Green industrial project funding - momentum building?

Decarbonising industry is key, with hydrogen playing a big part. What to watch out for.

Summary: Encouraging to see US$750 million investments committed to three green projects (two green hydrogen and one green iron) from Australian green technology company, Fortescue. It suggests that momentum continues to build in the transition to greener industrial processes. We found this interesting for a number of reasons. Firstly the obvious one: solid investment in new green industrial infrastructure projects with relatively near term goals potentially catalysing further investment. However this is not without concerns. We shall take a look at some of those in this blog. Are these projects as green as they appear? Do the costs and economics stack up? What about impact on scarce resources, in particular water?

Why this is important: as the sustainability transitions progress driven by political and economic incentives that we don't lose sight of the end goal too.

The big theme: Heavy industry is responsible for approximately 20% of global CO₂ emissions. There are a number of areas that can be addressed from the feedstock for chemical plants to the energy requirement for heat and pressure to the reductants (chemical reducing agents).

Fortescue reaches FID on three green projects.

Australian green technology, energy and metals company Fortescue announced it has progressed three green hydrogen projects to a final investment decision (FID) - i.e. they are going ahead ahead with the investment - in the US and Australia with a total investment of US$750 million over three years.

The three projects are:

- Phoenix Hydrogen Hub: this represents the bulk of the investment at US$550 million and will comprise an 11,000 tonne annual production capacity liquid green hydrogen plant based in Arizona, USA, expected to begin production in 2026. About half of the investment is expected to be on equipment and half on construction of the site.

- Gladstone PEM50 Project: this is a green hydrogen production project under construction in Queensland, Australia with a production capacity of 8,000 tonnes annually. The initial 30MW electrolyser plant (using Fortescue's own proprietary Proton Exchange Membrane or PEM technology) is expected to be operational in 2025 with a remaining 20MW to take it up to full production capacity by 2028. This project takes US$150 million of the investment.

- Christmas Creek Green Iron Trial Commercial Plant: the remaining US$50 million investment is allocated to this green iron plant which processes iron ores to produce iron without using fossil fuels and instead using existing green hydrogen and solar generated electricity. Production capacity is expected to exceed 1,500 tonnes annually with first production in 2025.

We found this interesting for a number of reasons. Firstly the obvious one: solid investment in new green industrial infrastructure projects with relatively near term goals potentially catalysing further investment.

However this is not without concerns. We shall take a look at some of those in this blog. Are these projects as green as they appear? Do the costs and economics stack up? What about impact on scarce resources, in particular water?

But let's start with the positive. Momentum building in the transition to a greener industrial sector.

Greening industrial processes

Heavy industry is responsible for roughly 20% of global CO2e emissions. It produces many products that have made our lives more convenient but in addition many products that are arguably imperative for our life as we know it. Fertilisers to help us grow enough crops to feed us and steel to build infrastructure and equipment are two examples.

Hydrogen is an important raw material or feedstock in industry and in particular for producing ammonia. Of the 52 Mt of hydrogen consumed in 2022 by industry, well over half was used to produce ammonia and 80% of that ammonia was used to make fertilisers.

The Phoenix Hydrogen Hub is expected to qualify for a Clean Hydrogen Production Tax Credit as part of the Inflation Reduction Act (IRA) Section 45V which equates to US$3 per kg, as well as the Low Carbon Fuel Standard credit (we'll come back to that shortly).

We have previously written about how policy such as IRA could be just the catalyst to take certain green industrial transitions such as green hydrogen and one of its consumers, green steel to a tipping point. You can read that blog here 👇🏾

Let's take a look at some concerns. Not nails in the coffin, but certainly issues to keep an eye on and be aware of.

Is it really green yet?

We shall focus on the Phoenix Hydrogen Hub as it is the bulk of the investment. A reminder that green hydrogen is hydrogen produced by the electrolysis of water, using renewable electricity as opposed to black/grey hydrogen made from steam methane reformation, i.e. from fossil fuels, or blue hydrogen which is black/grey with carbon capture and storage.

That's quite an important definition if the economics rely on, at least initially, receipt of the green hydrogen production credits.

From the press release, the comment on power generation for the project says that it "...is serviced by Arizona Public Service, with power to be supplied from new sources of wind and solar generation under its regulated extra high load factor tariff, together with green

attributes under its Green Power Partners program. The installation of a 69 kilovolt transmission line to the Project site has been initiated."

