Bridging the gap 34.23

In case you missed it ...

Not a subscriber yet? Click here

('Bridging the gap' is free)

Here is a selection of recently published Deep Dives, Perspectives and Quick Insights that our subscribers get to read in full.

- Coffee, deforestation and new supply chains (Agriculture / Natural Capital)

- Is green steel coming of age? (Greener Energy Applications)

Plus a few from the archives:

- The good stuff in wastewater - part 1 (Built Environment / Wellness)

- Sunday Brunch - who decides the topics for engagement?

- Ooh ah, just a little bit - transition is a series of steps (Transitions / Human Rights)

What subscribers are reading this week

Coffee, deforestation and new supply chains

(Agriculture / Natural Capital, Premium and Professional)

Over the last month or so we have been publishing on sustainability in coffee. Demand for coffee is growing, but at the same time the industry is facing a triple impact. Climate change is potentially reducing the land area where coffee can be grown. Deforestation and supply chain regulations are adding to the industry's complexity. A lack of capital among farmers, many of whom are very poor, is limiting the ability of the industry to respond.

If the coffee industry is going to continue to prosper, we need to find solutions. These must include finding the capital needed for investment, which in turn could assist in providing farmers with a living wage. Collaboration will be key, with a role for governments, companies and NGO's. In this sense coffee is a microcosm of the issues faced by the wider agricultural industry, and solutions developed here could be applied across other commodities. The upcoming World Coffee Summit, being held in London on September 13th 2023, could not be more timely.

Link to blog 👇🏾

Is green steel coming of age?

(Greener Energy Applications, Professional)

The last few years have seen a dramatic change in the outlook for green steel, especially in Europe. Less than five years ago the consensus on green steel was that “investments in zero-carbon alternatives still come at prohibitive commercial risk”. Now, nearly all European steelmakers have announced plans to replace their old, high carbon emitting blast furnaces with direct reduction iron and electric arc furnaces. We have realistic plans for production at scale by the end of this decade.

In the US, legislation and corporate climate commitments aimed at their supply chains has the potential to drive demand for green steel which in turn could bring in investment into capacity.

So is green steel at a tipping point? RMI think so.

We take a look at why RMI believe that green steel is at a tipping point and what the financial considerations are when thinking about the transition to greener steel more broadly.

Not only is green steel an important sector from an emissions perspective but it could also be the trail blazer for a number of other important transitions.

Link to blog 👇🏾

From the archives

The good stuff in wastewater - part 1

(Built Environment / Wellness, Premium and Professional)

