Is green steel coming of age?

Green steel reaching a tipping point, accelerating demand. A lesson for other hard to abate sectors? What is the combination of factors that have got us to this point?

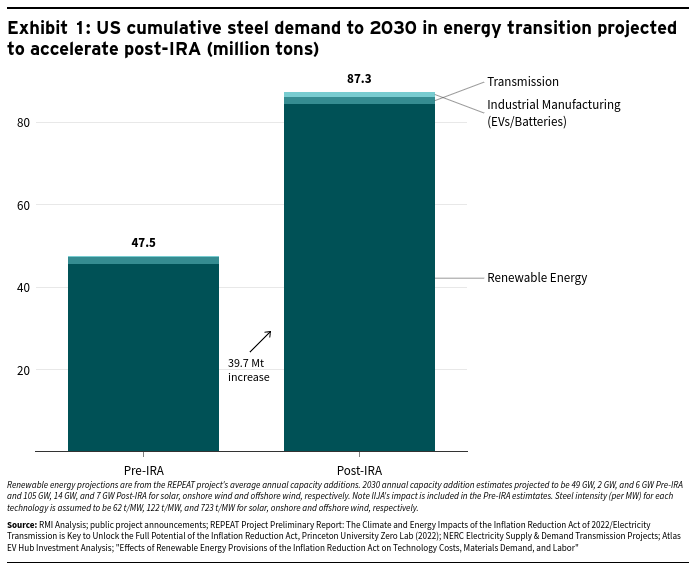

Summary: The IRA, IIJA and Buy American Act provide powerful incentives to mobilise the US steel industry towards near zero emissions production by creating demand for green steel.

Why this is important: Solutions do exist but they will require partnership building both on the supply and demand side to ensure economic scalability. Green steel's progress could provide a template for other hard to abate sectors.

The big theme: Steel is a fundamental building block of our modern economy. It is used extensively in construction, automotive and transportation as well as energy, infrastructure and machinery. Globally the steel industry is responsible for approximately 7% of human-made greenhouse gas emissions.

Some context

Steel is an alloy of iron and carbon with small amounts of other elements producing varying properties - for example stainless steel which contains chromium doesn't rust or corrode as easily as other forms of steel.

Whilst almost 90% of steel is recycled, the steel industry is still responsible for about 7% of all man made global greenhouse gas (GHG) emissions and so is an important decarbonisation problem that needs solving.

Steel is currently produced via two main routes:

- Blast Furnace-Basic Oxygen Furnaces (BF-BOF): Coke (coal that has been heated at high temperature for a day, then cooled) and iron ore (in the form of sinter) are fed into a blast furnace and then hot air at 1,250oC is blown in from below. The iron ore is 'reduced' (its oxygen is removed) to produce 'pig iron' and a waste product called slag. The amount of carbon in the pig iron is reduced by mixing in scrap steel and then blowing oxygen in to produce crude steel. Between 70 -75% of current global steel production comes from the BF-BOF method.

- Electric Arc Furnaces (EAF). A mixture of scrap steel, Directly Reduced Iron (DRI) and quicklime (calcium oxide) is preheated (often using heat from the previous cycle of steel making). This mixture or 'charge' which can be fully scrap or fully DRI, is put into the furnace and graphite electrodes inserted and an electric current passed through them creating an arc (plasma) which melts the charge at a temperature of up to 3,000oC. The process is repeated a number of times and then oxygen is injected to reduce the mixture to steel. The EAF technology, which uses mainly recycled scrap steel, is seen as better for the environment as it produces materially fewer GHG emissions. But, there is not enough recycled steel to meet growing demand using the EAF steel making method alone. DRI could take up the bulk of the shortfall in scrap. The iron is reduced using syngas, a mixture of carbon monoxide and hydrogen. If the hydrogen is produced using renewables rather than from fossil gas, then emissions are even lower.

Let's look at why RMI believe that green steel is at a tipping point and what the financial considerations are when thinking about the transition to greener steel.

Not only is green steel an important sector from an emissions perspective but it could also be the trail blazer for a number of other important transitions.

The details

Are we reaching a tipping point?

A recently published report from RMI argues that a combination of factors have led to that tipping point being reached driven by both demand and supply side factors.

"We believe the time for sustainable steel has arrived.."

RMI

In fact so much so that they are launching a new sustainable supply line for steel, the 'Sustainable Steel Purchasing Platform' with the aim of helping companies secure low-emissions steel volume. RMI's hope is that by pooling interested buyers of various sizes throughout the supply chain, it should act as a virtuous circle to stimulate the required investment.

So what are the drivers that give them this confidence?

The two key demand side drivers are:

- Legislation: The Inflation Reduction Act (IRA), the Infrastructure and Investments Jobs Act (IIJA) and the Buy American Act are providing strong financial incentives and mandates for the development of locally produced product and intermediates as well as the development of low-emissions energy solutions and associated infrastructure much of which will require steel.

