Sunday Brunch: Should I worry about floods or heat stress

Based on what's in the press, we should worry more about floods and sea level rise. But, while the financial impact of floods on our society is material, the human cost of excess deaths suggests we should also worry about heat stress, as this may make regulation of building cooling more likely.

If we look at this issue from an investors perspective the question maybe isn't which risk imposes the greatest financial impact on our wider society, but instead which risks might result in governments looking to add new regulation? In other words, where companies might see added pressure to act. And this might be in relation to heat stress rather than flooding. We need the companies that we are invested in to start preparing for this.

If you look at the 'total' financial impact - floods and sea level rise are clearly a more material financial risk for society. However, my argument is a bit more subtle than that.

Mitigating and adapting to floods and sea level rise requires two related sets of actions. The first (mitigation) is to act to reduce the risk that climate change will bring more storms and floods, creating a new climate normal.

This is a societal challenge. Yes, companies and investors have a role to play, but it has to be a combined and coordinated effort.

The second set of actions (adaptation) is to build better flood and sea level rise protection. This will impact specific companies, such as utilities, but again much of the investment will need to be by governments etc. Yes, I understand the role that insurance companies might play - but you get my drift.

By contrast, many aspects of the response to heat stress will fall directly on companies across a range of industries. Today I want to talk about buildings, both residential and commercial, but the arguments equally apply to industries right across the food supply chain, and to multiple industries that rely on water as a raw material for production.

How might governments respond to rising incidents of heat stress - and the related deaths? Regulation of how buildings are designed and operated is both an obvious lever, and a potentially effective one. Changing design and building codes, introducing new rules for worker (heat) safety, and making landlords responsible for keeping rented residential homes cooler, are all potential actions.

One set of solutions for building owners involve active air conditioning. But this can be expensive. And so another equally valid approach is an increased use of passive cooling techniques such as those practiced by the Moors in 12th & 13th century Spain (hence the Alhambra image above).

Floods vs Heat Stress - the data

I am just focusing on Europe here, as this is where I have found the best data.

We know from the data that flooding is becoming more frequent and more damaging. Or as the IPPC report put's it 'there is high confidence that intensive precipitation is an increasing trend in Europe, especially for winter flooding. This is not new news. Back in 2020, the UN Environment Programme wrote about how climate change is making record breaking floods the new normal.

How big a problem is flooding? Last year (2024), storms and flooding in Europe affected an estimated 413,000 people, resulting in the loss of at least 335 lives. Material damage is estimated to amount to at least €18 billion.

And a recent 2025 ECB bulletin highlighted that the economic impacts go well beyond the immediate devastating impacts. Flooding can have material medium and long term impacts on the local and regional economy.

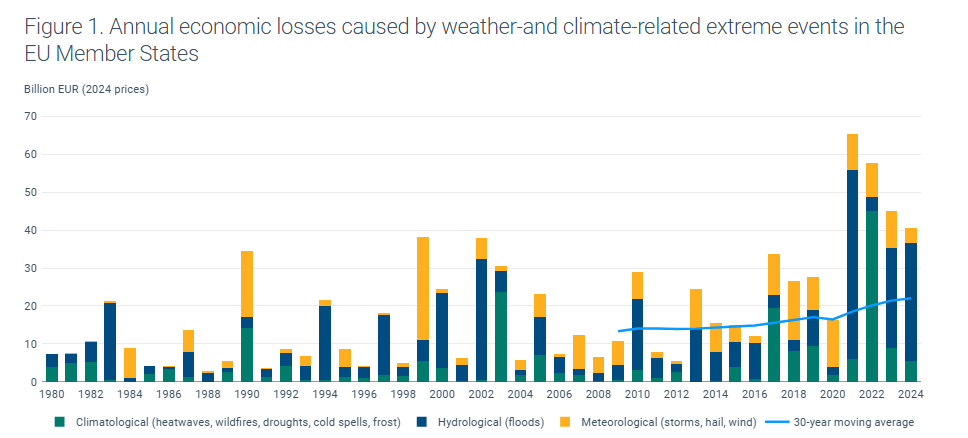

But the negative impact of climate change on companies, societies and the economy is not just about flooding. A 2025 European Environment Agency report looked at the economic losses suffered from all weather and climate related extreme events, divided into climatological (heatwaves, wild fires, droughts etc), hydrological (floods), and metrological (storms and wind).

While much press attention was given to the increase in total economic losses in recent years, what is equally interesting is how material climatological losses have become (they are the light green element of the vertical bars above).

But what about heat stress on it's own? According to a 2024 UN World Health Organisation report, a staggering 175,000 people die from heat-related causes every year in Europe and that figure is set to soar in line with our steadily warming planet.

Let's put this in context, last year floods in Europe resulted in ... the loss of at least 335 lives. In terms of deaths, heat stress is way more material, even if it's less visible.

And one of the key tools we have to cope with heat stress is ...keeping our homes (& workplaces) cool. This is why I would expect governments to increasingly demand, via regulation etc, that building owners act. Yes, flooding will probably continue to dominate the news feeds, but at some point heat stress will go up the political agenda. Especially as those impacted are often the most vulnerable in our societies.

Companies need to start preparing for this change. Retrofitting is possible, but building heat reducing features in from the beginning is way easier and more effective.

One last thought

A future event doesn't have to be 'certain to happen' to be of concern to investors. The future is not knowable in that way, we don't have certainty - despite what some analysts seem to imply. We cannot be sure what the future will bring, but as we invest we can prepare for possible future events. Companies betting on only one outcome, normally the status quo, can be risky.

Grant me the strength to accept the things I cannot change, the courage to change the things I can, and the wisdom to know the difference. Reinhold Niebuhr - a Lutheran theologian in the early 1930's

Please read: important legal stuff. Note - this is not investment advice.