Sunday Brunch: Innovation alone will NOT save the world

Innovation is great. It's the life blood of long term value creation in many industries. But on it's own it's not enough. When it comes to putting your money to work, look beyond this to those companies that are good at taking good ideas, and turning them into profitable businesses.

UK declares national incident as measles cases soar

Between 1st October 2023 and 18th January 2024 (15 weeks), there have been 216 confirmed and 103 probable cases of measles in the West Midlands (a region in the UK) with the majority of cases among children under the age of 10. It has prompted the UK Health Security Agency

Could EVs potentially have a much longer working life than ICEs?

Motoring journalist Quentin Wilson posted an interesting discussion topic on LinkedIn about EVs. Quentin Willson on LinkedIn: Following my post on extending the working life of EV batteries through… | 130 commentsFollowing my post on extending the working life of EV batteries through repair and cell replacement, I wonder if EVs

Investment opportunities hiding in plain sight ?

A $330bn/year green investment opportunity. What is not to like. So what is the catch ? Yes, it's in emerging markets. But the real challenge is that we need to develop new business models.

What caught our eye - three key stories (week 3, 2024)

The cost of CCS; do EVs have a longer working life than ICEs?; the reemergence of measles

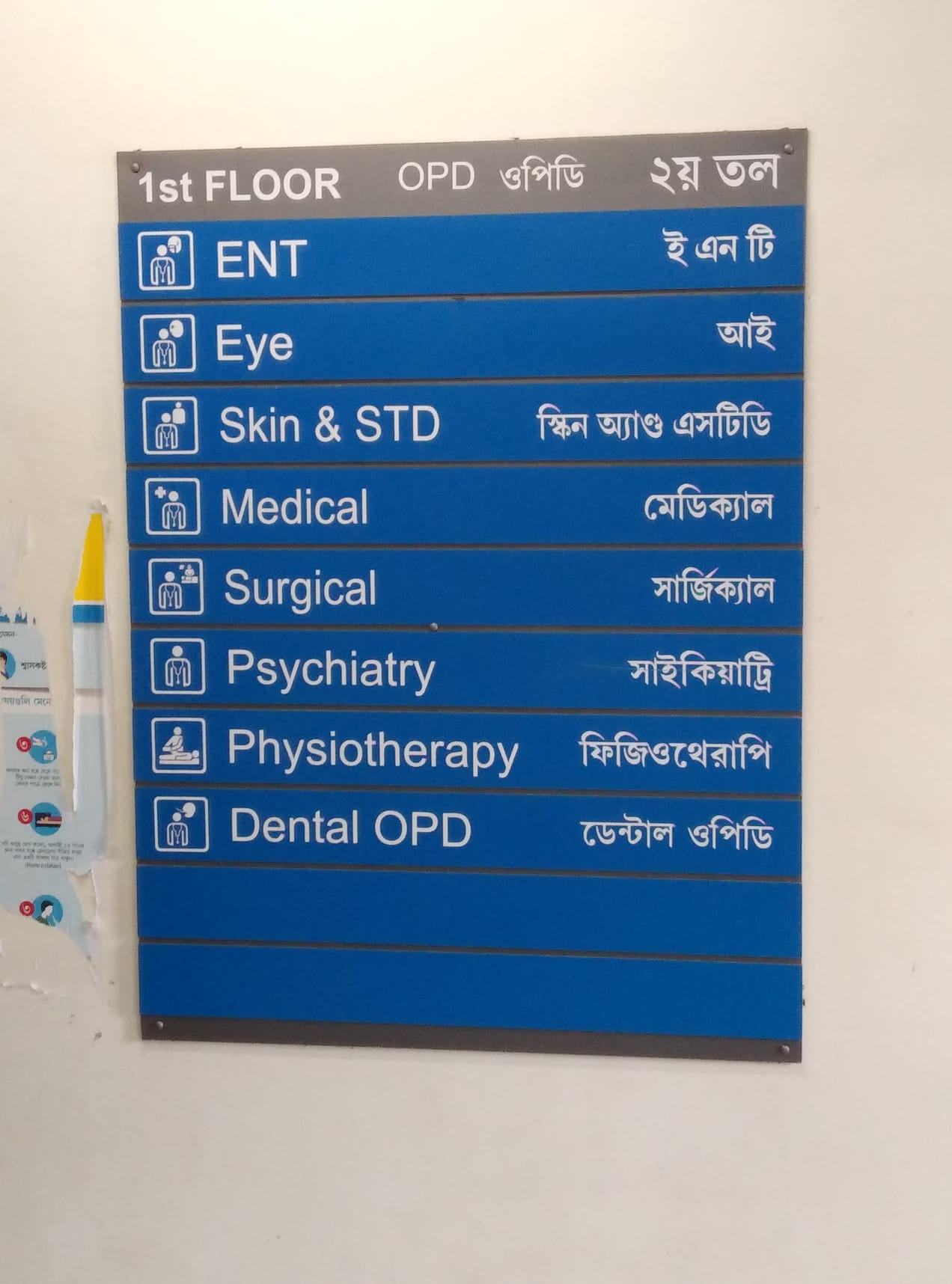

Sunday Brunch: is there a doctor in the house? (or why sustainability's a tough gig)

The CSO as the curator of sustainability expertise and driver of change

Do soil carbon-sucking projects deserve the credit they get?

A story over the holiday period that caught our eye in New Zealand publication Stuff was one discussing carbon dioxide (carbon) storage in soil. The article highlighted Australian agricultural start up Loam Bio that produces a fungal and bacterial seed coating which boosts plants' ability to absorb carbon into

Critical minerals - will we have enough?

Kathryn Porter, who writes the Watt Logic blogs, recently did a two part detailed dive into the potential demand from the sustainability transitions for critical minerals. Part 1 sets the scene in some detail. In Part 2, the blog we are highlighting, she looks at the supply situation for two

We need more (sustainable) mining

If we want the sustainability transitions to actually happen, especially in energy and industry, then we have to accept that more mining (of some minerals) needs to happen. Full stop.

What caught our eye - three key stories (week 2, 2024)

Green investment opportunity in emerging markets; Critical mineral choke points; Soil carbon credits

Sunday Brunch: it's companies that will really deliver change (Part 1)

We should not forget that it's companies who will, by and large, deliver the changes. It's companies that will make investments, change products and services, and adopt new operational practices.

Big batteries bridging the gap?

The electricity system's increasing reliance on renewables could get vital support from big batteries