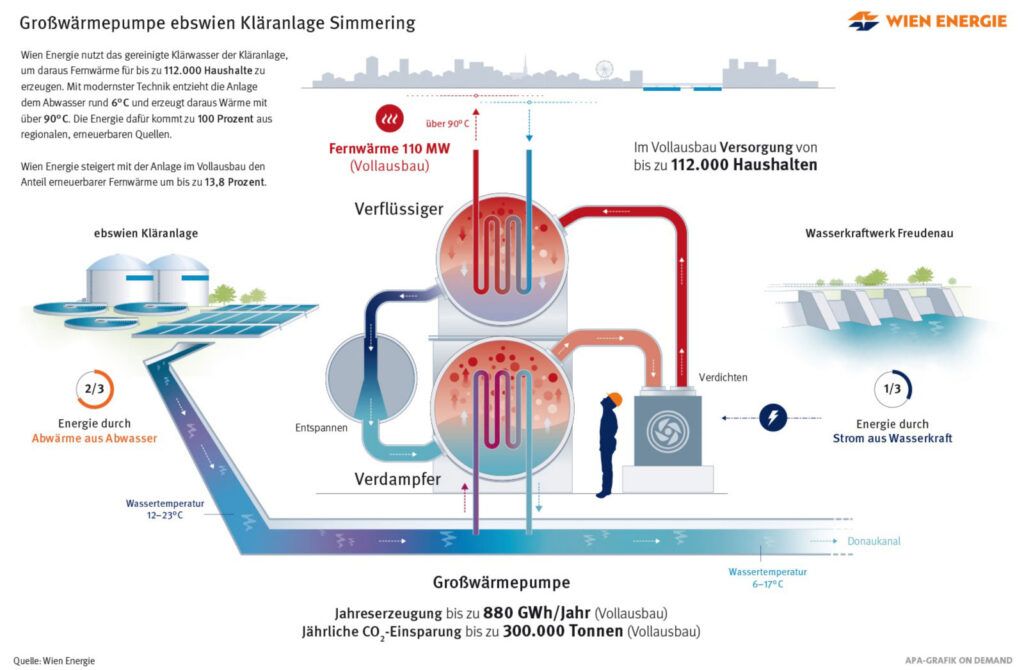

In a world of increasingly scarce resources, wastewater can provide us with heat (for our buildings) plus raw materials for fertiliser and for energy. It now makes sense to better use the good stuff in our waste water - resources that we are currently just wasting.

Why this is important? We tend to think about wastewater treatment as being an environmental and health issue. That is why we treat our sewage rather than just pump it into rivers and the sea. In our growing circular economy, recycling the resources in our wastewater increasingly makes financial sense.

In their 2021 update, UN Water estimated that globally nearly half of household water flows were NOT safely treated. The data shows massive variations, with the lowest levels of treatment in Central and Southern Asia & Sub-Saharan Africa. Funding this is a massive challenge, so finding alternative revenue streams can really help.

Link to blog 👇🏾

Sunday Brunch - who decides the topics for engagement?

Sunday Brunch is one of our three free emails. Just register to receive them directly into your inbox. Click here

Unless you have been living off grid, you will know that one of the defining debates around ESG and Sustainability relates to engagement - by which we mean interacting with companies to get them to change their behaviour.

This has often been defined in terms of fiduciary duty. Should asset managers only care about delivering the 'best' financial return for their investors/clients, or should their role be wider (and if so how much wider)?

Many people argue that asset managers, such as say Blackrock, should be engaging with the companies that they are invested in on a broad range of Environmental, Social and Governance issues. A key question that remains largely unanswered in this debate so far is how does the asset manager decide what topics to engage on, and how do they decide what changes they want to see happen? The answer is not as obvious as it might seem.

We don't think it's for the asset manager alone to decide this. This is something that their clients, the asset owners and the individual savers in the investment value chain chart (see the full blog), should also be heavily involved with. We need to find a way that this can happen, so that the choices and trade-offs implicit in sustainable investing are well understood upfront. This goes beyond voting.

We need to move asset owners, the real providers of investment capital, to the centre of this process. After all its their money that the finance industry actually manages.

One final point before digging down into this topic - there is absolutely nothing in this debate that impacts the ability of asset managers to offer sustainable products to their clients. Or to make engagement on specific issues part of their mandate.

This is simply about the best way to deal with issues that have both financial and societal dimensions.

Link to the full blog 👇🏾

Ooh ah, just a little bit - transition is a series of steps

(Transitions / Human Rights, Professional)

Transition is a series of steps: stages, individual action & nudges (and their limitations). Training for a triathlon and transitioning in sustainability have many parallels. There are barriers to change: nirvana fallacy, bite-sized content and binaries and when balanced journalism causes an imbalance. Small steps and nudges can be effective. Examples discussed include preventing conflicts between cyclists and cars, how 'superpower satsumas' helped kids to eat more healthily, picking no sugar drinks options at McDonald's, wasting less food through measurement, and using less 'small power'.

Why this is important: Perfect can be the enemy of good. However, we can't teleport to the ideal. We need to make the right sequential moves to get there.

The thing with sustainability transitions is that whilst there is a starting point, there is no end point. The world is a continually changing place and we are continually transitioning. Getting from walking to completing a triathlon doesn't happen overnight. The same is true in sustainability. It's a series of steps.

Link to blog 👇🏾

Please forward

to a friend, colleague or client

If this was forwarded to you, click the button below and sign up for free to get 'Bridging the gap', 'What caught our eye' and the 'Sunday Brunch' in your inbox every week.

Please read: important legal stuff.