What struck a chord in 2023

Articles that went viral in 2023 garnering huge engagement.

During 2023 we published 194 articles across our major themes of greener energy (and their applications), transitions and human rights, the built environment and wellness, and agriculture and natural capital.

Some of these stories really struck a chord and went 'viral' garnering huge engagement across our various platforms and stimulating debate. In our final publication of 2023, we highlight these as well as a few other articles that we think you will find interesting.

At The Sustainable Investor our aim is to help Sustainability Professionals seeking to influence strategy development, finance and investment. We are unique in bringing in both deep sustainability AND finance experience and expertise.

If you are not a member yet, to read all of our blogs in full...

The stories that struck a chord in 2023 were...

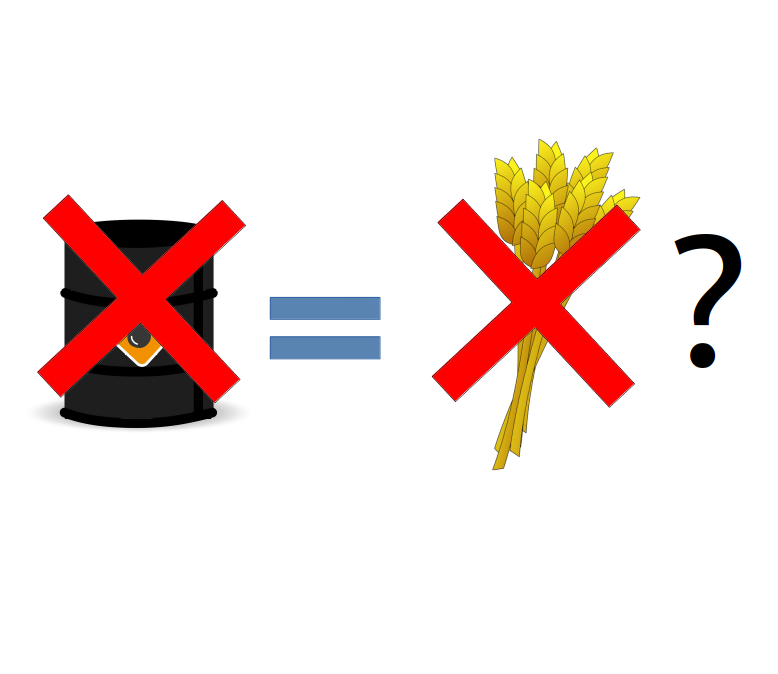

- Will half the world starve without fossil fuels?

- Kenya farm hosts first on-site green hydrogen-to-fertiliser plant

- Sunday Brunch: ad singula or 'can I cut airline emissions by getting more people to fly?'

- Why does our sewage end up dumped in our rivers?

- Green hydrogen - why should I care what it costs?

What struck a chord in 2023

Will half the world starve without fossil fuels?

Our World in Data is a fabulous source of data, charts and insights.

One such chart - 'World population supported without synthetic fertiliser' and 'World population fed by synthetic fertiliser' - with an excellent accompanying article from the brilliant Hannah Ritchie, has been used by a number of commentators to make the assertion that 'stopping oil and gas production means half the world will starve.'

This intrigued us, so we thought we would explore.

There are actually a number of separate questions within that assertion:

- Do we need oil and gas (hydrocarbons) to make synthetic fertilisers? The answer to this is currently (mostly) yes, but low carbon alternatives are emerging fast.

- Do we need to use so much synthetic fertilisers? The answer to this is no - we’re incredibly inefficient in our use of fertilisers in some areas, and we’re using far more than we need.

- How do we feed the World population? (how much food do we need?) To answer this we need to think about the entire food system, not just farm production. We can do much more with less inputs.

On-site green hydrogen-to-fertiliser plant

US-based Talus Renewables, a manufacturer of modular green ammonia systems is starting up a plant in Naivasha, Kenya that will enable local production of both low-cost and low carbon emission fertilisers. Talus will supply Kenya Nut Company Ltd with eventually 95% of Kenya Nut Co's fertiliser needs. The plant will be powered by on-site solar.

Traditional ammonia production is very carbon intensive, but there are ways to make it greener (including this). The thing that caught our eye about this development is the close linkage between what is being produced and what is needed. This is an important point for sustainability professionals to understand and one that can differentiate them in strategy conversations.

In this case Kenya Nut Co needs fertiliser. Fertiliser needs ammonia. Ammonia needs hydrogen. Talus makes green hydrogen to make green ammonia for the fertiliser. The starting point is the need, not the input. A concern with discussions about a 'hydrogen economy' or an 'electric economy' is the starting point is this-thing-I-am-producing-and-I-need-to-find-a-use-for-it. That can lead to inefficiencies.

Not a blog about flying

This Sunday Brunch looked at two areas where there is a mismatch between an activity's proportional emissions contribution at the individual level versus the aggregate level. We looked at flying where for an individual it is likely to be the biggest contributing activity but because the vast majority of the population don't fly, the aggregate industry level is modest. We also looked at watching TV where for the individual it is quite a small contributor but there are an estimated 1.72 billion TV households globally, so in aggregate it is worthy of consideration.

The point of the blog though is not to look at flying and watching TV per se, but more to provoke thought when looking at any problem to understand the drivers and how the individual and aggregate levels interact.

