Sunday Brunch: Does Europe want cheaper green steel?

What if green steel could be produced cheaply outside of Europe? If that meant putting domestic industry jobs at risk, would governments be keen?

The bad news is that even a relatively modest premium likely makes green steel unviable for much of the market, where costs are a major factor - Clyde Russell Asia Commodities and Energy Columnist at Reuters

Steel is one of the building blocks of our modern economy. But it's also a major emitter of GHG's. It is estimated that the steel industry is responsible for about 7-8% of all man made global carbon emissions, most of it from the blast furnace-basic oxygen furnaces (BF-BOF) production processes. So this is a challenge that we should want to fix, in the most cost effective way. Or do we ?

Green steel is clearly a good thing. But it's going to need a lot of government support to get from where we are now, producing it using a lot of coal, to where we want to be, producing it mainly using renewables.

And this could be problematic. Government support for industries transitioning to using renewables is often about protecting domestic industry, and the jobs they create. And that is leading to material financial support to the industry. But what if green steel could be produced cheaply outside of a domestic region? If that meant putting domestic industry jobs at risk, would governments be as keen?

That is where we are with green steel. And to an extent with mass market EV's. There will be compromises. As we frequently say, the sustainability transitions are complicated. Even the easy changes have negative implications for someone. But ignoring them is not the answer.

If you want to read the rest and are not already a member...

What if the non financial costs of green steel were material?

Let's start at the beginning. As we highlighted in a blog back in Jan 2023 steel is currently produced via two main routes: blast furnace-basic oxygen furnaces (BF-BOF) & electric arc furnaces (EAF).

Put simply, the EAF technology, which uses mainly recycled scrap steel, is seen as better for the environment as it produces materially fewer GHG emissions. But, there is not enough recycled steel to meet growing demand using the EAF steel making method alone. As a result some 70 -75% of current global steel production comes from the BF-BOF method. It's often called virgin steel, because its made from mined iron ore, with no scrap steel required.

There is some good news. There are alternatives. We can build more EAF plants, but we would need a lot more scrap steel to feed them. So a partial answer.

And we could develop new technologies. For now we want you to take on trust that new (ish) technological solutions to the green steel challenges exist - probably involving variations on what is known as Direct Reduced Iron (DRI) plus Electric Arc Furnaces (EAF).

But this blog is not about the technology, it's about cost and jobs.

The cost issue is being openly debated.

On one side we have Rystad Energy. In a recent article they argued that “the long-term economic viability of green steel versus grey steel — produced using fossil fuels — is in serious jeopardy, with the environmentally-friendly material costing up to €1,000 ($1,072) per tonne more than the alternative.”. That is a big gap.

Others have smaller gaps. A recent Reuters article, covering the latest Global Iron Ore and Steel Forecast Conference, says the consensus in the industry is that the gap is more like $150 per tonne. They quote figures from Monash University, which estimates that green steel could be made in Australia for around $570 per tonne using a mixture of wind, solar, battery storage and green hydrogen.

And as we highlighted in a blog back in Aug 2023, RMI argues that 'the time for green steel has arrived'. They point to the impact of the US IRA and growing demand from customers.

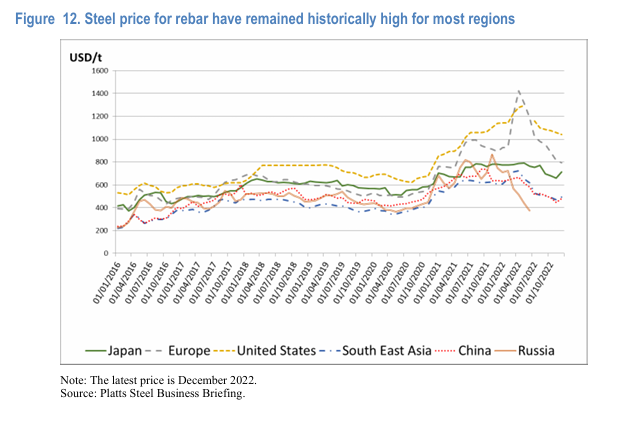

So lot's of different numbers being tossed about. And so it's hard to know if the required carbon price in Europe to make green steel is E500 per tonne of CO2, or something a lot less. Remember that the Rystad numbers are for Europe, and costs vary by region, often by large amounts. The chart below for rebar (reinforcing bar for concrete) prices is from a recent OECD report.

But it's not just about cost

Yes, cost is important. At least for many applications of steel. One exception is automotive, where it is frequently estimated that using green steel to make cars (around 1-1.5 tonnes per car) would only add c. $150-$300 to the cost of the vehicle.

But most steel goes into cost sensitive industries, such as buildings.

But, rather bizarrely, there is a bigger issue than cost. It's jobs.

Looking specifically at Europe - while the steel industry is nowhere near as important as it used to be, it's still a decent sized employer. According to Eurofer data, the sector directly employs c. 325,000 people across Europe, with the biggest country being Germany (just over 83,000). If you add in indirect employment, the total number of jobs is claimed to be as much as 2.6m, with c. 500,000 of these being in Germany.

And these are often well paid jobs. Jobs that governments do not want to lose. Given this, finding a lower cost way to make green steel, but that meant the jobs left Europe, would probably not be popular.

This brings us back to the Rystad report we quoted above. And that technological solution we asked you to take on trust - producing green steel (not using scrap) using Direct Reduced Iron (DRI) plus Electric Arc Furnaces (EAF).

Where you produce the DRI matters, especially as EAF steel making creates fewer jobs than required for BF-BOF.

Sadly, Rystad Energy's analysis shows that it is currently more cost-effective to import DRI from Oman than to produce it internally in Germany, with savings of around $25 to $30 per tonne.

Why Oman ? We talked about DRI back in Sept 2022, when we highlighted a report, from the Institute for Energy Economics and Financial Analysis. This identified the opportunity for the Middle East & North Africa (MENA) region to become, over time, a powerhouse in green steel production. All based on DRI.

You don't need to know much about DRI, other than it's a raw material that is used in the production of steel, alongside scrap metal and pig iron.

And while the MENA region produced just 3% of global crude steel in 2021, it accounted for nearly 46% (55 Mt) of the world’s DRI production. Furthermore, some of the largest iron ore pelletising plants (where DR grade pellets are produced) in the world are in MENA.

So, one solution that would require a lower carbon price (or less subsidies) could be to produce the DRI that Europe needed in Oman. But why stop there. The MENA region could end up with a lot of cheap solar electricity, which with battery storage (again getting cheaper) could power cheaper EAF green steel production.

But, with many fewer jobs in Europe.

And this is not just a debate solely about green steel. We are seeing something similar in EV's. In a recent blog we asked "can a $25,000 'cheaper' European EV really compete with the mass market offer coming out of China, where local carmakers already market nearly 50 small, affordable electric car models, many of which are priced under $15,000."

One political response is tariff barriers for cheap Chinese EV's. But without a cheaper mass market EV product, will EV fail to bridge the S curve chasm?

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.