Interesting analysis from John Poljak, founder of Keynumbers posted on LinkedIn highlighted an issue. As John says

"The electricity procured will be from the Arizona Public Service (APS), the local utility. APS, who is owned by Pinnacle West Capital Corporation publishes their energy mix and in 2022 was 26% Nuclear, 25% Coal, 24% Gas, 23% purchased and 1.5% Renewable Energy."

He also points out that at capacity the electrolysers would need to be running 90% to 95% of the time - clearly the wind and sun do not. So will that 'green hydrogen' always be produced by green energy sources?

So the options are battery energy storage systems to balance out intermittency or use of green energy certificates to offset but as John comments:

"...this is the big problem with renewable energy certificate arbitrage. It opens up pandora’s box to all sorts of paper shuffling and calls into question the business case behind hydrogen."

Or more specifically what do we want to use the hydrogen for?

We have previously commented on the importance of green hydrogen for replacing grey hydrogen in industrial processes. The Phoenix Hydrogen Hub project was originally Nikola Corporation's project - a largely transportation focused company.

We mentioned earlier that the project is expected to indirectly benefit from Low Carbon Fuel Standard credits. This is telling from the press release: "The Project’s strategic location makes it optimal for contributing to decarbonising the heavy duty road transportation sector."

We wrote in a recent Sunday Brunch about the need to prioritise what will likely be a scarce resource with industrial processes being a top priority. You can read about that here 👇🏾

Do the economics stack up?