2. Corporate Climate commitments: scope 3 emissions or those emissions resulting from activities in the supply chain are increasingly under the purview of corporate directors. RMI highlight the Auto industry as a key example. Steel represents approximately 30% of the Auto industry's supply chain emissions and yet moving to low-emissions steel, even assuming a 50% premium in cost per ton in 2030 would add less than $200 to the price of a car.

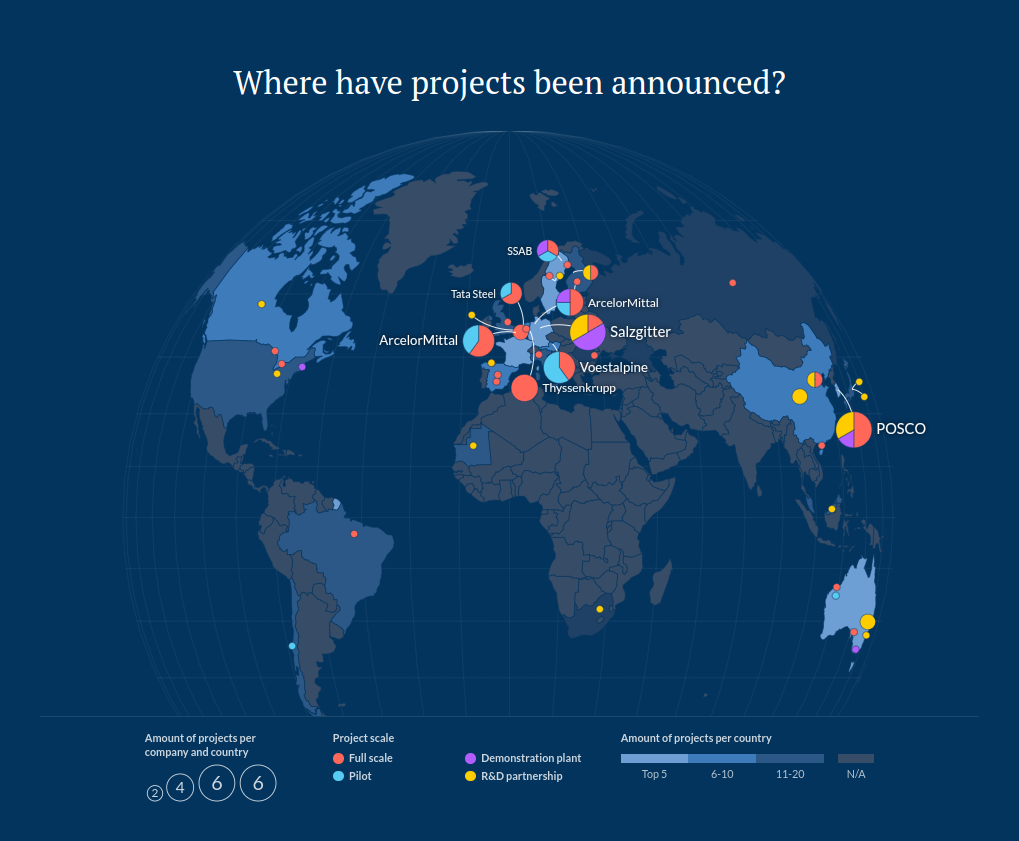

The supply side driver is really that more full scale production facilities, beyond demonstration plants, are being planned and built.

Looking globally, a number of green steel projects have been announced with some full scale plants scheduled to come on line within the next 18 months.

One example is H2 Green Steel’s flagship plant in Boden, Sweden, which will be one of the world’s first large-scale producers of low carbon iron and steel. The plant is expected to start operations in 2025, processing direct reduction pellets into HBI and then making steel through electric arc furnaces using green hydrogen. The Boden site will hold one of the world’s largest electrolysis plants for green hydrogen production.

What are the financial considerations?

The steel making process, like many heavy industries, is incredibly complex. It's not just a case of throwing some iron ore, coking coal, and quicklime into a furnace. Companies have invested a lot in accumulated knowledge and infrastructure. This is a capital intensive industry with relatively low margins and returns on capital employed. Developing new processes to create green steel, even if they might look broadly similar to processes used now, is a material risk for the companies involved. Changing processes from what they know to something new is a material "step into the dark". Learning how to create green steel in a cost effective way will involve hundreds if not thousands of small improvements - fine tuning production processes, inputs and operating practices. This is an important factor to bear in mind - it's going to take time.

