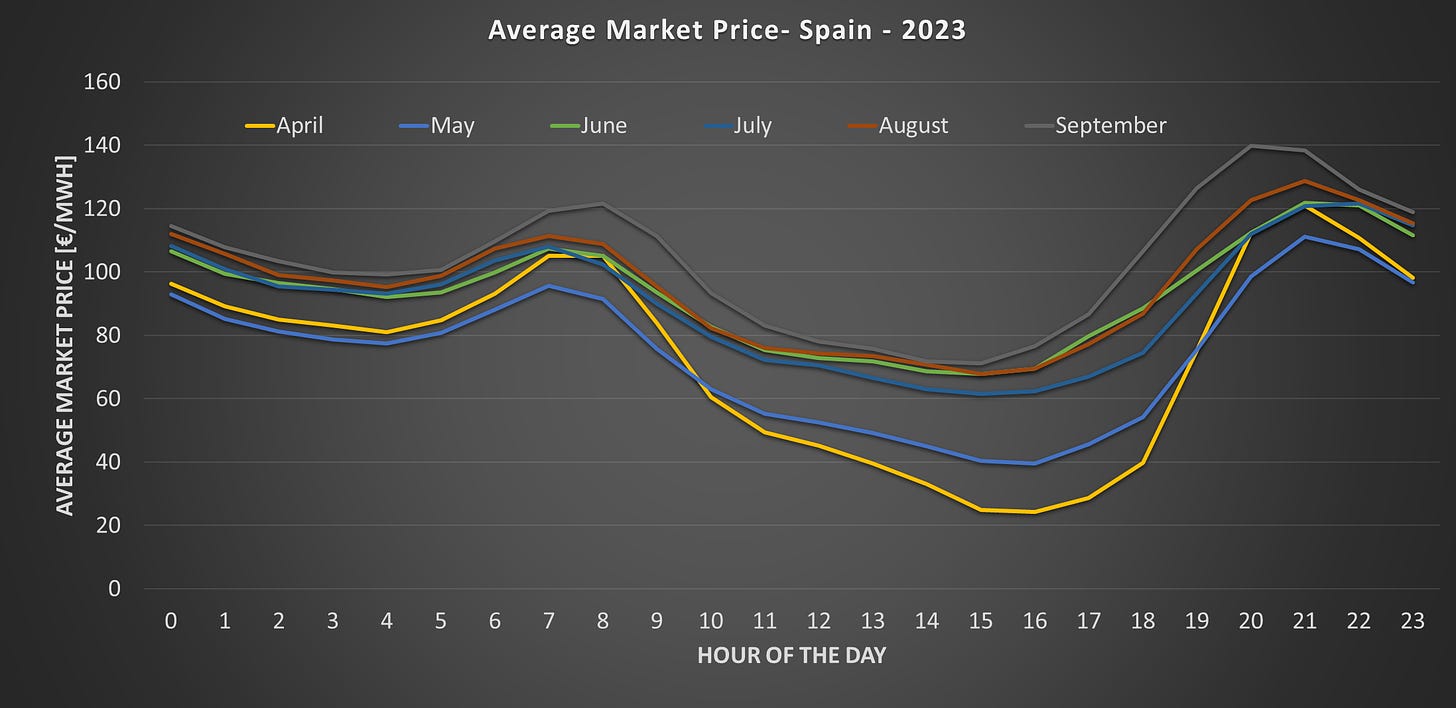

What is this doing to electricity average prices - taking Spain as an example? A picture says a thousand words ....

One possible consequence of this trend is that the economics of new solar get weakened, at least for what is known as merchant power. The SolarPower Europe report we quoted earlier suggests that this might slow down supply growth. Their forecast for new supply being built in Spain is now "26% less than the June 2023 expectations".

Looking forward this suggests a growing importance for battery storage (to time shift supply into the evening peak), and a material need for demand management (moving the peak by shifting demand out of the existing peak periods).

As we said above, we wrote on the Duck curve, and why all sustainability professionals and investors need to care about ducks, in a blog we published in June last year 👉🏾 https://www.thesustainableinvestor.org.uk/quick-insight-what-do-ducks-have-to-do-with-revenues-from-solar/

Our point, just to reinforce it, is that while solar will probably be our renewable electricity generator of choice in the future, its growing market share means we need to think about all of the other aspects of our electricity grids now - before the challenges become real.

This article featured in What Caught Our Eye, a weekly email featuring stories we found particularly interesting during the week and why. We also give our lateral thought on each one. What Caught our Eye is available to read in full by members.

If you are not a member yet, you can read What Caught Our Eye when it comes out direct in your email inbox plus all of our blogs in full...

Click this link to register 👉🏾 https://www.thesustainableinvestor.org.uk/register/

Please read: important legal stuff.