For example, 'fewer people should fly to reduce global warming from the aviation industry' is a common statement. So 100 people flying should be less harmful than 300 people, right?

However what we actually want is fewer aircraft flying. 'Fewer people flying' should ultimately lead to 'fewer aircraft flying' - of course the actual problem of reducing the impact of aviation is more nuanced than this. The point of the above is to question our viewpoint in assessing the driver for any problem.

Why does our sewage end up in our rivers?

Sewage has moved up the social and political agenda in the last few months, but for the wrong reasons. Far too much of it is ending up in our rivers, lakes and the sea. We broadly know why. We have under invested in our waste and storm water systems for decades. So when it rains, and sometimes even when it doesn't, the excess (contaminated) water is diverted around the treatment plant, and spilled directly into our waterways. This is called overflows. Obviously, the solution is more investment, and hence higher bills for the consumer. Or is it?

An alternative approach is what is known as water sensitive urban design. This uses our natural environment, so soil, plants and natural drainage, to soak up heavy rainfall, slowing the rate at which stormwater runoff enters the combined sewage system. This means the sewage treatment plant does not get overwhelmed by the volume of water, reducing or even eliminating the need for overflows. This is not the total answer but it would really help. But, our water treatment companies are not incentivised to make this type of investment. And neither is anyone else. We need better systems level thinking.

Green Hydrogen and how much it will cost

This finally became a bigger topic in 2023. Historically many people seemed to believe that at some point green hydrogen would become so cheap that we could use it for almost anything. And we mean anything, including heating our homes. But more recently it's becoming increasingly obvious that this is unlikely to happen. And so attention switched back to what might be reasonable cost assumptions. And using these, the applications for green hydrogen look a lot more limited. For those who haven't seen it yet, we recommend Michael Liebreich's hydrogen ladder, now on version 5.

And, as well as cost, we also need to think about the availability of green electricity. We need a lot of this to produce green hydrogen. By 2030, up to 200 GW of additional renewables would be needed in the US alone to power clean hydrogen electrolysis. This compares with the total current installed solar capacity of 100GW. Yes, we are going to be bringing a lot more green electricity online in the coming years, but I can think of a whole range of better uses for it than making green hydrogen. When we look back, will 2023 be the year when the hype around green hydrogen started getting punctured?

You may also be interested in...

Diversity target setting: solution or distraction?

With non-financial disclosure requirements increasingly focusing on DEI, is target setting (and incentivisation) which typically centres around demographic diversity at the board level, helping or hindering the development of a culture of DEI?

There is often a confusion between measures and targets. Companies can improve diversity statistics without improving DEI. Sometimes what you are measuring isn't what you think you are measuring. For example two people can be demographically different but have identical upbringings. Diverse on paper, but diverse in reality? Sometimes there can be confusion between manifestation versus ambition. For example, a neighbourhood with low traffic is a manifestation of a 15-minute city not the starting point; similarly diversity should be a manifestation of an inclusive culture not a standalone goal.

For sustainability professionals, understanding the most effective way to develop and embed a DEI culture within a firm can enhance #strategy and performance for the long term, benefiting all stakeholders.

Target setting is important to provide a goal to the individuals concerned, an incentive for them to perform and meet that target and to provide disclosure on progress for other stakeholders.

However, diversity targets CAN be a distraction from achieving DEI goals IF used in isolation. The other aspects of DEI should also be considered and at all levels within a firm in designing strategy, goals, incentives and disclosure.

The evolving role of a Chief Sustainability Officer

One of the really big debates in Sustainability is how best to fully integrate it into company strategy and financial decision making. Delivering this will, rather ironically, require us to move away from ESG measurement and scoring. And divestment as an investment strategy. But another important element is who the Chief Sustainability Officer (CSO) actually reports to, and hence how much influence they have.

Historically CSOs have acted like stealth PR executives, telling appealing stories to the company's many stakeholders. This has made the CSO responsible for everything, but with limited power to actually deliver. The good news is that this is now changing. "Some CSOs are now spearheading the true integration of material Environmental, Social, and Governance issues into corporate strategy". By corporate strategy we mean all of the decisions the organisation needs to make about where it invests its capital. Who you report to matters more than you think.

Is failure on climate change really financially harmless?

You might think this is a stupid question. Of course climate change (and all of the other related environmental and social issues) will create financial as well as social and economic harm. Some economists believe the harm will be small - as little as 2% of global GDP at 3 degrees of warming. And before you dismiss them as nutter's, what they think matters - because they influence what are known as climate damage function models. And these influence the investing decisions and strategies of insurance companies, banks, and pension funds.

Let's be clear, we don't know exactly what the financial and economic damage will be. As Daniel Kahneman said - “Forecasts create the mirage that the future is knowable.” But, a recent report from the Institute and Faculty of Actuaries, together with the University of Exeter, entitled The Emperor's New Climate Scenarios, quietly takes apart the notion that the financial risk from climate change is minimal. We need to talk about this more, in an informed way, as it could lead to a dramatic rethink as to what we mean by sustainable investing and fiduciary duty.

Thank you for all of your support in 2023

The Sustainable Investor will be back on Tuesday 9th January, 2024

Please read: important legal stuff.