The challenges are however solvable. Some of the solutions require financial and other assistance from governments, as they seek to create benefits for the wider society that they represent. Important considerations include:

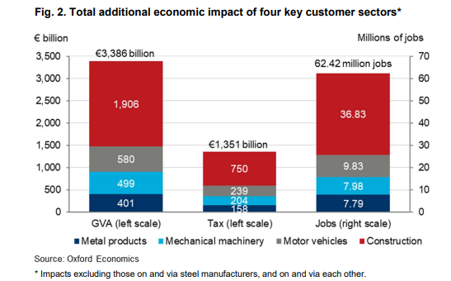

- Jobs: looking specifically at Europe -while the steel industry is nowhere near as important as it used to be, its still a decent sized employer. According to Eurofer data, the sector directly employs c. 325,000 people across Europe, with the biggest country being Germany (just over 83,000). If you add in indirect employment, the total number of jobs is claimed to be as much as 2.6m, with c. 500,000 of these being in Germany. The region produces over 177m tonnes of steel per year, c. 11% of global output. In terms of consumption, the biggest European end markets are the construction industry, automotive, and metal goods.

- Supply chain security: A 2019 report from Oxford Economics estimated that the four main steel customer groups (fabricated metal products, mechanical machinery, automotive, and construction) together contributed €3,386bn in Gross Value Added (GVA) and supported over 62m jobs. To quote the report, "across all four sectors combined, almost one-third of their additional economic impacts could be thought of as being ‘enabled’ by EU steel". The biggest impacts were in automotive and machinery manufacturing (60%) and the smallest in construction (12.5%).

In 2022 Europe was estimated to have imported some 35m tonnes of finished steel products, of which the majority came from Turkey, South Korea and India. In the context of total European production (as above c.177m tonnes) this is not overly material. But you can see that, especially in times of supply chain stress, many manufacturers would be concerned if the level of imports rose substantially.

Other things to consider

There is only so much scrap available for use in steel production and so pig iron or direct reduced iron will have to be the main sources. According to McKinsey there were 24 new direct reduced iron plants with between 40 and 50 metric megatons of capacity announced in Europe as at the end of November 2022. However, that could require almost two Mt of hydrogen per annum. That is 10% of European forecast hydrogen demand in 2030! An alternative would be to 'bring the DRI' in from elsewhere. That would be in the form of Hot Briquetted Iron (HBI) which is DRI that has been put under very high pressure and temperature to form dense and very much less porous briquettes - much less reactive and so easier to transport. Of course there is a trade-off: Hot Direct Reduced Iron (HDRI) requires less heat than cold HBI (an estimated additional 100 to 150 kWh per ton to melt) as it is integrated and already hot! There would also be additional transportation costs of bringing in the HBI.

Rio Tinto, for example, have signed a multi-year supply agreement for high grade direct reduction iron ore pellets with H2 Green Steel (mentioned earlier). The pellets will come from Rio Tinto’s Iron Ore Company of Canada (IOC) operations. Rio Tinto will also buy and on-sell a part of the surplus HBI produced by H2 Green Steel during the ramp-up of its steelmaking capacity.

When looking at lower emissions hydrogen, the costs of green hydrogen vary considerably across the globe but they are improving. The discussion below is from April 2023 👇🏾

At that point, grey hydrogen (made from fossil fuels) cost between $1 and $2/kg to produce, depending on where in the world you are located. By contrast, the cheapest green hydrogen (made using electricity and water) cost close to $3/kg, and in most parts of the world it was more like $4-6/kg. In Europe, it was closer to $10/kg.

As of 23rd August 2023, according to S&P Global Platts, the cheapest grey hydrogen is US Midcontinent at $0.93/kg with prices ranging from that level to $1.68/kg. The cheapest green hydrogen is $2.61 now whilst in Europe pricing has improved to around $6-$7/kg.

Outside of Europe, Liberty Steel, part of the GFG Alliance group bought the Australian Whyalla steelworks out of bankruptcy in 2017 and is now aiming to spend half a billion dollars installing an EAF powered by renewable power sources and a 1.8 million tonne Direct Reduction Plant which will eventually be transitioned to green hydrogen, although will use fossil gas initially. The owner Sanjeev Gupta claims that the plant will be able to reduce its direct CO2 emissions by 90% and be 'carbon neutral' by 2030. One worth monitoring given controversy with GFG Alliance's other projects, most notably in Scotland with the Lochaber smelter which included a substantial amount of public funds too.

There are a number of other emerging technologies at varying stages of development. HYBRIT is a technology that is a direct reduction process using green hydrogen as the reducing agent. The HYBRIT initiative was started by SSAB, LKAB and Vattenfall with financial support from the Swedish Energy Agency and EU's Innovationfund. The demonstration plant is scheduled to start production in 2026. There are a number of very early stage initiatives using electrolysis to produce steel. Boston Metal with their Molten Oxide Electrolysis technology and Siderwin from ArcelorMittal are two examples.

A template for other hard to abate sectors?

The last few years have seen a dramatic change in the outlook for green steel, especially in Europe. Less than five years ago the consensus on green steel was that “investments in zero-carbon alternatives still come at prohibitive commercial risk”. Now, nearly all European steelmakers have announced plans to replace their old, high carbon emitting blast furnaces with direct reduction iron and electric arc furnaces. We have realistic plans for production at scale by the end of this decade.

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.