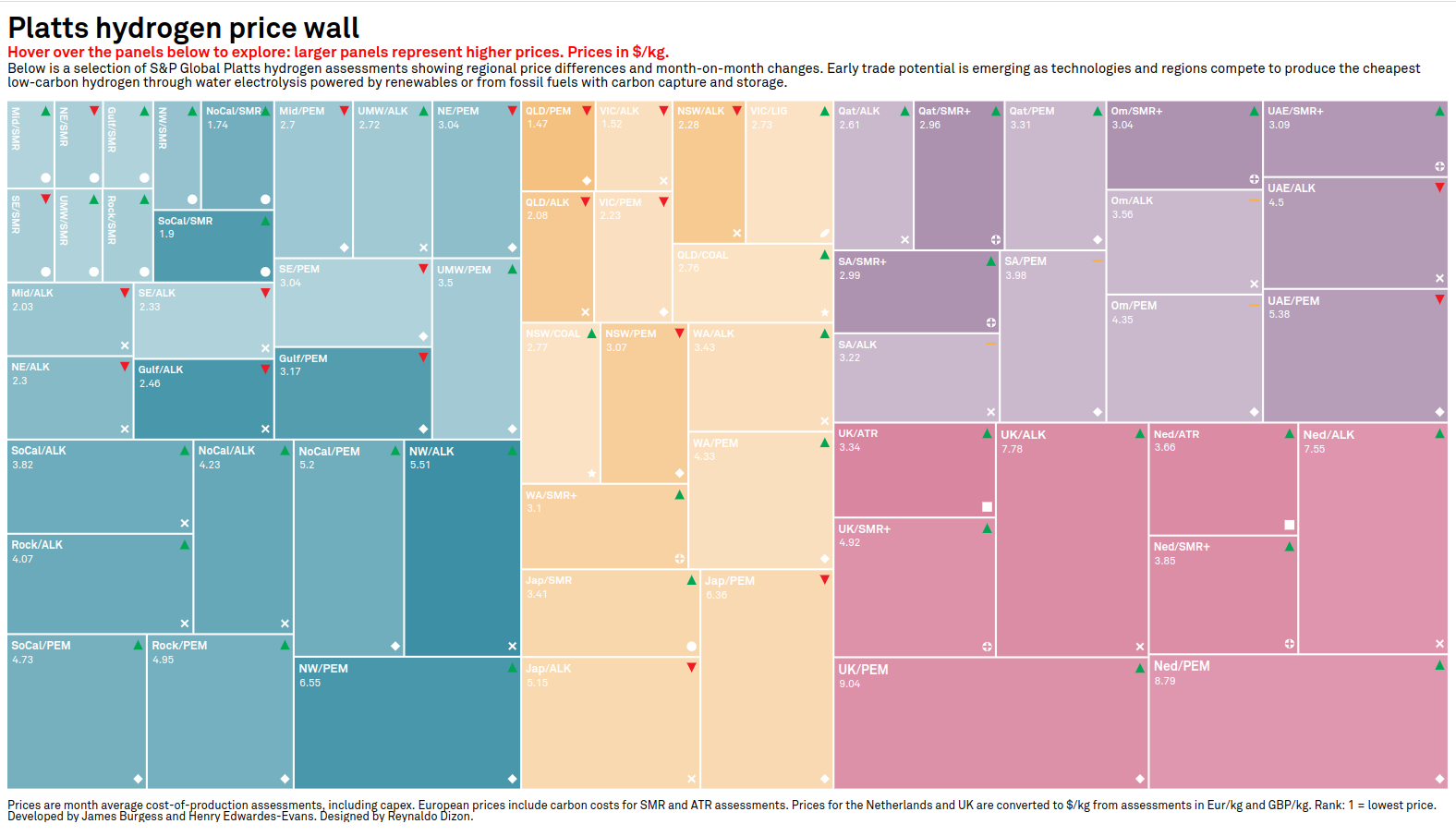

Currently the cheapest green hydrogen production cost is US$2.70 per kg with a range extending to US$9.04 per kg (data extracted on 6th Dec, 2023 from Platts). Grey hydrogen can be produced as cheaply as $0.92 per kg.

A report from PwC estimates that green hydrogen production costs will "decrease by around 50% through 2030, and then continue to fall steadily at a slightly slower rate until 2050" calling for prices in MENA, Russia, China, the US and Australia at €1 to €1.50 per kg by 2050 (US$1.08 to US$1.62) and around €2 per kg in Europe, Japan and Korea (US$2.16). This is a similar forecast to others - an article in Hydrogen Insight summarised a number of these.

So around the time of, for example, the Phoenix Hydrogen Hub project starting production PwC estimates the green hydrogen production price to be somewhere around US$1.50 per kg.

But how realistic is that? Chemical process development expert, Paul Martin has a strong view that it is unlikely. He points out that the learning curve potential in electrolysers is limited and that for the plant overall, much of the infrastructure is made up of equipment for which the learning curve has already plateaued (as he puts it "tanks and pumps and sh*t") - you can read his comments here in a recent post on LinkedIn.

Does the overall return on the project rely on those price reductions and associated demand drivers? Something to monitor closely.

The investment in the Christmas Creek Iron Ore trial plant is interesting, especially when compared with other green pig iron projects. For example Vale's, Tecnored plant in Mabara, Brasil which has capex of $1,380 per ton, falling to closer to $700 per ton at full capacity, is significantly lower than the Christmas Creek project which works out at $33,333 per ton. Of course that calculation that I made is misleading. It is a trial plant and the overall capital requirement is likely to be much lower as the plant will use existing infrastructure and it is not clear yet whether further investment will be sought.

Water, water everywhere?

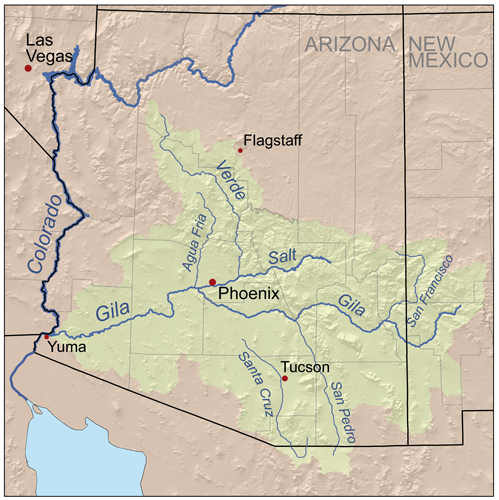

For the Phoenix Hydrogen Hub the project has rights to source water from the Gila Bend Basin (about 50 miles southwest of Phoenix) through existing bore wells. Irrigated agriculture is the most important economic activity and the biggest consumer of groundwater reserves so what will be the impact of increased demands on water from industry not just from this project but others too? Notwithstanding the investments committed as part of the Investing in America agenda for water conservation, water efficiency and protection of critical environmental resources in the Colorado River System (of which the Gila river is a part), will surrounding communities see water stress in the coming years?

Moving to Australia, for the Gladstone project, there are sufficient water reserves to support the initial 30MW phase but the second 20MW phase would need upgrades to the existing water infrastructure which would need to be completed by the Queensland Government. How guaranteed is that?

Conclusion

There is a need to decarbonise a number of key industrial processes from ammonia to steel production. Hydrogen - or more specifically green hydrogen - will be important in that. It is encouraging to see investments going in to develop green production plants with policy incentives driving both supply side and demand side. However, there are some concerns to monitor including the 'greenness' of the projects, the uses of the resultant output (green hydrogen) and how those uses are prioritised and the impact on other resources such as water.

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.